Investors have been buoyed this year by the fact that a mooted recession has failed to materialize. However, Morgan Stanley’s chief U.S. equity strategist, Mike Wilson, says that it does not mean the prospect of one taking place has completely evaporated.

“While the investor sentiment pendulum on a recession arriving in 2023 has swung from roughly ’70/30′ to ’30/70′ over the past 6 months based on our dialogue, there is more debate on whether we have avoided it altogether – i.e., soft/no landing, or if it’s just been pushed out to 2024,” Wilson recently said,

Given the uncertainty about what’s coming next, Wilson expects the market to trade in a “late cycle” manner and he recommends a way to deal with such an environment. “In our view,” says the strategist, “the best way to express that in a portfolio is to hold a barbell of defensive growth (select growth stories and more traditional defensive sectors like Healthcare and Consumer Staples) with late-cycle cyclicals.”

Taking that advice to heart, the analysts at Morgan Stanley have been busy pointing out stocks with such attributes and ones they believe investors should be loading up on right now.

We ran 3 of their picks through the TipRanks database to find out whether the rest of the Street is comfortable with these choices. Turns out they certainly are; all are currently rated as ‘Strong Buys’ by the analyst consensus. Let’s see why they are drawing plaudits across the board.

Howmet Aerospace (HWM)

The first Morgan Stanley pick we’ll look at certainly has the defensive credentials to deal with uncertain times. Howmet Aerospace is a global leader in advanced engineered solutions for the aerospace and defense (A&D) industries. Formerly known as Arconic, the company rebranded as Howmet Aerospace in 2020 following a separation from its parent company. With a rich history dating back to the early days of aviation, Howmet Aerospace is an established provider of high-performance materials and precision-engineered components that play a critical role in the functioning of modern aircraft and defense systems.

Strong demand for jet parts on account of plane makers ramping up production activities saw Howmet raise its full-year profit and revenue outlook when the company reported Q2 earnings in early August. Howmet called for 2023 revenue between $6.40 billion and $6.47 billion, up from the prior $6.20 billion to $6.33 billion range. Adj. EPS was increased from between $1.65 to $1.70 per share to between $1.69 and $1.71.

The new forecasts came off the back of a strong quarterly performance. Revenue reached $1.65 billion, amounting to an 18.7% year-over-year increase while beating the consensus estimate by $40 million. Adj. EPS of $0.44 edged ahead of the Street’s call by $0.01.

After paying a visit to the company’s Michigan-based Whitehall Plant, it’s clear to Morgan Stanley analyst Kristine Liwag why Howmet is a leader in its field – a situation she does not see changing any time soon and that is good news for investors.

“The company’s investment in technology and automation underscores how it was able to take market share, increase price, and expand margins,” Liwag said. “We continue to expect operating performance to be a meaningful differentiator in monetizing the aerospace upcycle. What we saw from our visit is that Howmet has invested in cutting edge technologies and automation in its manufacturing processes to deliver on customer requirements. Additionally, the company continues to invest to support future growth. Its strength in operations also provides upside to long-term margins for shareholders. We continue to see Howmet as our Top Pick in Aerospace.”

These comments underpin Liwag’s Overweight (i.e., Buy) rating on HWM, while her $60 price target makes room for 12-month returns of 31%. (To watch Liwag’s track record, click here)

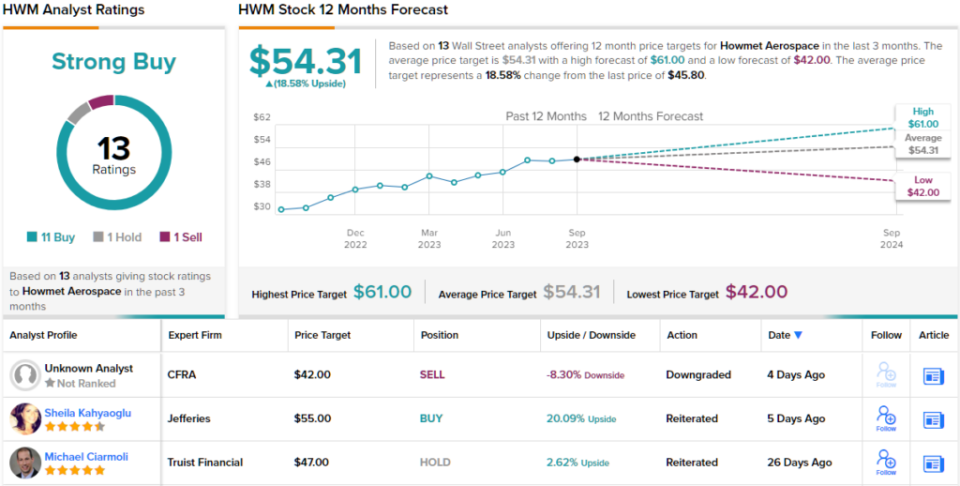

That thesis gets the backing of most of Liwag’s colleagues. The stock’s Strong Buy consensus rating is based on 11 Buys vs. 1 Hold and Sell, each. Going by the $54.31 average target, a year from now, shares will be changing hands for ~19% premium. (See HWM stock forecast)

Thermo Fisher (TMO)

The second pick from Morgan Stanley brings us to Thermo Fisher, a global leader in scientific research and laboratory equipment. This giant with a $194 billion market cap serves a wide range of industries and sectors and is one of the world’s largest and most influential providers of scientific solutions. Thermo Fisher’s extensive portfolio includes instruments, reagents, consumables, software, and services designed to support research, diagnostics, and manufacturing processes in fields such as life sciences, healthcare, pharmaceuticals, biotechnology, environmental monitoring, and more.

Despite its size and global reach, the macro environment has blighted its recent performance and the company missed expectations on both the top-and bottom-line in Q2. Revenue fell by 2.6% YoY to $10.69 billion, missing the analysts’ forecast by $310 million. Adj. EPS of $5.15 also fell short of the consensus estimate – by $0.28.

The outlook was not much to shout about either. The company lowered its forecast for the year, now seeing $43.4–$44.0 billion in revenue (down from the prior $45.3 billion) and adj. EPS of $22.28–$22.72 (vs. $23.70 before), both also below consensus.

The lackluster quarterly results have mirrored the stock’s performance this year and the shares are down by 9% year-to-date. However, Morgan Stanley analyst Tejas Savant argues the bottom might just be in, making this health colossus worthy of investors’ consideration.

“In the near-term, we continue to feel confident in TMO’s ability to deliver above market growth relative to peers when factoring in macro conditions and view the reduced ’23 outlook as achievable with room for further upside should we see a strong year-end budget flush or a faster recovery in China,” Savant explained. “Moreover, with investor sentiment in Tools now appearing to have bottomed, we see the reset (not just in 2H23 but also in 2024 estimates) as making the stock ‘ownable’ again.”

“Longer term, we continue to believe that TMO is among the best positioned across the sector to drive above -peer/-market growth, given the combination of a resilient and diversified business model, strong operational track record, best-in-class mgmt team (that has demonstrated consistent all-weather execution), increasing exposure to high-growth verticals within their ~$225B TAM, and embedded capital deployment optionality,” Savant went on to add.

Accordingly, Savant rates TMO shares as Overweight (i.e. Buy), backed by a $640 price target. The implication for investors? Upside of 27% from current levels. (To watch Savant’s track record, click here)

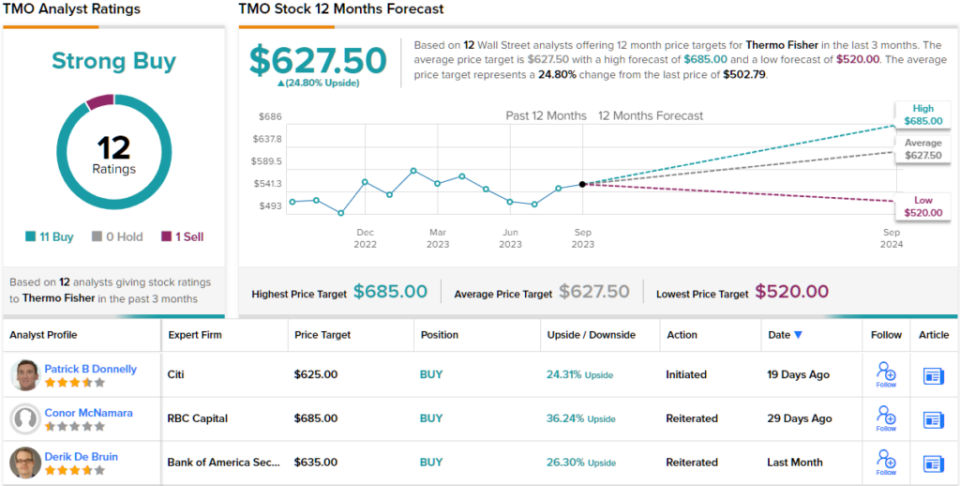

Overall, Wall Street takes a bullish stance on TMO shares. 11 Buys and 1 Sell issued over the previous three months make the stock a Strong Buy. Meanwhile, the $627.50 average price target suggests ~25% upside from current levels. (See TMO stock forecast)

Zoetis Inc. (ZTS)

For our final Morgan Stanley selection, we’ll remain within the realm of healthcare, albeit in a unique niche. With a market cap over $81 billion, Zoetis is a leading global animal health firm dedicated to improving the health and well-being of animals. Founded in 1952 as a subsidiary of Pfizer, Zoetis became an independent company in 2013, and operates in more than 100 countries.

The company specializes in the development, manufacturing, and distribution of a wide range of veterinary medicines, vaccines, diagnostics, and other products essential for the care and welfare of animals and serves a customer base that includes veterinarians, livestock producers, and pet owners.

The latest Q2 report delivered solid results on all fronts. Revenue surged by 4.8% year-over-year, reaching $2.2 billion, which exceeded expectations by $40 million. Additionally, the adj. EPS of $1.41 trumped the $1.31 forecast.

The beats were accompanied by a mixed outlook. Full-year revenue is expected in the range of $8.50 billion to $8.65 billion, down from the range between $8.58 billion to $8.73 billion, although it still stuck to its operational revenue growth target. The profitability profile, on the other hand, got a boost. The company now anticipates full-year adj. EPS between $5.37 to $5.47 per share vs. $5.34 to $5.44 per share beforehand.

Looking at Zoetis’ prospects, Morgan Stanley analyst Erin Wright thinks the company is moving in the right direction and believes it is not given the respect it deserves.

“While the latest print had several moving pieces, it was still somewhat cleaner than its recent reports, and it encouragingly reaffirmed its operational growth guide, suggesting strengthening trends for the balance of the year,” the 5-star analyst commented. “We continue to view the unmatched breadth of ZTS’ portfolio as significantly underappreciated, with continuing innovation expected to further distinguish ZTS from competitors with over 300 projects in its R&D pipeline and with new products enhancing its exposure to faster-growing, more profitable categories.”

Quantifying this stance, Wright rates Zoetis shares an Overweight (i.e. Buy) with a $248 price target, implying shares will post growth of 40% in the months ahead. (To watch Wright’s track record, click here)

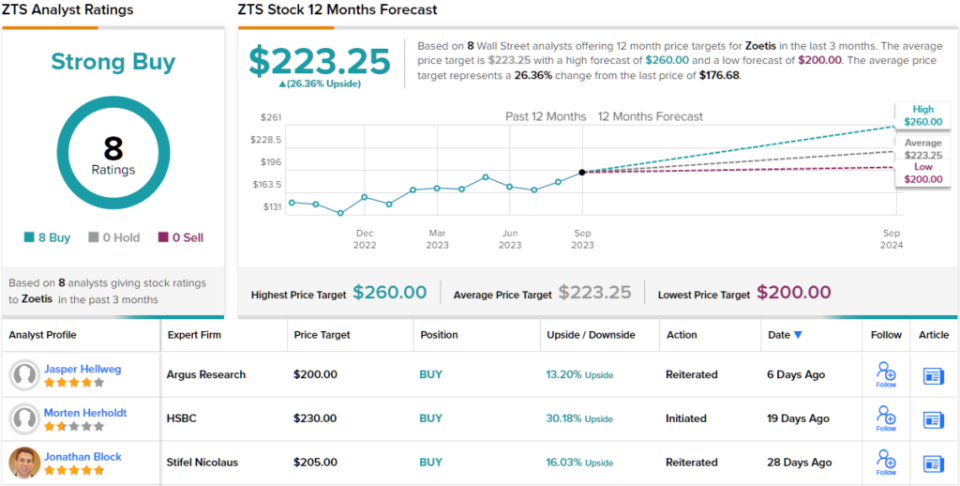

Overall, the analysts are all behind this one; Zoetis gets a full house of Buys – 8, in total – all naturally coalescing to a Strong Buy consensus rating. The shares are expected to appreciate by 26% over the course of the year, considering the average target stands at $223.25. (See Zoetis stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.