NEW YORK, Aug 18 (Reuters) – More than two years since a breathtaking surge in shares of GameStop (GME.N) captivated Wall Street, the meme stock phenomenon continues to defy predictions of its demise.

Yet the retail investors who have driven past meme stock moves appear to have become more cautious after last year’s market selloff, while rallies in the shares of the often small and heavily-shorted companies bearing the meme stock label have tended to be more fleeting.

Here are some charts illustrating what has changed, and what has not, in meme stocks.

A rally in a crop of recently minted meme stocks has already hit turbulence as shares of companies including Tupperware Brands (TUP.N), trucking firm Yellow and American Superconductor Corp (AMSC.O) tumble from highs touched weeks ago, amid a broader selloff in U.S. equity markets, though many are still far higher than they were earlier this year.

Data from JPMorgan illustrate how quickly sentiment can turn among individual investors, who have been among the key drivers of moves in meme stocks. Retail investors sold a net $852 million in single stocks in the past week. Over the last four weeks, they have wiped out all inflows the category had seen since the debt ceiling resolution at the end of May, the data showed.

The Roundhill MEME ETF (MEME.P), which tracks the performance of a basket of meme stocks, is down about 55% from where it started trading in December 2021, though up about 38% for the year.

A quick rise, often followed by a rapid descent, is a fate common to meme stocks of both the past and present. Analysts at Vanda Research, however, say investors in recent months are putting less money into shares of individual companies and are less likely to stick with their trades than they were in 2021.

In some cases, that has resulted in rallies that are far less dramatic than the ones witnessed in the phenomenon’s earlier days. For instance, at its closing high on Jan. 27, 2021, GameStop’s stock price had logged a one-month gain of more than 1,600%, with one-month net retail flows at the peak of its initial rally totaling around $460 million, Vanda’s data showed.

In contrast, C3ai , which this year has benefited from investor excitement over artificial intelligence, drew a one-month net total of $285 million in June, when the stock hit a peak that saw it up 314% year-to-date.

Individual investors may still be licking their wounds after a drubbing in markets last year, with the average retail portfolio off between 20% and 25% from its all-time highs, compared to the S&P 500, which is off 8.3% from its 2022 peak, said Marco Iachini, Vanda’s senior vice president.

Retail players “think twice before chasing these opportunities and if they do, they don’t stick with them for as long as they did in ’21,” Iachini said.

Of course, there are exceptions. Shares of Tupperware Brands, which had been trading below $1 before its rally drew just $32 million of net retail inflows between mid-July and early August, Vanda’s data showed, at its peak was up 85% from a month ago.

Jonathan Krinsky, chief market technician at BTIG, said the most recent rally in suggested traders had been hunting for “lower quality” stocks they believed could catch up with shares that had already soared.

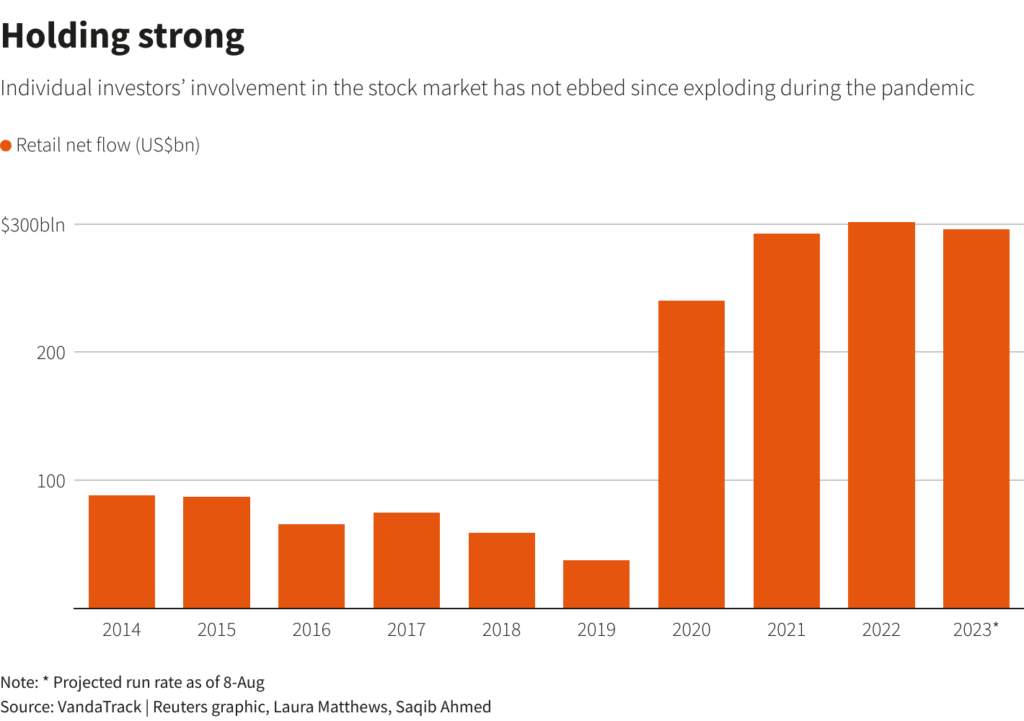

Despite the recent wobble, retail participation in the market remains strong, after interest in stock trading surged during the pandemic. Global retail net flow is expected to reach $295.62 billion this year, just shy of the 2022 record of $301.36 billion, Vanda’s data showed.

At the same time, the latest batch of meme stocks – like many before it – is also drawing the attention of institutional investors who bet on share price declines.

Still, few have approached the levels of short interest seen in GameStop, which had 170% of its sales sold short in late December 2020, as high demand to short the shares led to the same shares being lent out multiple times.

Options activity by retail investors continues to be a factor in driving many meme names higher, though volumes are far off levels seen in 2021.

At its peak, on average, 3.1 million AMC Entertainment (AMC.N) options contracts changed hands daily. In contrast, Tupperware drew just under a 100,000 a day at its peak.

Reporting by Saqib Iqbal Ahmed and Laura Matthews; Writing by Ira Iosebashvili; Editing by Jamie Freed

: .