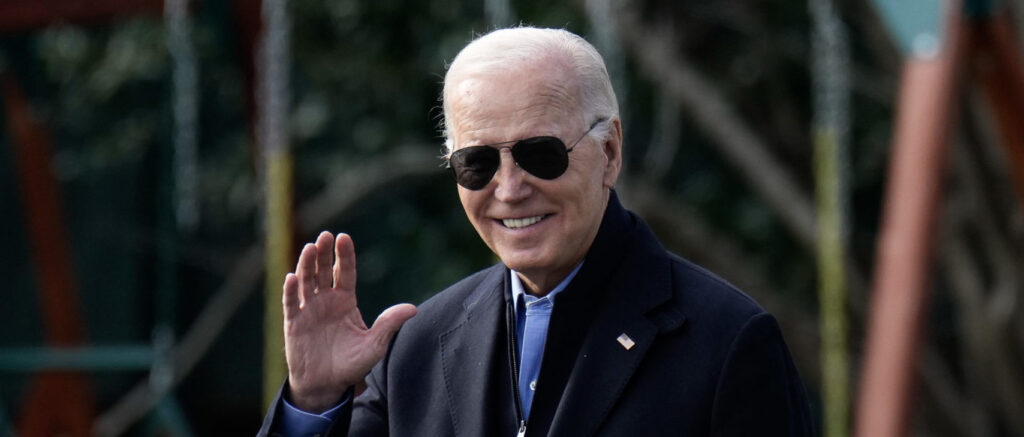

Interest rate hikes to combat sky-high inflation under President Joe Biden have led the Federal Reserve to run over a hundred billion dollar deficit, adding to the national debt, experts told the Daily Caller News Foundation.

The Federal Reserve in past years has operated a net surplus, remitting those excess earnings to the Treasury to pay off the national debt, according to a press release from the Fed. In 2023, following an inflation-driven increase to the federal funds rate, the interest rate that the central bank has to pay to commercial banks that are holding excess cash overnight, the Fed began losing money, which the Treasury has to issue debt to pay, according to experts who spoke to the DCNF. (RELATED: Dem Demands On Automakers Could Backfire On Their Own Climate Agenda And Americans’ Wallets, Experts Say)

“The Fed’s losses do contribute to the deficit,” George Selgin, director emeritus of the Center for Monetary and Financial Alternatives at the Cato Institute, told the DCNF. “Normally, the Fed saves the government money by sending most of the interest it earns on its securities back to the U.S. Treasury. But because the Fed now pays interest on banks’ reserves, when the rate it pays goes up, its remittances to the Treasury go down, and lately the rate it pays has risen so much that this past year alone it owed banks more than $100 billion more than it earned. Until it makes up for this loss and also for losses from the previous few years, which could take a long time, it won’t be sending anything to the Treasury.”

The Fed was able to remit around $79 billion to the Treasury in 2022 before having to take out $16.6 billion in debt by the end of the year as rising interest rates took hold, later losing $114.3 billion in 2023, according to the Fed press release. The Treasury received $109 billion, $86 billion, $54.9 billion and $62.1 billion from the Fed in 2021, 2020, 2019 and 2018, respectively.

The rates that the Federal Reserve pays on the overnight reserve balances held by commercial banks have risen in accordance with hikes in the federal funds rate, which the Fed has put in a range of 5.25% and 5.50%, the highest rate in 22 years, in response to high inflation that peaked at 9.1% in June 2022 under Biden. Inflation has since moderated to 3.4% as of December — still not at the Fed’s 2% target, but enough to prompt a median of Fed governors to predict three rate cuts before the end of 2024.

“The Fed’s rate hikes are supposed to counter inflation by raising the cost of borrowing, which is supposed in turn to cause people to borrow and spend less,” Selgin told the DCNF. “But the same hikes add to the government’s deficit, by reducing the Fed’s Treasury remittances, but mainly by raising the interest the Treasury has to pay on its shorter-term obligations. So unless the government cuts spending, the rate hikes can fail to counter inflation, and might even aggravate it, and the public bears the double burden of higher rates and high, if not higher inflation.”

Many economists point to high-spending policies for a portion of the inflation that has plagued Americans under Biden. Biden signed the American Rescue Plan in March 2021 and the Inflation Reduction Act in August 2022, authorizing $1.9 trillion and $750 billion in new spending, respectively.

The U.S. national debt exceeded $34 trillion for the first time in the country’s history on Dec. 29, 2023, with around $27 trillion being held by the public and the other more than $7 trillion being intergovernmentally held. For Fiscal Year 2023, the federal government ran a budget deficit of around $2 trillion when the president’s failed student loan forgiveness plan is properly accounted for, compared to $1 trillion in the previous fiscal year.

Federal debt at new record high: $34.059 trillion

It’ll buff… pic.twitter.com/FRtupIDHNT— E.J. Antoni, Ph.D. (@RealEJAntoni) January 12, 2024

“The reason it has losses is that the Fed printed money to buy federal debt,” Richard Stern, director of the Grover M. Hermann Center for the Federal Budget at the Heritage Foundation, told the DCNF. “Then, when it stopped printing money to buy more debt, new federal deficits fell onto the private money markets. This triggered crowding out and the ensuing interest rate surges we’ve seen. Then the interest rate spike reduced the market value of the existing debt that the Fed is holding — that’s what the losses are.”

Net interest payments on the national debt have also increased rapidly as rates have risen, with any new Treasury debt issued having to be at a much higher interest rate, costing more to maintain and hold. In the first quarter of 2021, when Biden first took office, interest payments totaled around $535 billion, which has grown to more than $980 billion as of the third quarter of 2023, according to the Federal Reserve Bank of St. Louis.

“I’d say that the losses are indicative of the inflationary money printing used to cover Biden’s spending and just one more example of where the government is using inflation and interest rate manipulation to cheat bondholders and steal from hard-working Americans,” Stern told the DCNF.

The White House did not respond to a request to comment from the DCNF.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.