Inflation remained high in May as rising prices and elevated interest rates continue to weigh on Americans’ finances, according to the latest Bureau of Labor Statistics (BLS) release on Wednesday.

The consumer price index (CPI), a broad measure of the price of everyday goods, increased 3.3% on an annual basis in May and 0% month-over-month, compared to 3.4% in April, according to the BLS. Core CPI, which excludes the volatile categories of energy and food, remained high, rising 3.4 year-over-year in May, compared to 3.6% in April. (RELATED: Financial Titan Warns Of Impending ‘Distress’ That Could Devastate Small Banks)

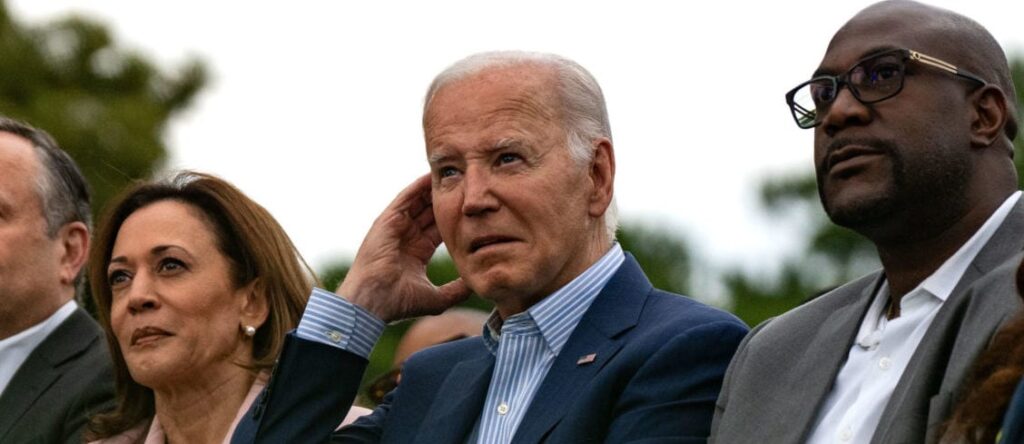

Inflation peaked at 9% under President Joe Biden in June 2022 after rising from 1.4% year-over-year in January 2021 and has since failed to drop below 3%. Economists expected CPI to increase by 0.1% for the month in May and remain at 3.4% for the year, according to MarketWatch.

May’s changes to the CPI were released just hours ahead of the conclusion of the Federal Open Market Committee’s (FOMC) June meeting, where it will be decided whether to adjust its benchmark federal funds rate. The Federal Reserve has currently set the rate in a range of 5.25% and 5.50%, a 23-year high, in an attempt to tame elevated inflation, raising the cost of credit across the economy.

Economic growth has also slowed in the last several months as inflation continues to weigh on consumer spending, with the nation’s gross domestic product increasing just 1.3% in the first quarter of 2024.

NFIB: small business optimism remained extremely depressed, near decade low in May w/ uncertainty hitting levels not seen since ’20 when many small businesses were still under gov’t-imposed closures; inflation remains major concerns for small business w/ profits being squeezed: pic.twitter.com/HxGp6vs9HG

— E.J. Antoni, Ph.D. (@RealEJAntoni) June 11, 2024

Persistently high inflation coupled with slow growth has stoked fears that the economy is in a period of stagflation, which wreaked havoc on Americans’ finances in the 1970’s and 1980’s. Fed Chair Jerome Powell pushed back against stagflation claims in the press conference following the FOMC’s May rate decision, pointing to slowly decelerating inflation and low unemployment.

The unemployment rate ticked up slightly to 4.0% in May, marking the first time since January 2022 when the rate was above 3.9%. The U.S. added 272,000 jobs in May, but the number of people employed declined by 408,000 due to a drop of over 600,000 full-time workers.

A poll conducted in May found that inflation was the biggest concern for 49% of small business owners, and 67% said that current economic conditions could force them to close their doors.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.