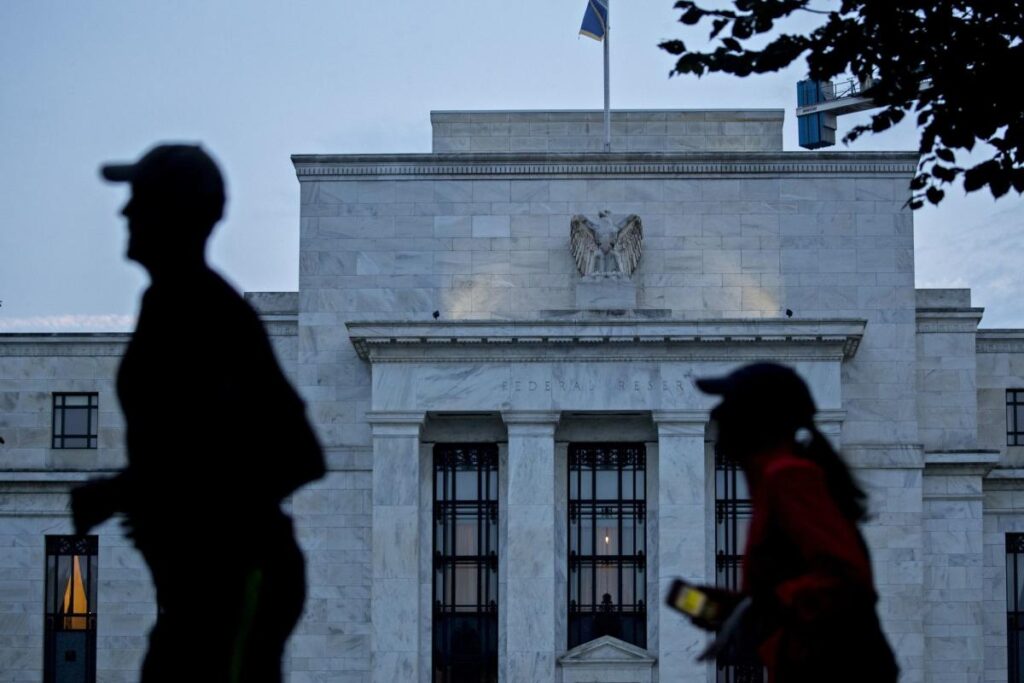

(Bloomberg) — Federal Reserve officials stressed the need for further interest-rate increases to help tame inflation, but expressed differing views about how close they are to stopping after new data showed signs of persistent price pressures.

Most Read from Bloomberg

Several officials said Tuesday that interest rates may need to move to a higher level than anticipated to ensure inflation continues to ease.

Richmond Fed President Thomas Barkin, speaking in a Bloomberg TV interview, said that “if inflation persists at levels well above our target, maybe we’ll have to do more.”

Speaking at Prairie View A&M University in Texas, Dallas Fed President Lorie Logan said: “We must remain prepared to continue rate increases for a longer period than previously anticipated, if such a path is necessary to respond to changes in the economic outlook or to offset any undesired easing in conditions.”

They both commented shortly after data showed consumer prices climbed 6.4% in January from a year earlier, higher than economists expected and still far above the Fed’s goal for 2% annual inflation, which is based on a separate measure.

Philadelphia Fed President Patrick Harker, speaking later in the day, said he believes policymakers will need to raise interest rates above 5% and possibly higher to counter inflation that is easing only slowly.

“We’re going to have to let the data dictate that,” Harker said in answering questions from the audience after a speech at La Salle University. “It’s going to be above 5% in the fed-funds rate. How much above 5? It’s going to depend a lot on what we’re seeing.”

New York Fed President John Williams said Tuesday afternoon that having the federal funds rate in a range of 5% to 5.5% by the end of the year — as listed in Fed officials’ estimates in December — is the appropriate framing.

“I do think with the strength in the labor market, clearly there’s risks that inflation stays higher for longer than expected or that we might need to raise rates higher than that,” he told reporters, following a speech at the New York Bankers Association.

Williams said he was confident that higher rates would continue to bring inflation down toward the Fed’s 2% goal, but emphasized the job was not yet done.

The overall consumer price index climbed 0.5% in January from the previous month, bolstered by gasoline and shelter costs, the Labor Department. That was in line with economists’ expectations, but marked the biggest increase in three months.

“Inflation is normalizing but it’s coming down slowly,” Barkin told Bloomberg’s Jonathan Ferro and Michael McKee.

While all Fed officials participate in meetings of the Fed’s policy committee, Logan and Harker are voting members this year and Barkin is not. Williams, as New York Fed president, is a permanent voting member, along with the Fed’s seven governors.

Fed officials have been raising rates aggressively to try to cool inflation that hit a 40-year high last year.

At the start of February, they lifted their benchmark lending rate by a quarter of a percentage point to a range of 4.5% to 4.75%. That followed a half percentage-point increase at their December meeting, which came after four consecutive jumbo-sized 75-basis-point hikes.

Officials in December penciled in a peak interest rate of about 5.1% this year, based on the median forecast, implying two more quarter-point increases.

Market Reaction

The S&P 500 Index fell and Treasury yields jumped following the latest inflation data. Investors now give near-even odds that Fed officials will raise rates by a quarter percentage point in June, following similar increases in March and May.

Expectations for where interest rates will peak have risen following stronger-than-expected jobs figures and continued signs of persistently high prices.

Economists at Barclays Plc and Monetary Policy Analytics now see the Fed lifting rates to a range of 5.25% and 5.5%.

The higher forecast “reflects our view that the Fed will need to see material slowing in labor market outcomes to convince itself that wages are on course to return to rates of increase consistent with 2% inflation, and that such evidence will not be evident until midyear,” Barclays economists wrote.

Logan said she sees two risks to monetary policy right now: doing too little and causing an inflation comeback and doing too much and creating excess pain in the labor market. The “most important” risk is doing too little, she said.

Policymakers have been particularly worried by increases in services prices, driven in part by a shortage of workers exacerbated by the Covid-19 pandemic.

Fed Chair Jerome Powell has cautioned that an easing in a too-tight labor market would be needed to cool continuing price pressures. Nonfarm payrolls increased 517,000 last month – more than twice the expectations of Wall Street – and the unemployment rate dropped to 3.4%, the lowest since May 1969.

There are some indications that economic growth could be more resilient than expected, or even accelerating. The Atlanta Fed’s tracker has put an early estimate of first-quarter gross domestic product growth at a 2.2% annualized rate, as of Feb. 8.

“You have seen demand moving very quickly” in some sectors, Barkin said.

(Updates with comments from Williams in ninth paragraph.)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.