Every investor wants a portfolio that will generate returns, but finding the right stocks for that is always a challenge. The analysts at Goldman Sachs have developed a data-based rule to sort through the mass of stocks and find the shares that are going to bring in solid returns.

The key to Goldman’s ‘Rule of 10’ lies in each company’s projected sales growth – the firm looks for stocks with potential to show a multi-year CAGR of 10% or higher. According to David Kostin, the bank’s Chief Investment Officer and Head of Investment Strategy, rapid and consistent sales growth is a prevalent characteristic among today’s leading stocks as they ascend the ranks.

“We refresh our ‘Rule of 10’ screen, which identifies stocks with realized and expected annual sales growth greater than 10% during the five years from 2021 through 2025,” Kostin noted.

Some of the top analysts at Goldman Sachs have been recommending stocks that align with the “Rule of 10” criteria. We’ll take a look at two of them, using the data drawn from the TipRanks platform. Both are S&P-listed firms, and both have shown high sustained sales growth over time – with high potential to maintain that performance. It also doesn’t hurt that each stock is admired by the rest of the analyst community, enough so to earn a “Strong Buy” consensus rating. Let’s take a closer look.

SolarEdge Technologies (SEDG)

The first Goldman pick on our list is SolarEdge Technologies, a designer and manufacturer of microinverters, which are essential technology in solar power installations. Microinverters convert DC current, the type produced by photovoltaic panels, into AC current that can be used on the grid and in household systems. SolarEdge is one of the leading companies in the US microinverter segment, with approximately 40% market share.

The company doesn’t rest solely on the microinverter business; it produces a wide range of solar technology products. The product line includes monitoring systems for photovoltaic generation systems, power optimizers, and even solar-powered EV chargers for home use. SolarEdge markets directly to the residential market, as well as to commercial clients, including building owners, small businesses, construction clients, and installation professionals.

When examined through the lens of Goldman’s ‘Rule of 10,’ SolarEdge exhibits a projected sales CAGR of 24% from 2022 through the end of 2025. Few companies can match this remarkable level of sustained growth.

SolarEdge’s current performance gives good reason to believe it will match the projections. The company showed several record metrics in its 1Q23 financial results, the last quarterly results reported. These included record quarterly revenue of $943.89 million, a result that was up 44% year-over-year and came in more than $12.05 million ahead of the estimates. The records also included the non-GAAP EPS results of $2.90, a significant improvement compared to the $1.20 value in 1Q22 and surpassing the forecast by 95 cents.

In his coverage of SolarEdge for Goldman Sachs, 5-star analyst Brian Lee sees the company’s diversification as a key support for its success. Lee acknowledges that SolarEdge has established itself in the US residential solar market, but he also points out that the company’s business is expanding at the fastest pace in Europe and in the commercial and industrial markets.

“For 2023, we expect Europe to be one of the fastest growing regions, with total solar installations up >25% yoy (we expect the growth of resi to be inline-to-above the overall market) vs. US residential end market up <10% yoy and recent datapoints suggesting it could end up being worse than that. Notably, SEDG’s shipments to Europe accounted for ~60% of the total in 1Q23… In terms of end market, 50%-60% of SEDG’s total volumes were shipped to the C&I end market — which appears to have remained solid and resilient despite macro uncertainties vs. resi, based on our channel checks. With the aforementioned dynamics, we are tactically more positive on SEDG,” Lee opined.

To this end, Lee rates SEDG shares a Buy, unsurprisingly in light of his comments, and sets a $445 price target that suggests ~65% one-year upside for the stock. (To watch Lee’s track record, click here)

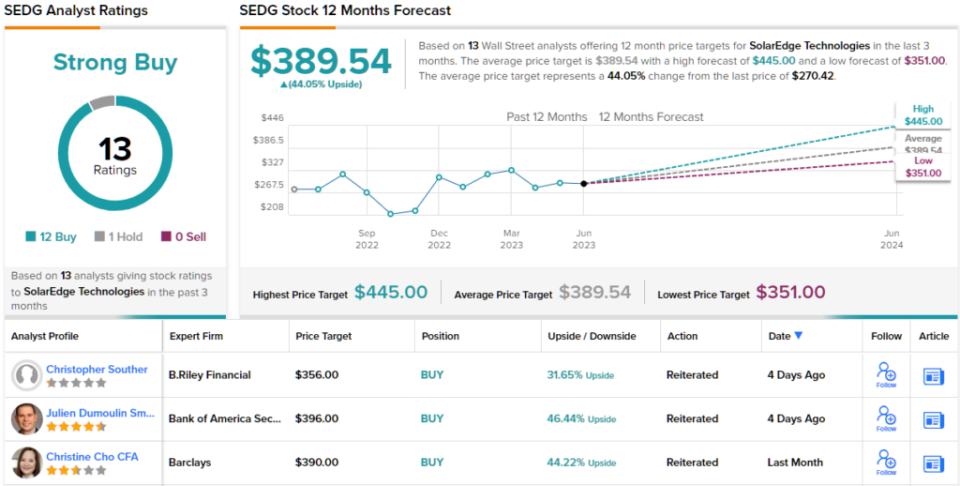

Overall, SolarEdge has attracted 13 analyst reviews recently, with a breakdown of 12 to 1 in favor of Buys over Holds. The shares are trading for $270.42, and the average price target of $389.54 suggests a gain of 44% in the next 12 months. (See SEDG stock forecast)

Intuit, Inc. (INTU)

The second stock we’re looking at has recently completed its strongest season of the year. Intuit is a software company best known for its two flagship products: TurboTax and QuickBooks. These software products provide tax calculation and filing services, bookkeeping capabilities, and other accounting tasks optimized for in-home or small business use. The company’s other products include the Credit Karma personal software package and the popular marketing automation system, Mailchimp.

Intuit’s product line is aimed at facilitating financial and marketing record-keeping and automation for non-professionals, and the company boasts over 100 million customers worldwide. The company operates out of 20 offices in 9 different countries, and last year brought in $12.7 billion in total revenue.

Applying the Goldman Rule of 10, we find that Intuit’s 2022 to 2025E CAGR runs at 13%, a solid figure that puts the company well above the 10% threshold Goldman uses to predict future success. The company has plenty of room for future growth, as its largest segment is tax prep – and the US tax preparation market alone exceeds $11.2 billion. Globally, the tax prep market is estimated at more than $28 billion this year.

The company finished its fiscal Q3 on April 30, reporting top line revenue of $6.02 billion, up 7% from the prior year period. The revenues just missed expectations, coming in $73.9 million, or 1.22%, below the forecast. At the bottom line, Intuit’s non-GAAP earnings per share hit $8.92, for a 17% y/y increase, and beat the analyst forecasts by 42 cents.

Kash Rangan, another of Goldman’s 5-star analysts, lays out several reasons why Intuit is poised to cash in on its growth potential. As the analyst writes, “We see several long-term structural growth drivers: 1) Generative AI could solidify INTU’s market leadership as it is uniquely positioned to leverage a vast amount of tax-related data with the use of LLMs. 2) The broader ~$30bn tax-prep market creates significant opportunities for TurboTax Live (which holds 3-5% of the market) to capture share. 3) With Intuit only capturing ~10% of the ~$2 trillion in volume occurring on its platform, and considering 70% of B2B payments are still not digitized, we expect its payments offering to scale to $4-5bn in revenue. Intuit’s ability to pull cost levers to drive efficiency despite lower top-line visibility should also be rewarded.”

Quantifying his positive stance, Rangan gives Intuit shares a Buy rating, along with a $565 price target that indicates his confidence in a one-year upside of 25%. (To watch Rangan’s track record, click here)

This is another stock with a Strong Buy consensus rating from the Street. The rating is based on 16 recent analyst reviews, which include 15 Buys against a single Hold. Intuit shares are currently priced at $451.57, while the $508.67 average price target implies ~13% upside going forward into next year. (See INTU stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.