(Bloomberg) — Federal Reserve officials sounded divergent notes about the central bank’s next policy move, with one of its top officials suggesting another rate increase may be needed to quell inflation and its newest policymaker signaling a pause may be in order.

Most Read from Bloomberg

New York Fed President John Williams said Tuesday that Fed officials still have more work to do to bring down prices, echoing remarks from his colleagues in recent days, and suggested they will stay the course despite new uncertainty from turmoil in the banking sector.

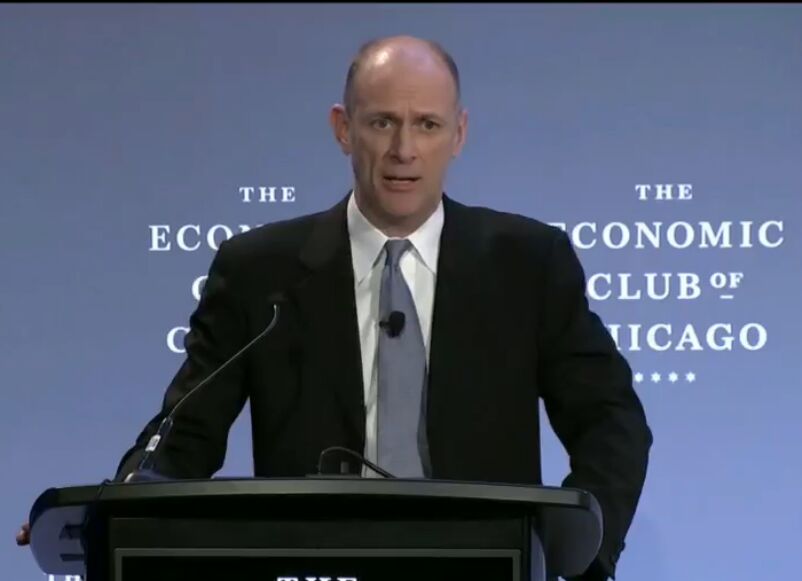

Chicago Fed President Austan Goolsbee, who votes on monetary policy decisions this year, instead called for “prudence and patience” in assessing the economic impact of tighter credit conditions that are likely to stem from financial stress, the first official to suggest policymakers may need to hold off on further hikes for now.

“Given how uncertainty abounds about where these financial headwinds are going, I think we need to be cautious,” Goolsbee said in prepared remarks at an event hosted by the Economic Club of Chicago. “We should gather further data and be careful about raising rates too aggressively until we see how much work the headwinds are doing for us in getting down inflation.”

Williams, speaking earlier in an interview with Yahoo! Finance, said Fed officials’ median forecast in March projecting one more interest-rate hike this year, followed by a pause, is a “reasonable starting place” — though the path will depend on incoming economic data.

“We need to do what we need to do in order to make sure we bring inflation down,” Williams said. Inflation is coming down but remains well above the Fed’s 2% goal, he said.

Fed officials lifted interest rates by a quarter percentage point last month, bringing their policy benchmark to a target range of 4.75% to 5%, up from near zero a year earlier.

Forecasts last month showed the 18 officials expected rates to reach 5.1% by year-end, according to their median projection. Investors bet the Fed will raise rates at its next meeting May 2-3, but will cut rates later this year — something officials have not projected.

Williams said the market expectations reflect forecasts for recession as well as a sharper slowdown in inflation than what most officials anticipate.

“We’re seeing signs of inflation slowing, but inflation is still very high,” he said. “Some of this core services inflation, excluding housing, that hasn’t budged yet. So, still kind of got our work cut out for us to get inflation back to 2%.”

A string of bank collapses last month has added new uncertainty to the outlook this year. Still, most Fed officials have continued to emphasize their commitment to bringing prices down.

Minneapolis Fed President Neel Kashkari, who also votes on policy this year, said last month that though it’ll take a while to see the full effects of the banking fallout, the Fed still has more work to do to lower inflation.

He spoke again on Tuesday evening, and while he didn’t comment directly on the outlook for policy, he did suggest that the worst of the banking strain was now over.

“I’m not ready to declare all clear but there are hopeful signs that these risks are now better understood and calm is being restored,” he told a town hall event at Montana State University in Bozeman.

James Bullard, Kashkari’s counterpart in St. Louis, said steps taken to ease financial strains were working and the central bank should keep raising interest rates to fight high inflation. And Cleveland Fed chief Loretta Mester said policymakers will need to raise rates “a little bit higher” and then hold them there for some time. Neither Mester nor Bullard vote in monetary policy decisions this year.

‘Surprisingly Strong’

Goolsbee said that inflation and labor market data came in “surprisingly strong” at the end of 2022 and beginning of this year, but the knock-on effects of the Silicon Valley Bank collapse in March and the resulting financial-market stress may help the Fed in its campaign to cool the economy.

“We’ve been tightening financial conditions to bring inflation down, so if the response to recent banking problems leads to financial tightening, monetary policy has to do less,” he said.

He was careful to say that the Fed should still prioritize its mission to bring down elevated price pressures.

Recent data suggest banks are pulling back on lending in the wake of turmoil in the banking sector, which sent markets reeling and prompted federal regulators to intervene to contain the panic.

More US small businesses reported having greater difficulty getting a loan in March, according to a survey from the National Federation of Independent Business. And US bank lending contracted by the most on record in the last two weeks of March, the Fed said last week.

Meanwhile, employers added 236,000 jobs in March and the unemployment rate fell to 3.5%, a sign that the labor market remains resilient despite the uncertain outlook.

Fresh data is due Wednesday on consumer prices, which economists forecast rose 5.6% from a year earlier, excluding food and energy prices, roughly unchanged from the previous month.

Philadelphia Fed President Patrick Harker, who also votes on policy this year, repeated that he favors getting rates above 5% and then going on hold.

“If we see inflation not budging, then I think we’ll have to take more action,” he told an audience in Philadelphia on Tuesday. “But at this point, I don’t see why we would just continue to go up, up, up and then go, whoops! And then go down, down, down very quickly. Let’s sit there.”

(Updates with Kashkari comment in 14th paragraph.)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.