This illustration photo shows a smart phone screen displaying the logo of First Republic Bank, with a screen showing the logo of JP Morgan Chase in the background in Washington, DC on May 01, 2023.

Olivier Douliery | AFP | Getty Images

Regulators took possession of First Republic on Monday, resulting in the third failure of an American bank since March, after a last-ditch effort to persuade rival lenders to keep the ailing bank afloat failed.

JPMorgan Chase, already the largest U.S. bank by several measures, emerged as winner of the weekend auction for First Republic. It will get all of the ailing bank’s deposits and a “substantial majority of assets,” the New York-based bank said.

JPMorgan is getting about $92 billion in deposits in the deal, which includes the $30 billion that it and other large banks put into First Republic last month. The bank is taking on $173 billion in loans and $30 billion in securities as well.

The Federal Deposit Insurance Corporation agreed to share losses on mortgages and commercial loans that JPMorgan assumed in the transaction, and also provided it with a $50 billion credit line.

JPMorgan said it was making a payment of $10.6 billion to the FDIC.

Since the sudden collapse of Silicon Valley Bank in March, attention has focused on First Republic as the weakest link in the U.S. banking system. Like SVB, which catered to the tech startup community, First Republic was also a California-based specialty lender of sorts. It focused on serving rich coastal Americans, enticing them with low-rate mortgages in exchange for leaving cash at the bank.

But that model unraveled in the wake of the SVB collapse, as First Republic clients withdrew more than $100 billion in deposits, the bank revealed in its earnings report April 24. Institutions with a high proportion of uninsured deposits such as SVB and First Republic found themselves vulnerable because clients feared losing savings in a bank run.

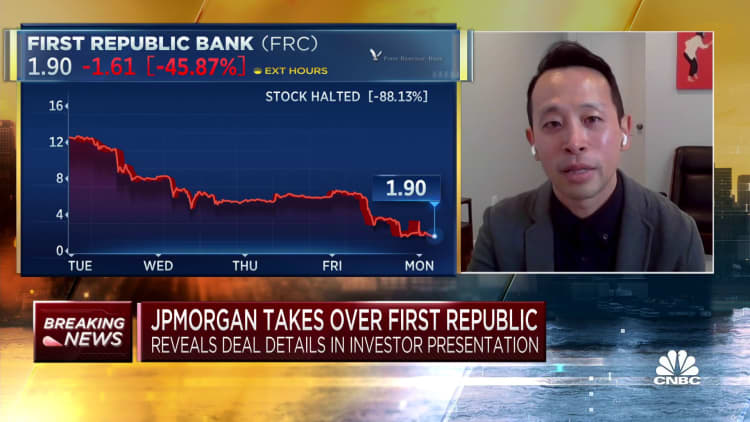

Shares of First Republic had lost 97% as of Friday’s close.

$13 billion hit

The weekend auction, which drew bids from JPMorgan Chase and PNC, as well as interest from other banks, was a “highly competitive bidding process,” according to the FDIC.

The transaction will cost the FDIC’s Deposit Insurance Fund an estimated $13 billion, according to the regulator. By way of comparison, the SVB process cost the fund about $20 billion.

The California Department of Financial Protection and Innovation said Monday it had taken possession of First Republic and appointed the FDIC as receiver. The FDIC accepted JPMorgan’s bid for the bank’s assets.

“As part of the transaction, First Republic Bank’s 84 offices in eight states will reopen as branches of JPMorgan Chase Bank, National Association, today during normal business hours,” the FDIC said in a statement. “All depositors of First Republic Bank will become depositors of JPMorgan Chase Bank, National Association, and will have full access to all of their deposits.”

JPMorgan CEO Jamie Dimon touted the acquisition in a statement early Monday morning.

“Our government invited us and others to step up, and we did,” he said. “This acquisition modestly benefits our company overall, it is accretive to shareholders, it helps further advance our wealth strategy, and it is complementary to our existing franchise.”

In the wake of the takeover Monday morning, the Treasury Department sought to reassure Americans about the country’s financial system.

“The banking system remains sound and resilient, and Americans should feel confident in the safety of their deposits and the ability of the banking system to fulfill its essential function of providing credit to businesses and families,” a Treasury spokesperson said.

Weak link

First Republic’s deposit drain in the first quarter forced it to borrow heavily from Federal Reserve facilities to maintain operations, which pressured the company’s margins because its cost of funding is far higher now. First Republic accounted for 72% of all borrowing from the Fed’s discount window recently, according to BCA Research chief strategist Doug Peta.

On April 24, First Republic CEO Michael Roffler sought to portray an image of stability after the events of March. Deposit outflows have slowed in recent weeks, he said. But the stock tanked after the company disavowed its previous financial guidance and Roffler opted not to take questions after an unusually brief conference call.

The bank’s advisors had hoped to persuade the biggest U.S. banks to help First Republic once again. One version of the plan circulated recently involved asking banks to pay above-market rates for bonds on First Republic’s balance sheet, which would enable it to raise capital from other sources.

But ultimately the banks, which had banded together in March to inject $30 billion of deposits into First Republic, couldn’t agree on the rescue plan, and regulators took action, ending the bank’s 38-year run.