On a mild September day in 2015, a man walked into Walsall shopping centre in the West Midlands and headed straight for the local NatWest branch.

In his hands were a number of black bin bags filled to the brim but not immediately suspicious to those around him. As he reached his destination, however, the bags burst under the weight of their load and out fell £700,000 in cash.

Rather than raise alarm bells among NatWest staff, the branch’s employees helped the man to repack the notes into sturdier hessian sacks before the cash was taken to the bank’s safe.

The huge deposit was made by Bradford jeweller Fowler Oldfield, which lodged more than £260m in cash at NatWest branches over a five-year period. At times, the quantities were so large they filled two floor-to-ceiling safes at the Walsall branch and excess amounts had to be stored elsewhere.

Despite the Yorkshire jeweller only having an annual turnover of around £15m, NatWest failed to report the lodgements as suspicious before 2016, when police said they were investigating Fowler Oldfield.

In 2021, the Financial Conduct Authority (FCA) took NatWest to court, where the FTSE 100 bank was hit with a criminal conviction and a £265m fine for breaching anti-money laundering regulations over the deposits.

It turned out that the huge sums were the proceeds of an alleged money laundering scheme. Clare Montgomery, the barrister acting for the FCA, said in court, dismayed: “Someone was walking through the streets with black bin liners of cash.”

The case exemplified concerns that Britain’s lenders were not doing enough to prevent money laundering, especially when it came to cash transactions.

However, amid regulatory pressure there are now growing fears that banks are becoming overly zealous against cash. Last week, The Telegraph revealed that NatWest was imposing new limits on cash deposits and withdrawals. The move has fuelled warnings that banks are forcing customers towards a “cashless society”, threatening to leave millions of people shut out from accessing basic financial services and triggering a political backlash amid privacy concerns.

‘Sleepwalking into a cashless society’

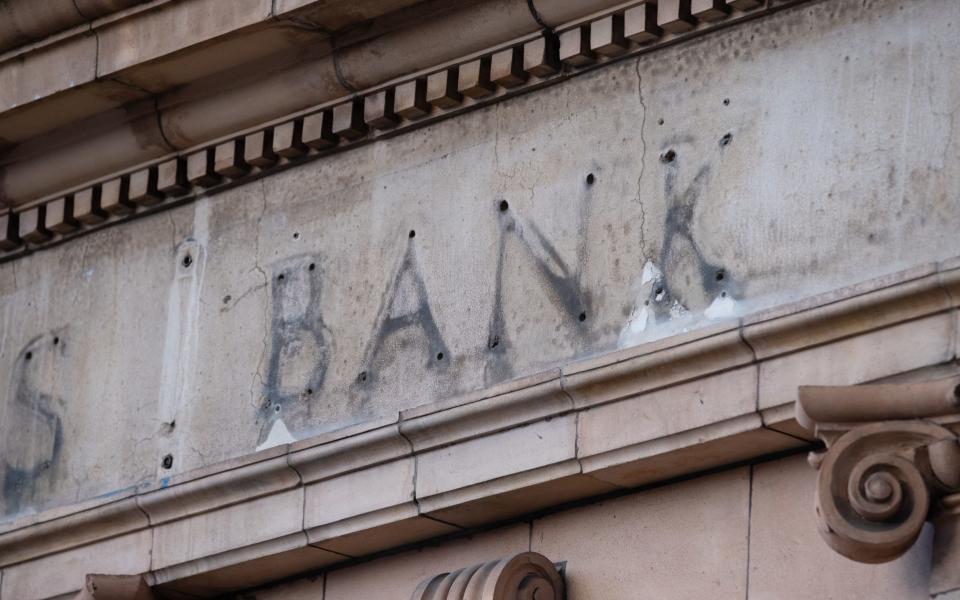

The decline of cash is a phenomenon that has been taking place for much of the 21st century.

The rise of digital payments, including Apple Pay and Google Pay, which allow users to pay for goods and services with a wave of their mobile phones, have made notes and coins an inconvenience for many.

Data from the Bank of England shows that cash use for everyday transactions has been declining rapidly for at least a decade, falling from over 50pc of all transactions in 2010 to just 15pc in 2021. Meanwhile, nearly a third of all payments in the UK were made via contactless methods in 2021, according to UK Finance.

Fears that the transition towards digital payments was accelerating at a pace that would harm millions of people forced Philip Hammond, the then chancellor, to vow to protect cash in 2019 by keeping all coins and notes – from the penny to the £50 note – in circulation.

At the time, he said: “Technology has transformed banking for millions of people, making it easier and quicker to carry out financial transactions and pay for services. But it’s also clear that many people still rely on cash and I want the public to have choice over how they spend their money.”

In the same year, Natalie Ceeney, a civil servant and businesswoman, published her government-commissioned review into the future of access to cash, in which she warned that Britain was at risk of “sleepwalking into a cashless society”.

“We can’t wait long for action,” she wrote. “Once infrastructure has gone, or communities have been harmed, rebuilding is very hard. But if we act now, we can take steps to stop harm happening, and prepare for a world of lower cash, without societal and economic damage.”

Ceeney cited the closure of bank branches and ATMs, particularly in rural areas, as a key concern. She added that these closures create a vicious cycle by making it harder for locals to access cash, while also increasing the costs for local retailers using cash – which pushes them to digital only.

The number of cash points fell from more than 70,000 in 2015 to just 51,000 in 2021.

Branch closures can have a significant impact on communities, especially in more rural locations. Richard Foord, a Liberal Democrat MP for Tiverton and Honiton in Devon, says: “When people go to their bank or building society it’s often about something fairly big and serious in their lives.

“I can think of one elderly individual whose wife died and one of the first things he had to do in the wake of his wife dying was to settle her financial affairs. The way he saw fit to do that, which many people of his generation would, was to go and speak to the local bank manager.

“That sort of personal service in a time of very acute grief is underestimated. I think the banks don’t fully value how important that kind of personal service is and their circumstances. Given that the FCA has been asked by the government to introduce a consumer duty not to de-bank individuals, how about a similar duty not to de-bank communities?”

In a bid to combat this trend, the Government has overseen the creation of so-called “shared banking hubs”, which effectively act as mega-branches that are shared among several high street lenders, with a counter service run by the Post Office.

Eight of these hubs have opened so far with another 60 in the pipeline. One hub in Axminster, which is in Foord’s constituency, was set to open this month but has been delayed, which he says has led to a lot of queries from constituents.

Despite these efforts, the rapid decline of cash shows no signs of abating. In April, Sir Jon Cunliffe, the deputy governor of the Bank of England, told a finance summit that “cash is likely to decline further and cash itself will become less useable in everyday transactions”.

Threadneedle Street’s own forecasts show that just 9pc of all payments will be made in physical cash by 2028, while UK Finance expects that to fall to 6pc of all payments by 2031.

Significant privacy concerns

The decline of cash has also triggered concerns around privacy and civil liberties. The public has far more control and privacy when using cash compared with digital transactions, which leave a traceable footprint. While the latter can be convenient for banks and regulators, it also curtails personal freedoms.

Sir Jacob Rees-Mogg, a Conservative MP and former Business Secretary, says that the increased monitoring of transactions is a disturbing consequence of a cashless society.

He says: “It assumes that people using cash are doing something wrong. You should be free to do anything you like in this country within the confines of the law and [banks] are being given the power to trace transactions, often for no reason.”

The issue appears to transcend party political lines. In a parliamentary debate in March, Martyn Day, an SNP MP, raised similar concerns.

He said: “There are also those who have valid privacy concerns about electronic payments. In an age of technology, algorithms, digital footprints and cyber-crimes, it is understandable that some – perhaps many – of our constituents would prefer the financial privacy offered by cash transactions.

“Some constituents wrote to me in recent weeks to make that point. Many stated that they regard barriers to using cash as a violation of their right to privacy.”

Groups such as Cash Matters, which styles itself as a “civil society movement”, are campaigning to “support the existence and relevance of cash as an integral part of the payment landscape now and in future”.

The group argues that cash is the most secure payment method, is resilient in times of crisis and offers privacy when fraud and personal data collection is proliferating. The group adds: “Banknotes and coins reflect a nation’s identity and its magic moments, presenting its most significant people, landmarks and values to the world.”

While Sir Jacob says that it is somewhat condescending to suggest that elderly people are unable to use digital payment methods, he adds that he is more persuaded by the “surveillance argument”.

He says: “One needs to keep in the back of their mind the risk of becoming a surveillance society without getting paranoid about it.”

Earlier this year, the Bank of England and the Treasury threw their weight behind the creation of a “digital pound”, sparking further concerns about the erosion of financial privacy.

Dubbed “Britcoin”, the so-called central bank digital currency (CBDC) would use blockchain technology currently used by cryptocurrencies to record transfers on a central digital ledger.

Threadneedle Street already creates money digitally by issuing new reserves at commercial banks but a CBDC would theoretically allow the Bank to issue new currency digitally directly to individuals or businesses. It would also allow people to hold digital currency on smartphones without the need for a bank account, similar to how physical cash can be held in a wallet.

Privacy campaigners have raised concerns about CBDCs, with a developer working on the Britcoin project saying it could be used to check shoppers’ ages or nationalities.

There are also concerns within the upper echelons of the Bank itself, with Carolyn Wilkins, a member of the Financial Policy Committee, warning in May about privacy risks.

She said that there needed to be a “high bar” for the technology, as “privacy and potential to monitor citizens top the list of worries” over mission creep by authorities.

On the fringes, the issue has been taken up by conspiracy theorists who claim digital currencies are being used to control populations. Earlier this year, conspiracy theorists seized on a video of a talk at the World Economic Forum where they claimed a “Davos agent” was calling for a cashless society and saying those determined “less desirable” will be locked out.

In fact, Eswar Prasad, an economics professor from Cornell University, spoke at the event and spoke about both the benefits and the dangers of CBDCs.

Meanwhile, for Sir Jacob, the main issue around access to cash revolves around ownership. “It’s your cash and you should be allowed to take it all out if you want to,” he says.

“Now, if a 90-year-old woman walked into a bank branch with someone dodgy and sought to withdraw cash, a bank has a duty to prevent exploitative fraud. But if a sound-minded person wants to take out their cash they should be able to do so.”

The increasing number of shops refusing to accept cash has also led to calls for the Government to make it illegal for retailers to decline cash payments. While cash is legal tender, businesses are not legally required to accept it. There is a growing list of popular high street restaurant chains that have stopped taking cash altogether, including Prezzo, Itsu and Côte Brasserie.

Meanwhile, many branches of Starbucks and Burger King are also only accepting card payments.

Covid accelerated this trend as companies rushed to cut down on handling cash at the outset of the pandemic, but many businesses decided to maintain their no-cash policies.

The reasons for doing so are varied, with Prezzo saying that it makes things “much simpler and quicker” for staff and customers. Côte Brasserie said it went permanently card-only because of reduced local banking facilities and for the “safety of its teams”. Meanwhile, Asian-inspired chain Itsu said being cash-free lets it serve customers “safely and more quickly”, “with no distraction on cash handling policies”.

Other chains that continue to take cash but say they “encourage” card payments include Caffè Nero, Pizza Express and Greggs.

While these policies can make the running of hospitality businesses more straightforward, they also risk alienating a cohort of the population that still rely on cash payments.

According to the FCA, more than a million adults in the UK do not have a bank account and rely solely on cash.

Not every business is shunning cash, however. JD Wetherspoon has said that many of its customers still prefer to use cash, adding that turning down people who turn up with legal tender is “controversial”.

Legislation guarantees

Pressure is growing for the Government to do more to guarantee access to cash. Last year, a petition calling for new legislation that would make it illegal for retailers to decline cash payments garnered more than 33,000 signatures, easily meeting the 10,000 threshold to trigger a response from the Government.

However, despite the growing backlash, ministers said they had no plans to force shops to accept notes and coins. “The Government does not plan to mandate cash acceptance. Businesses are able to choose the forms of payment they accept. The government’s proposals for legislation support cash acceptance,” the response said.

Sir Jacob agrees. “We should be cautious about reaching for the legislative gun,” he says.

Under the recent Financial Services and Markets Act, the FCA will become the lead regulator for retail cash access and will be given appropriate powers for ensuring that companies continue to provide deposit and withdrawal facilities across the UK.

However, with the use of cash in potentially terminal decline, tougher action might need to be taken to ensure that some of the most vulnerable in society are still able to access basic economic rights.