(Bloomberg) — Amid signs the bond market has bought into the Federal Reserve keeping interest rates higher for longer, a cohort of investors is placing bets on the economy hitting a wall — and a sharp policy reversal in short order.

Most Read from Bloomberg

Treasury yields have settled into tight ranges this month near the highest levels in more than a decade as data show a resilient economy and inflation still well above the Fed’s 2% target. But with yields anticipating a peak in the policy rate, the outlook for growth takes on greater importance.

The past week has seen a pickup in demand for options that will turn a profit should interest rates tumble before the middle of next year. That’s a more dire scenario than what’s seen in the swaps market, where traders are no longer pricing in a rate cut during the first half of 2024.

Bond traders have been placing these sorts of bets since the hiking cycle began and so far they haven’t panned out. But this time may be different as the Fed’s tightening cycle has had more time to work through the economy.

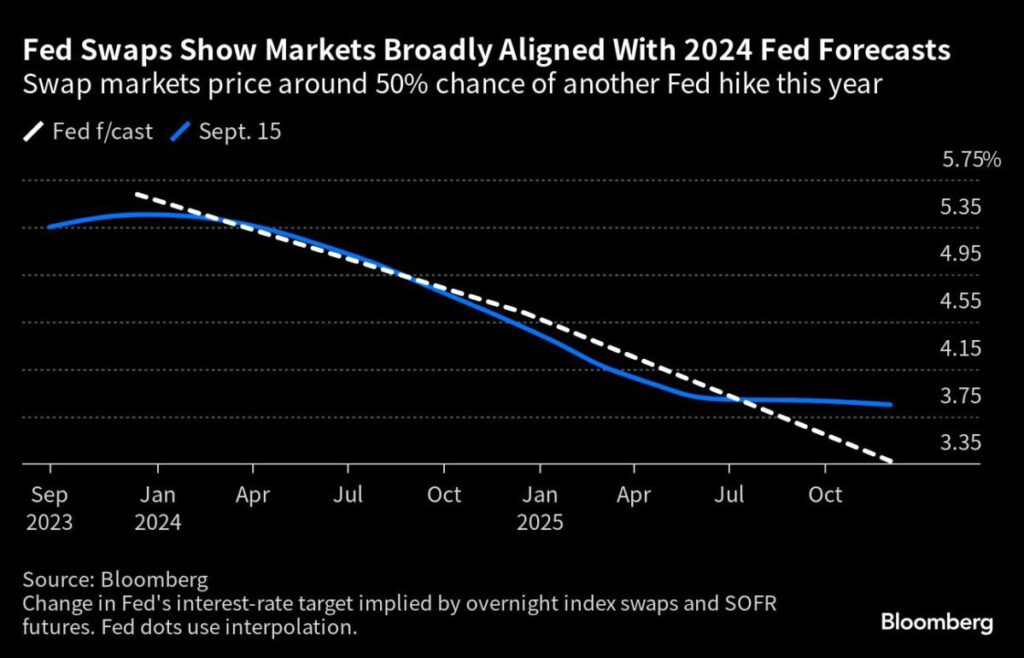

The Fed is widely expected to leave its policy rate unchanged next week after lifting it in July for the 10th time in an aggressive hiking cycle that began in March last year. It’s also seen significantly raising its forecast for growth and indicating another rate increase this year in its so-called dot plot. The rate outlook for 2024 remains up for debate. In June, the median projection showed a full percentage point cut by the end of next year.

The longer rates stay elevated so does the risk of a downturn, and at the margin there are more signs of consumer stress as higher borrowing costs and weaker hiring start to erode household spending. With the Fed seen being close to its policy rate peak, the focus is now on growth softening.

“There is a question mark around whether the economy is transitioning to a soft landing or does the labor market weaken towards a more recessionary outlook,” said Roger Hallam, global head of rates at Vanguard Asset Management.

The week saw notable demand for options linked to the Secured Overnight Financing Rate — which closely aligns to the projected path of Fed’s policy rate — hedging multiple rate cuts before June. These trades likely accompany existing positions that reflect the Fed’s current message, allowing some traders to benefit from a surprise policy pivot.

One trade positioned for a 3% rate by the middle of next year versus a current market level around 5%. The premium paid on that bet was in excess of $10 million. Other similar trades surrounding March were also made over the course of the week.

Ramping up wagers that the Fed could pivot to rate cuts by mid-2024, or even before, stands in sharp contrast to policy makers stressing a higher-for-longer narrative. Meanwhile, the current Fed rate at 5.25%-5.5%, well above the US annual inflation rate and three-month annualized figure, is seen as threatening the growth outlook.

Read More: The Bond Market Has Never Sounded Recession Alarms for This Long

As a result, investors are more worried about recession than they were nine months ago, according to Robert Waldner at Invesco.

“There is an increasing risk of recession as rates stay high and nominal growth comes down,” the chief strategist said. “As inflation is coming down, central bank policy is getting tighter, and if they don’t consider this, it will increase the risk of an accident.”

Positioning through options for next year’s Fed meetings in March and June may make sense, given the bond market faces the likelihood of being stuck in a holding pattern as investors wait for clarity on the economy.

It’s very reasonable to see lower yields in an economic environment heading into a downturn, according to Vanguard’s Hallam. But the picture for bond buyers gets complicated should higher energy prices stall the recent disinflationary trends.

“Sticky inflation would make it very difficult for the Fed to ease next year,” he said.

Given the uncertainty over the outlook for the economy and rates, parking funds in cash-like equivalents has been gaining favor. Shorter-dated Treasuries returning 5%-plus have seen a significant slice of investment flows locking in relatively high yields, according to EPFR fund data for this year.

For Monica Defend, head of the Amundi Institute, the middle of the Treasury curve looks attractive for a multi-strategy portfolio.

With rates staying higher for longer, yields should turn lower as the economy weakens, and the five- to 10-year sectors “are a good alternative to equities,” she said.

What Bloomberg Economics Says…

A cautious Fed to hold US rates steady, but keep options open. “If the labor market cools down over the rest of the year as we expect, and the unemployment rate rises to 4.1% as the Summary of Economic Projections forecasts, the Fed is likely done hiking rates.”

—Anna Wong, chief US economist

For the full note, click here

What to Watch

-

Economic data calendar

-

Sept. 18: New York services business activity; NAHB housing market index; TIC flows

-

Sept. 19: Building permits; housing starts

-

Sept. 20: MBA mortgage applications

-

Sept. 21: Current account balance; initial jobless claims; Philadelphia Fed business outlook; existing home sales; leading index

-

Sept. 22: S&P Global US manufacturing, services and composite PMIs

-

-

Federal Reserve Calendar

-

Sept. 20: Federal Open Market Committee policy statement and summary of economic projections; Fed chair Jerome Powell press conference

-

Sept. 22: San Francisco Fed President Mary Daly; Fed Governor Lisa Cook

-

-

Auction calendar:

-

Sept. 18: 13- and 26-week bills

-

Sept. 19: 42-day cash management bills; 20-year bond reopening

-

Sept. 20: 17-week bills

-

Sept. 21: 4- and 8-week bills; 10-year Treasury Inflation Protected Securities

-

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.