By Brett Rowland (The Center Square)

The federal government reported an estimated $247 billion in payment errors in fiscal year 2022, with the majority coming from five federal programs, including Medicaid and Medicare.

Improper payments include overpayments or payments that should not have been made. Examples include payments to people who have died and payments to those no longer eligible for government programs. The $247 billion in estimated improper payments in 2022, was down from an estimated $281 billion in improper payments in fiscal year 2021, but remained above the estimated $206 billion for fiscal year 2020.

“Payment errors are a long-standing issue for the federal government,” according to the U.S. Government Accountability Office.

The federal government has made almost $2.4 trillion in payment errors in the last two decades, according to reported estimates from the U.S. Government Accountability Office.

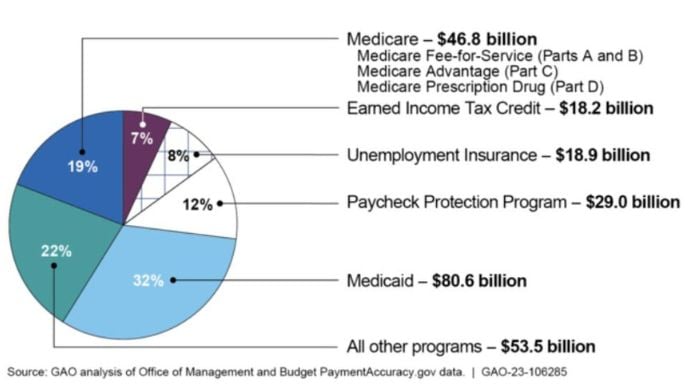

Eighteen agencies reported an estimated $247 billion in improper payments in fiscal year 2022 across 82 programs. Of that total, 78% of the improper payments – about $194 billion – came from five program areas: Medicaid, Medicare, the Paycheck Protection Program, Unemployment Insurance and the Earned Income Tax Credit.

Related: Warning to Seniors: Personal Data of 254K Medicare Beneficiaries at Risk After Breach

Medicaid, which provides health coverage to low-income people, accounted for $80.6 billion in improper payments, or 32% of the total, far more than any other single program. Medicare accounted for $46.8 billion (19% of the total).

Overpayments accounted for an estimated $200 billion, or 81%, of the $247 billion total, according to a new U.S. Government Accountability Office report.

The U.S. Government Accountability Office has identified improper payments as a material deficiency or material weakness on federal audit reports since 1997, according to the agency.

“Specifically, we note that the federal government is unable to determine the full extent to which improper payments occur or to reasonably assure that appropriate actions are taken to reduce them,” according to the report.

Federal agencies identified four primary causes for improper payments, including failure to access data or information needed (58.8%), inability to access the data or information (14.5%), data/information needed does not exist (9.8%) and unknown payment caused by insufficient or lack of documentation from applicants to determine eligibility (8.2%).

“While Congress and federal agencies have made efforts in recent years, more work remains to be done to improve payment integrity,” according to the report.

Related: Janet Yellen Says More Bank Bailouts Could Be Coming

The report noted that it has recommended Congress amend the Social Security Act to share the Social Security Administration’s full death data with the U.S Treasury Department’s Do Not Pay System. Lawmakers took such a step to prevent payments to people who have died with the Consolidated Appropriations Act in 2021, which requires the Social Security Administration, to the extent feasible, to share its full death data with Treasury’s Do Not Pay system for a 3-year period.

“Sharing these data will allow agencies to enhance their efforts to identify and prevent improper payments to deceased individuals,” according to the report.

Syndicated with permission from The Center Square.