“Legendary investor Peter Lynch has a straightforward perspective on corporate insiders and their actions in the stock market. He put it simply: ‘Insiders might sell their shares for any number of reasons, but they buy them for only one reason—they think the price will rise.’

Indeed, one of the best stock signals comes from corporate insiders, the company officers who hold positions of high responsibility – to their Boards, and to their peers, and to their shareholders and customers – for bringing in the maximum returns. Their main focus is on keeping the company healthy, and their positions give them access to knowledge that the general public just hasn’t got. And that knowledge will inform their trading decisions when they trade their company’s stock.

With this in mind, we turned to TipRanks’ Insiders’ Hot Stocks tool to identify two stocks that are flashing signs of strong insider buying. What makes these stocks particularly appealing to investors is their generous dividend yields, exceeding 9%. So, without further ado, let’s dive in.

Energy Transfer (ET)

The first high-yield dividend stock we’ll look at is Energy Transfer, a major player in the North American oil and gas midstream sector. Everything about Energy Transfer is big: the company boasts a market cap near $39 billion, operates over 120,000 miles of pipelines and other energy transport infrastructure across the continental US, and last year alone, ET spent approximately $740 million on maintaining and improving that network. While Energy Transfer’s operations primarily revolve around Texas, Louisiana, Arkansas, and Oklahoma, it also holds a strong presence in the northern Great Plains, the Great Lakes and Mid Atlantic regions, as well as Florida.

Energy Transfer’s most recent ‘big news’ was the announcement of its agreement to acquire the smaller firm Lotus Midstream. The acquisition will bring another 3,000 miles’ worth of crude oil gathering and transport pipelines into ET’s network, connecting assets in the Texas-New Mexico border region with Oklahoma. The transaction, in both cash and stock, is valued at approximately $1.45 billion and was completed earlier this month.

The Lotus acquisition demonstrates ET’s confidence in its position, despite the company missing its 1Q23 revenue targets. The total top line amounted to $19 billion, a 7% year-over-year decrease, falling short of the forecast by nearly $2.49 billion. ET reported earnings per share of 32 cents, both basic and diluted. However, the GAAP basic figure fell 3 cents below expectations, while the non-GAAP diluted figure exceeded the forecast by 2 cents.

Drilling down, we find that Energy Transfer reported an adjusted EBITDA of $3.43 billion for 1Q23, which compares favorably to the $3.34 billion posted in the prior-year period. Of particular interest to dividend investors, ET had $2.01 billion in distributable cash flow for Q1. Although this figure is lower than the $2.08 billion from the year-ago quarter, it was still sufficient for management to increase its dividend distribution for the sixth consecutive quarter.

That dividend is now set at $0.3075 cents per common share, or $1.23 annualized. At that rate, the dividend gives an impressive forward yield of 9.8%.

Turning to the insider trades, the major insider trades in ET shares were made by Kelcy Warren, the company’s executive chairman. Warren made two large purchases this month, for 1 million shares and 500,000 shares. These purchases cost a total of $18.62 million.

Wall Street likes this midstream giant, and 5-star analyst Justin Jenkins, covering the company for Raymond James, lays out a solid bull case.

“Regularly among our most-debated stocks, the narrative is shifting (with good reason) for Energy Transfer (ET) – look no further than one of the better YTD/TTM performance profiles in the group. With long-standing overhangs dissipating, the obvious investor push-backs are less frequent — and earnings results continue to illustrate improving fundamentals. Though tone towards growth spending remains aggressive, FCF generation is still robust in our model. The focus in 2023+ should be on attractively deploying excess FCF (e.g., helping lessen the impact of lower commodity prices). We wouldn’t bet against one of our most integrated names, particularly not at ~7x 2024E EV/EBITDA,” Jenkins opined.

It should be unsurprising, then, that Jenkins rates ET shares a Strong Buy. Not to mention his $17 price target puts the upside potential at 35.5%. Based on the current dividend yield and the expected price appreciation, the stock has ~45% potential total return profile. (To watch Jenkins’ track record, click here)

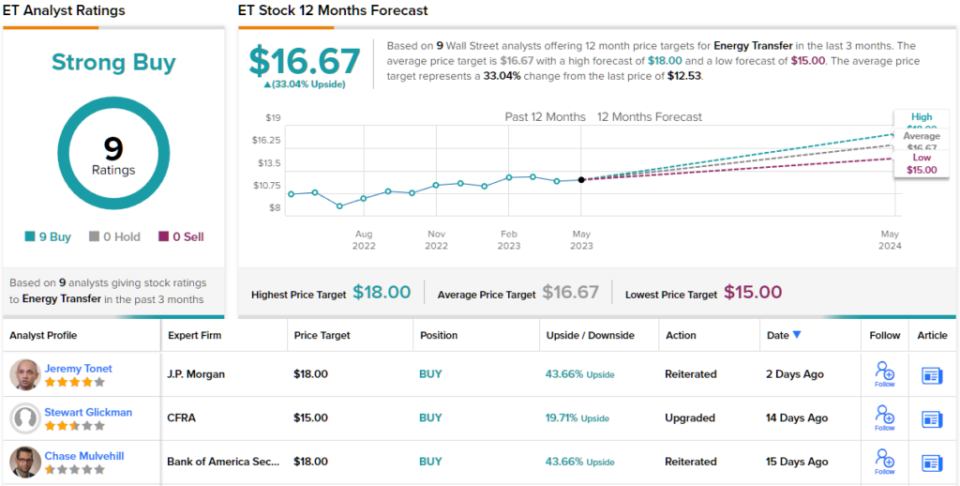

Jenkins is hardly the only one giving ET shares a Strong Buy rating; the stock has 9 positive analyst reviews on record, for a Strong Buy consensus rating. With the shares currently trading for $12.53, the average price target of $16.67 indicates potential for a 33% increase over the next 12 months. (See ET stock forecast)

AFC Gamma (AFCG)

Shifting our focus from the energy sector, let’s explore AFC Gamma, one of the many companies that have emerged to capitalize on the relaxation of regulations on marijuana and cannabis products, as well as the growing adoption of legal cannabis at the state level.

AFC Gamma operates as a real estate investment trust, providing real estate loans to businesses in the cannabis industry. In addition to real estate financial services, AFC Gamma offers loan underwriting and various financing solutions, targeting both direct lending and bridge loans ranging from $5 million to $100 million.

Operating within the cannabis industry, AFC Gamma finds it advantageous to establish its base in Florida, one of the leading states in the legal cannabis sector. From this stable location, AFC Gamma is able to provide its financial services to an industry facing challenges from a patchwork legal framework at the state level, complicated further by federal illegality. The company aims to leverage its financial flexibility to generate solid returns for shareholders.

The company generates these returns through its dividend, which was paid out in April for 1Q23 at a rate of 56 cents per common share. This payment was fully covered by the distributable earnings per share, which were reported as 57 cents for Q1. With an annualized forward payment of $2.24 per share, the dividend offers a sky-high yield of nearly 21%. Very few companies, regardless of type, can match such a substantial dividend yield. AFC Gamma has maintained its dividend at the current payment level for the past four quarters.

AFC Gamma was able to keep up the high dividend yield, and to pay out 98% of its distributable earnings, even though it missed the revenue and earnings expectations in the first quarter of this year. The total revenue showed a top line of $16.83 million, $1.48 million below the Street’s forecast, while the non-GAAP normalized earnings figure of 49 cents per share missed that forecast by 7 cents.

Despite missing on earnings, two insiders did not hesitate to buy large blocks of AFCG stock. In the past week, Company President Robyn Tannenbaum made two purchases, one of 125,000 shares and another of 116,372 shares. In total, Tannenbaum bought 241,372 shares of AFCG for almost $2.47 million. In a separate set of insider transactions, AFC Gamma CEO Leo Tannenbaum made four purchases this month, totaling 243,372 shares. The total cost of these purchases was $2.488 million.

AFC Gamma shares also caught the eye of TD Cowen analyst Michael Elias, who writes: “While we are encouraged by mgmt. commentary around improving pricing in cannabis and continue to believe non-cannabis CRE offers attractive lending opportunities given the pullback of traditional lenders in the space, we also recognize that the dividend is a key focus point for investors. For AFC Gamma to sustain current dividend levels, the company will need to increase its number of commitments and though we do believe there is enough lending opportunity in the market for the company to do so, we are skeptical that the company will increase its dividend in the NT and is more likely to elect to keep the dividend flat until its dividend is <85% of Distributable Earnings.”

Taking all of this into consideration, Elias stays with the bulls. Along with his Outperform (i.e. Buy) call, the analyst gives AFCG stock a $16 price target, which implies 48% upside from current levels. (To watch Elias’ track record, click here)

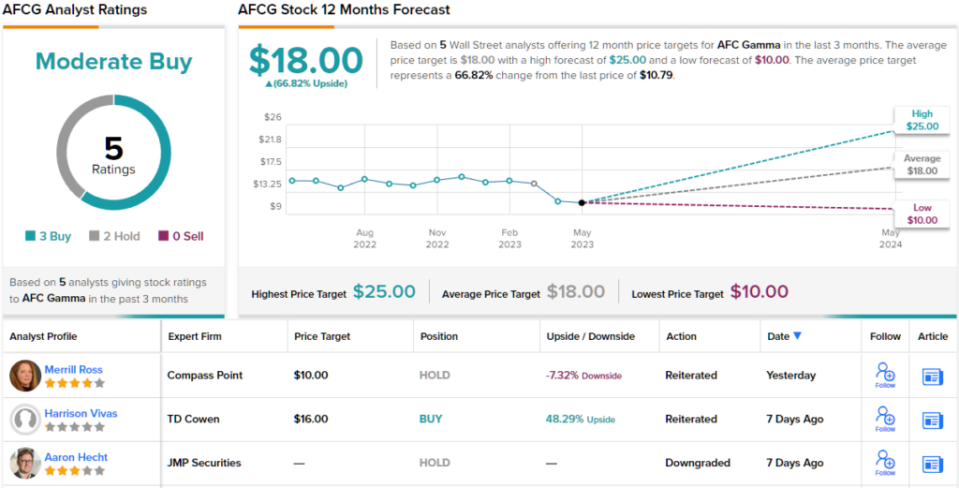

Overall, this cannabis-related REIT gets a Moderate Buy from the analyst consensus, based on 5 analyst reviews that include 3 Buys and 2 Holds. The stock’s $10.79 trading price and $18 average price target together indicate an impressive 67% potential gain for the year ahead. (See AFCG stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.