A version of this post first appeared on TKer.com

Stocks closed higher last week with the S&P 500 jumping 2.6%. The index is now up 14.8% year to date, up 23.3% from its October 12 closing low of 3,577.03, and down 8.1% from its January 3, 2022 record closing high of 4,796.56.

Back in February, I wrote: “Attitudes are on the cusp of shifting in 3 major ways.“

I think we are now past that cusp, and so it’s worth an update on those three themes.

1. The Fed has become less hawkish 🦅

Last spring, the Federal Reserve went into crisis mode over inflation. In May 2022, Fed Chair Jerome Powell first said economic “pain” may be necessary to get inflation down. In June, the Fed hiked rates by an eye-popping 75 basis points. At the time, it was the biggest single rate hike since 1994.

After months of cooling inflation, the Fed’s tone became much less hawkish on February 1, when Powell acknowledged that “for the first time that the disinflationary process has started.” And on March 22, the Fed signaled that the end of interest rate hikes was near.

On Wednesday, the Fed kept its target range for the federal funds rate at 5% to 5.25%. This pause came after 10 consecutive interest rate hikes since the beginning of the rate hike cycle in March 2022.

The news came after Tuesday’s May Consumer Price Index report, which was the lowest annual reading on inflation since March 2021. It was also a record 11th straight month of decline.

To be clear, Wednesday was not necessarily the end of this rate hike cycle. In its updated summary of economic projections, the Fed’s estimated median federal funds rate for the end of 2023 was revised up from 5.1% to 5.6%, implying that the central bank sees a need for two more rate hikes by the end of the year.

A “key takeaway from the June meeting is that FOMC participants see a more moderate pace of tightening as appropriate now that the funds rate is closer to its likely peak,” Goldman Sachs’ David Mericle wrote on Wednesday.

The bottom line is the Fed is moving away from emergency-mode. This bodes well for financial markets if it means efforts to further tighten financial conditions are coming to an end.

2. The economy has become less likely to go into recession 💪

Coming into 2023, most economists were pretty convinced the U.S. economy would go into recession some time during the year.

TKer readers have long understood the economy has been bolstered by massive tailwinds. These persistent reasons for optimism have kept recession at bay and continue to do so. Month after month, we’ve gotten confirmation job growth remains hot and consumer spending remains strong.

And more and more, economists have adopted an increasingly bullish tone. A June 8 piece on GoldmanSachs.com headlined “Why a US recession has become less likely” captures this sentiment.

Many economists who have been forecasting a recession have either withdrawn their call or delayed it.

“The risk backdrop has improved, and labor supply has rebounded,” BofA economist Michael Gapen wrote on Wednesday. “Both are contributing to resiliency in the US recovery… We revise in favor of a later, and more moderate, downturn in 2024. Inflation now falls, and unemployment rises, more slowly.”

Indeed, just because we get a recession doesn’t necessarily mean the economy will be in terrible shape.

The bottom line is that the case for an economic recession remains very weak as massive tailwinds continue to support growth.

3. The stock market is not doomed to crater 📉

The ‘most popular prediction’ coming into 2023 was that stocks would tumble during the first half of the year before rallying in the second half.

That prediction has been very wrong. In fact, the stock market officially entered a bull market earlier this month while spending almost no time this year in the red.

In recent weeks, the consensus has shifted with strategists across Wall Street revising up their year-end price targets for the S&P 500, including Goldman Sachs’ David Kostin (to 4,500 from 4,000), BMO Capital Markets’ Brian Belski (to 4,550 from 4,300), BofA’s Savita Subramanian (to 4,300 from 4,000), and RBC Capital Markets’ Lori Calvasina (to 4,250 from 4,100). Elsewhere, Evercore ISI’s Julian Emanuel, Stifel’s Barry Bannister, and Truist’s Keith Lerner moved their targets higher.

“With earnings estimates getting less bad and the Fed nearing the end of the rate cycle, it makes sense that equities are finding themselves on a better footing,” Fidelity’s Jurrien Timmer tweeted on Thursday.

Indeed, while the improving outlook for earnings is the simplest explanation for higher stock prices, it’s a welcome development to see that the Fed-sponsored market-beatings may not go on for much longer.

Who knows for sure what stock prices will do in the second half?

The bottom line is that market conditions appear to be improving, and stock prices have been moving up (as they usually do).

Zooming out 🔭

There’s a lot of good things happening right now. The economy is strong, the outlook for earnings is improving, and stock prices are moving higher.

Importantly, all of this is happening as inflation continues to cool, which means we could be nearing the end of the Fed’s market-unfriendly policies.

Instinctually, you may be thinking that it’s during times like this that things go wrong. Maybe so. History is riddled with negative shocks that set back the economy and the markets.

But history also says the economy tends to grow, earnings trend higher, and stocks usually go up.

While it’s never wise to get complacent, there’s also nothing wrong with enjoying things while things are good.

Reviewing the macro crosscurrents 🔀

There were a few notable data points and macroeconomic developments from last week to consider:

🏛️ A hawkish pause. The big event of the week was arguably the Fed announcement, which we discussed above.

🛍️ Consumer spending is holding up. According to Census Bureau data (via Notes), retail sales in May climbed 0.3% to $686.6 billion. While the pace of sales is off its record high, it continues to trend well above pre-pandemic levels.

Excluding autos and gas, sales were up 0.4% with gains across most categories, led by building material and garden equipment, cars and parts, furniture, and restaurants and bars.

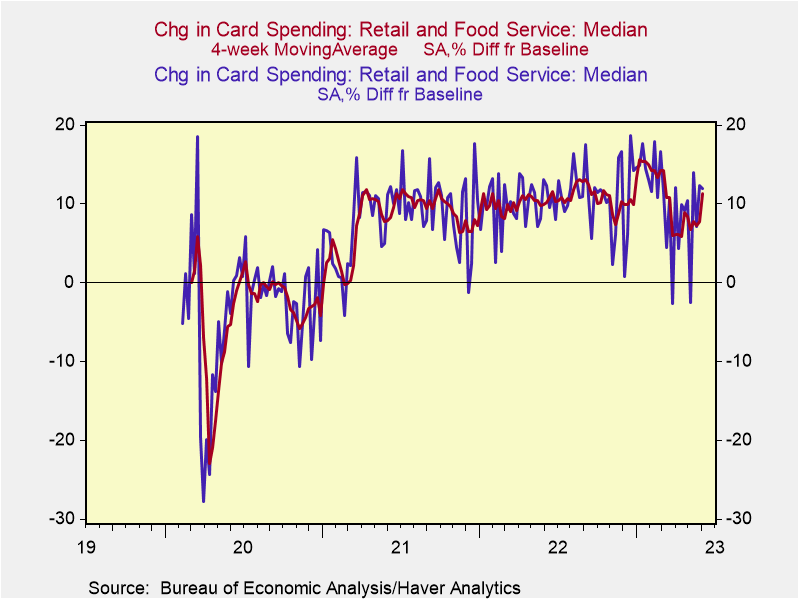

💳 Spending in June looks strong. From Renaissance Macro Research: “Consumption looks like it started off the month of June on a strong note. According to payment card transactions data from the Bureau of Economic Analysis, spending is up 12.0% against a pre-pandemic baseline; the four-week average is 11.4%, [a] notable improvement from early May.”

⛽️ Consumers are hitting the road. Weekly EIA data through June 9 show gasoline demand is up from a year ago.

💵 Consumers have cash in the bank. From BofA: “…median household savings and checking balances remain well above their 2019 levels for all generations.”

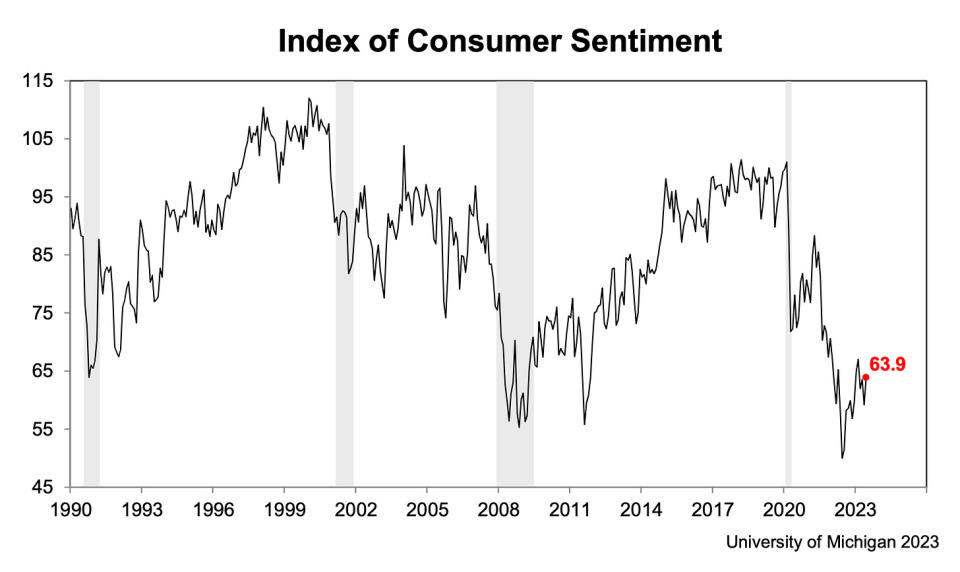

👍 Consumer sentiment is up. From the University of Michigan’s June Survey of Consumers: “Consumer sentiment lifted 8% in June, reaching its highest level in four months, reflecting greater optimism as inflation eased and policymakers resolved the debt ceiling crisis. The outlook over the economy surged 28% over the short run and 14% over the long run. Sentiment is now 28% above the historic low from a year ago and may be resuming its upward trajectory since then.”

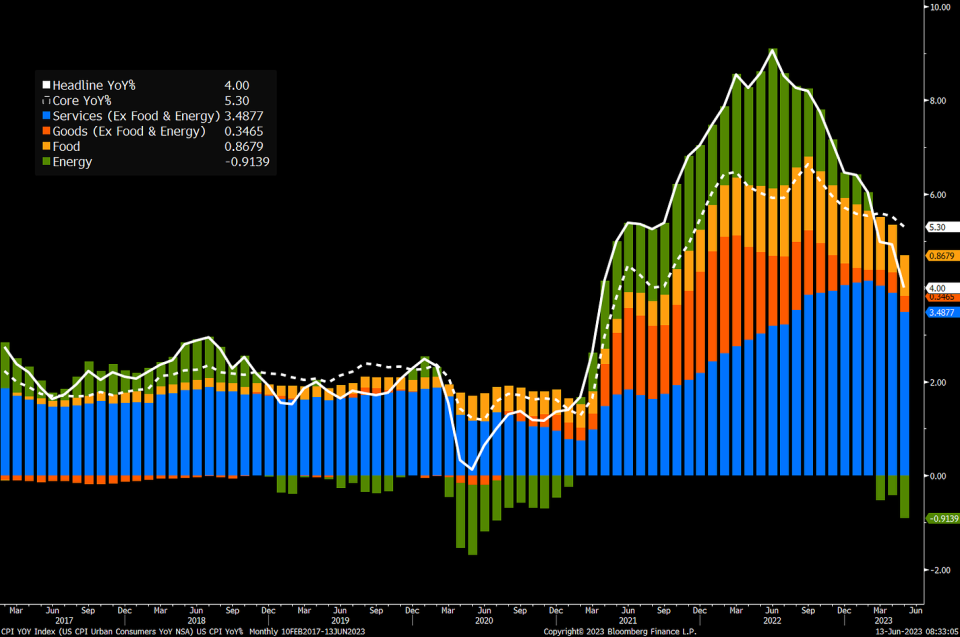

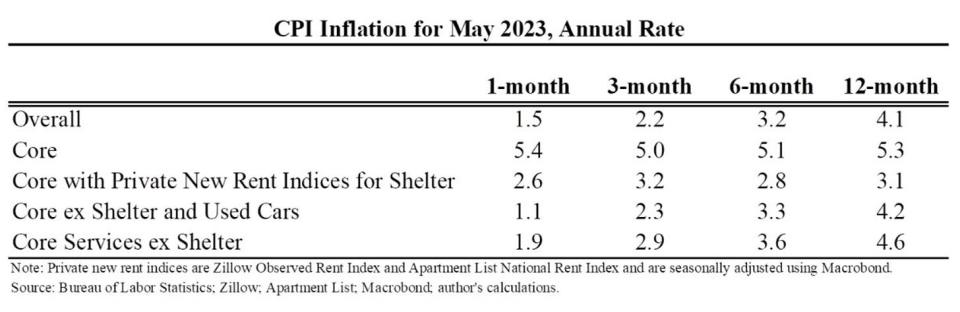

🎈 Inflation continues to cool. The Consumer Price Index (CPI) in May was up 4.0% from a year ago, down from 4.9% in April. It was a record 11th straight month of decline, and it was the lowest reading since March 2021. Excluding food and energy prices, core CPI was up 5.3% from a year ago, down from 5.1% in April.

On a month-over-month basis, CPI was up 0.1%, down from 0.4% the month prior as energy prices tumbled. Core CPI was up 0.4%, unchanged from the month prior.

If you annualize the three-month trend in the monthly figures, CPI is rising at a 2.2% rate and core CPI is climbing at a 5.0% rate.

While inflation rates have generally been trending lower, core measures of inflation continue to be above the Federal Reserve’s target rate of 2%.

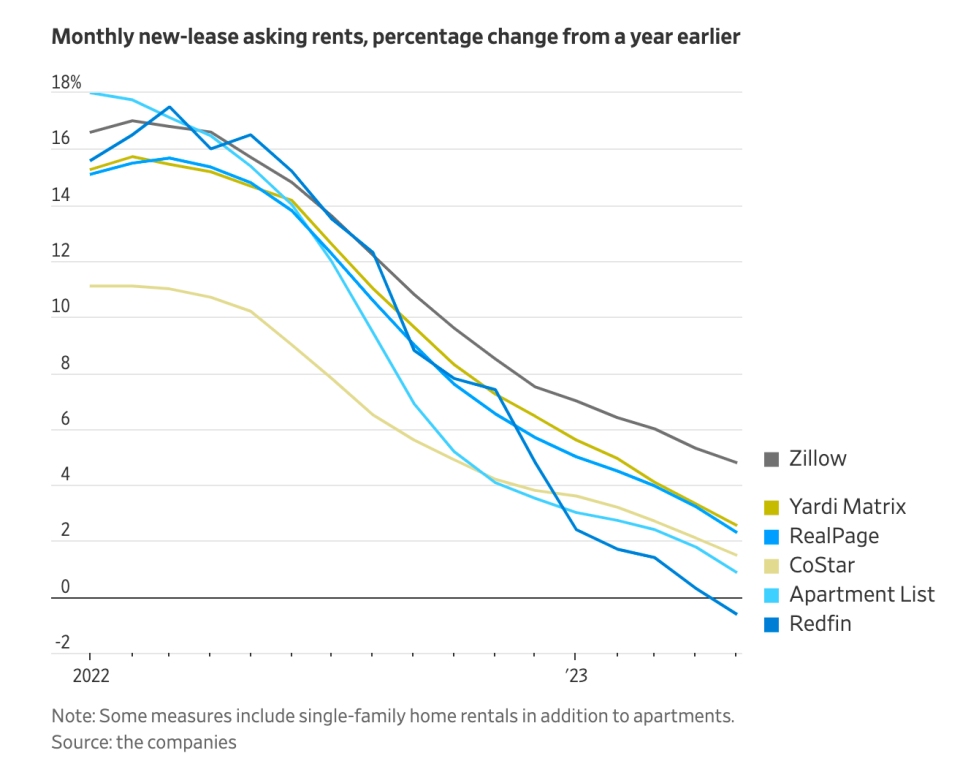

🏢 Rents are cooling. From the WSJ: “The average of six national rental-price measures from rental-listing and property data companies shows new-lease asking rents rose just under 2% over the 12 months ending in May. That is down from the double-digit increases of a year ago and represents the largest deceleration over any year in recent history, according to data firm CoStar Group and rental software company RealPage.”

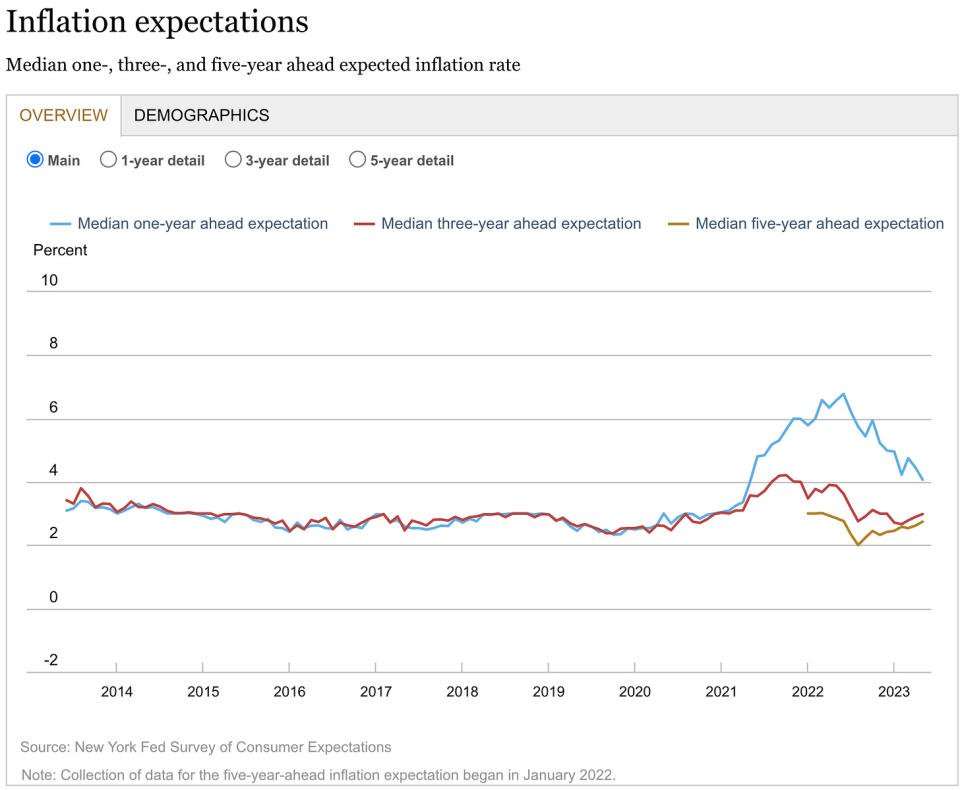

🤷🏻♂️ Consumers’ outlook for inflation is mixed. From the New York Fed’s May Survey of Consumer Expectations: “Median inflation expectations declined by 0.3 percentage point at the one-year-ahead horizon to 4.1%, the lowest reading since May 2021. In contrast, median inflation expectations increased by 0.1 percentage point at the three- and five-year-ahead horizons to 3.0% and 2.7%, respectively.”

From the University of Michigan’s June Survey of Consumers: “Year-ahead inflation expectations receded for the second consecutive month, falling to 3.3% in June from 4.2% in May. The current reading is the lowest since March 2021. In contrast, long-run inflation expectations were little changed from May at 3.0%, again staying within the narrow 2.9-3.1% range for 22 of the last 23 months. Long-run inflation expectations remained elevated relative to the 2.2-2.6% range seen in the two years pre-pandemic.”

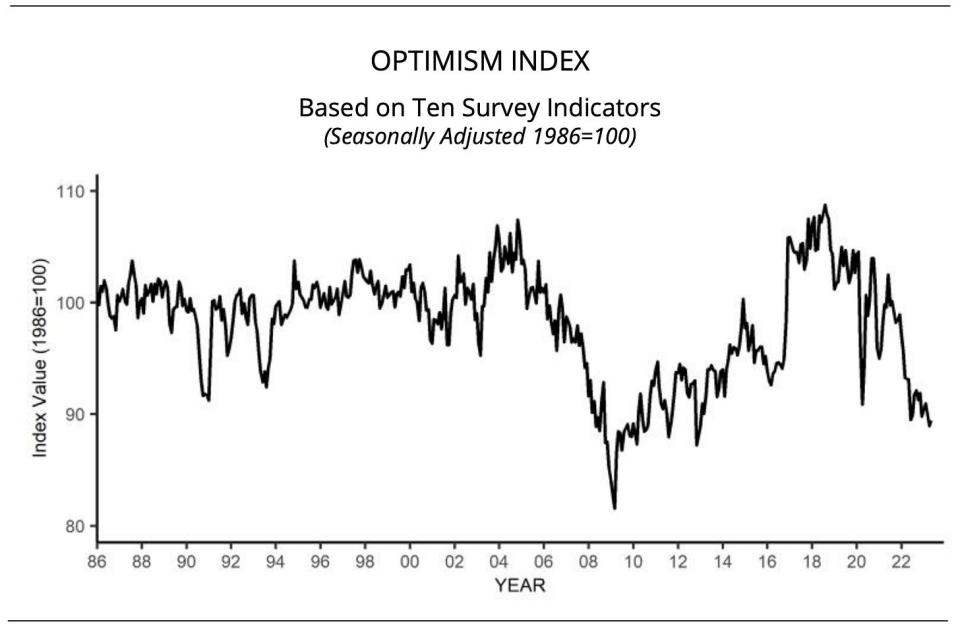

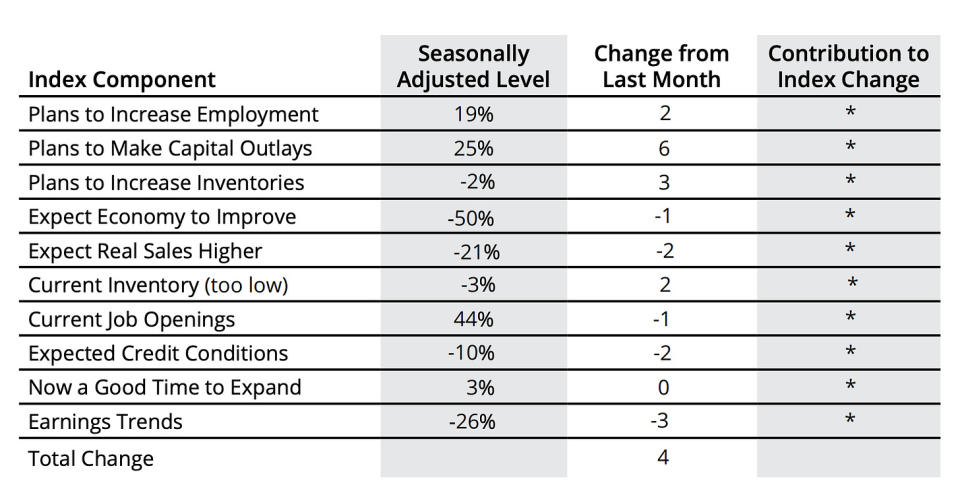

👍 Small business sentiment ticks up. The NFIB’s Small Business Optimism Index (via Notes) improved from depressed levels in May.

Moves in the underlying components of the index were encouraging: Plans to increase employment improved, plans to make capital outlays jumped, and plans to increase inventories ticked higher.

As the NFIB shows, the more tangible “hard” components of the index have held up much better than the more sentiment-oriented “soft” components.

Keep in mind that during times of stress, soft data tends to be more exaggerated than actual hard data.

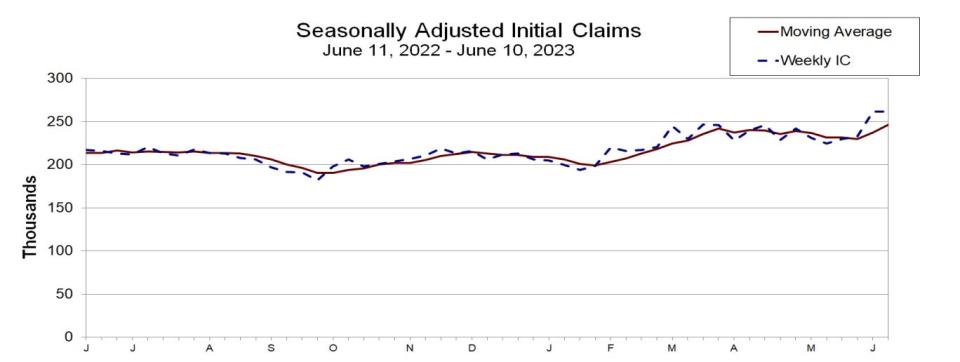

💼 Unemployment claims tick up. Initial claims for unemployment benefits stood at 262,000 during the week ending June 10, unchanged from the week prior. While this is up from the September low of 182,000, it continues to trend at levels associated with economic growth.

Regarding the increase, initial claims in Minnesota jumped by an outsized 3,664 during the period. Here’s Upjohn Institute economist Aaron Sojourner: “Minnesota had an unusually large increase into the prior week & a pretty big one this week, may be partially attributable to a new law that expanded UI system to include many school employees experiencing summer layoff.”

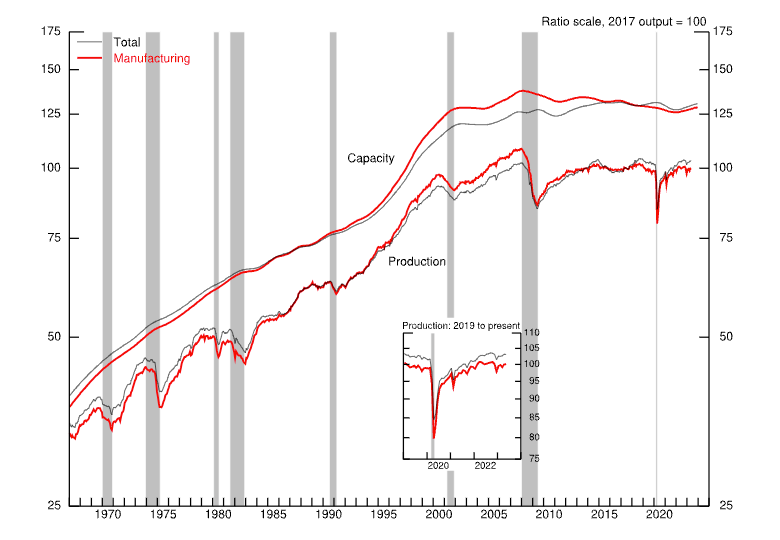

🛠️ Manufacturing output rises. Industrial production declined by 0.2% in May. The closely watched manufacturing output measure rose by 0.1%.

From Capital Economics: “Manufacturing output increased by 0.1% m/m, which isn’t much, but it’s better than we were expecting given the severe weakness evident in the survey-based activity indicators.”

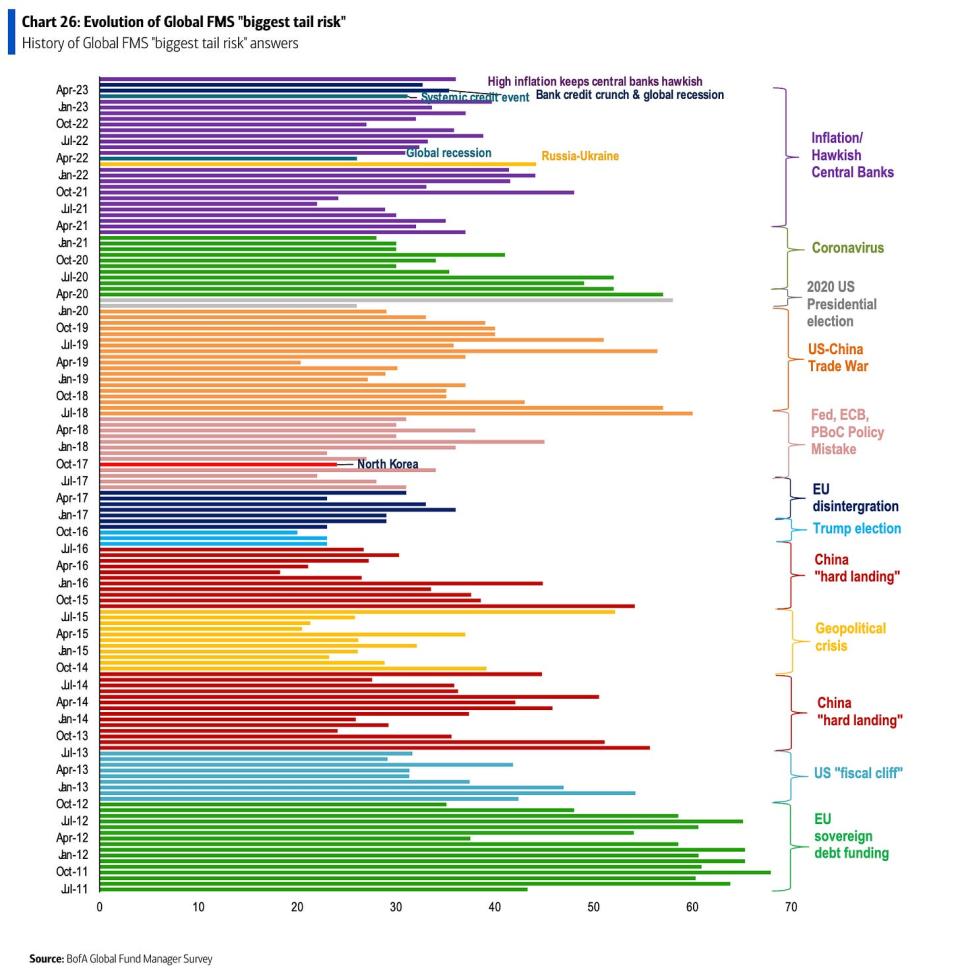

😬 The pros are worried about stuff. According to BofA’s May Global Fund Manager Survey (via Notes), fund managers identified central bank worries as the “biggest tail risk.”

The truth is we’re always worried about something. That’s just the nature of investing.

📈 Near-term GDP growth estimates remain rosy. The Atlanta Fed’s GDPNow model sees real GDP growth climbing at a 1.8% rate in Q2. While the model’s estimate is off its high, it’s nevertheless very positive and up from its initial estimate of 1.7% growth as of April 28.

Putting it all together 🤔

We continue to get evidence that we could see a bullish “Goldilocks” soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

The Federal Reserve recently adopted a less hawkish tone, acknowledging on February 1 that “for the first time that the disinflationary process has started.” On May 3, the Fed signaled that the end of interest rate hikes may be here. And at its June 14 policy meeting, it kept rates unchanged, ending a streak of 10 consecutive rate hikes.

In any case, inflation still has to come down more before the Fed is comfortable with price levels. So we should expect the central bank to keep monetary policy tight, which means we should be prepared for tight financial conditions (e.g. higher interest rates, tighter lending standards, and lower stock valuations) to linger.

All of this means monetary policy will be unfriendly to markets for the time being, and the risk the economy sinks into a recession will be relatively elevated.

BUT, we also know that stocks are discounting mechanisms, meaning that prices will have bottomed before the Fed signals a major pivot in monetary policy.

Also, it’s important to remember that while recession risks are elevated, consumers are coming from a very strong financial position. Unemployed people are getting jobs. Those with jobs are getting raises. And many still have excess savings to tap into. Indeed, strong spending data confirms this financial resilience. So it’s too early to sound the alarm from a consumption perspective.

At this point, any downturn is unlikely to turn into economic calamity given that the financial health of consumers and businesses remains very strong.

And as always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have had a pretty rough couple of years, the long-run outlook for stocks remains positive.