NEW YORK, May 24 (Reuters) – JPMorgan Chase & Co (JPM.N) may move forward with its lawsuit seeking to hold former executive Jes Staley liable for concealing what he knew about the disgraced financier Jeffrey Epstein, a U.S. judge ruled on Wednesday.

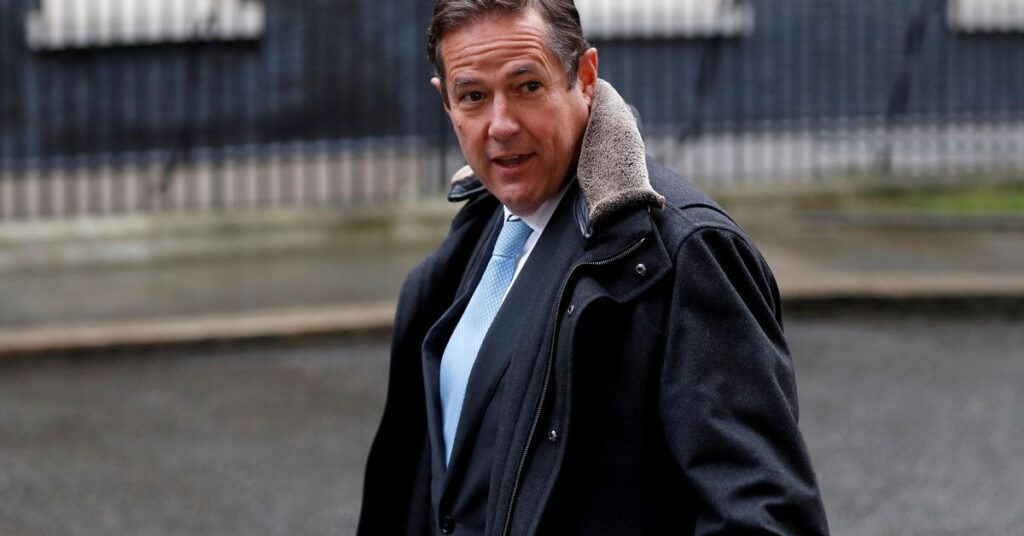

The ruling by U.S. District Judge Jed Rakoff in Manhattan means Staley, who is also a former Barclays Plc (BARC.L) chief executive, could be on the hook for millions of dollars over his ties to Epstein, a JPMorgan client from 1998 to 2013.

Rakoff said he will provide reasons for his ruling “in due course.”

Lawyers for Staley did not immediately respond to requests for comment. JPMorgan declined to comment.

Staley has expressed regret for befriending Epstein, denied knowing about his crimes, and accused JPMorgan of making him a fall guy for its own supervisory failures.

Now 66, Staley led JPMorgan’s asset management business from 2001 to 2009 and its investment bank from 2009 to 2013.

JPMorgan wants him cover losses it may incur in two lawsuits saying it should have cut ties to Epstein because it knew or should have known he sexually abused young women and girls.

It also wants Staley to forfeit his compensation from 2006 to 2013, estimated in the tens of millions of dollars.

Epstein died in a Manhattan jail in August 2019 while awaiting trial for sex trafficking. New York City’s medical examiner called the death a suicide.

SUGGESTIVE EMAILS

One of the lawsuits JPMorgan faces is a proposed class action by Epstein accusers, led by a former ballet dancer known as Jane Doe 1.

The other is by the U.S. Virgin Islands, where Epstein allegedly abused women on a private island he owned.

That territory has said Staley and Epstein swapped sexually suggestive emails about women after Epstein pleaded guilty in 2008 to a Florida prostitution charge and was required to register as a sex offender.

Jane Doe 1 said one of Epstein’s friends sexually assaulted her. JPMorgan later said Staley was that friend. Staley has called the accusation “baseless.”

Rakoff has said JPMorgan could be liable if Epstein’s accusers proved that Staley had firsthand knowledge that Epstein ran a sex-trafficking venture.

On Tuesday, JPMorgan accused the U.S. Virgin Islands of complicity in Epstein’s crimes over two decades, by letting him buy off high-ranking officials in exchange for tax breaks and looking the other way.

The three lawsuits are scheduled for an Oct. 23 trial.

Deutsche Bank (DBKGn.DE), where Epstein was a client from 2013 to 2018, this month reached a $75 million settlement with women who say Epstein abused them.

The cases in the U.S. District Court, Southern District of New York are: Jane Doe 1 v JPMorgan Chase & Co, No. 22-10019; Government of the U.S. Virgin Islands v JPMorgan Chase Bank NA, No. 22-10904; and JPMorgan Chase Bank NA v Staley, in Nos. 22-10019 and 22-10904.

Reporting by Jonathan Stempel in New York

: .