A look at the day ahead in U.S. and global markets from Mike Dolan

As U.S. markets return from Independence Day, the Federal Reserve’s slightly awkward deliberations are laid bare again just as China’s markets shrink from more unnerving economic signs.

Minutes from the Fed’s last policy making meeting – where it paused its brutal rate hike campaign despite signalling two more rises to come – top Wednesday’s macro diary after a relatively quiet first two trading days of July for world markets.

That early week calm was disturbed somewhat in China earlier today as Shanghai and Hong Kong shares and the yuan skidded lower again on a mix of dour service sector business surveys, geopolitical tensions and banking fears.

With U.S. Treasury Secretary Janet Yellen due in Beijing on Thursday, trade relations are tense – with China on Tuesday restricting exports of two key chipmaking metals and Washington reportedly banning Chinese firms from accessing cloud computing.

Despite a broad rally in developed market equities in the first half of the year, China’s CSI300 index (.CSI300) is down almost 6% in dollar terms for 2023 to date and lost 0.8% on Wednesday alone.

Hong Kong stocks (.HSI) dropped 1.6% and the Hang Seng’s Mainland Bank index (.HSMBI) lost more than 3% in its worst day for eight months after Goldman Sachs downgraded ratings on some Chinese banks and raised questions about the whole sector.

Stuck between the dilemmas of the inflation hawks in the West and China’s spluttering economy and likely renewed policy stimulus, the Reserve Bank of Australia on Tuesday paused its interest rate hiking again for the second time this year – saying it wanted more time to assess the situation.

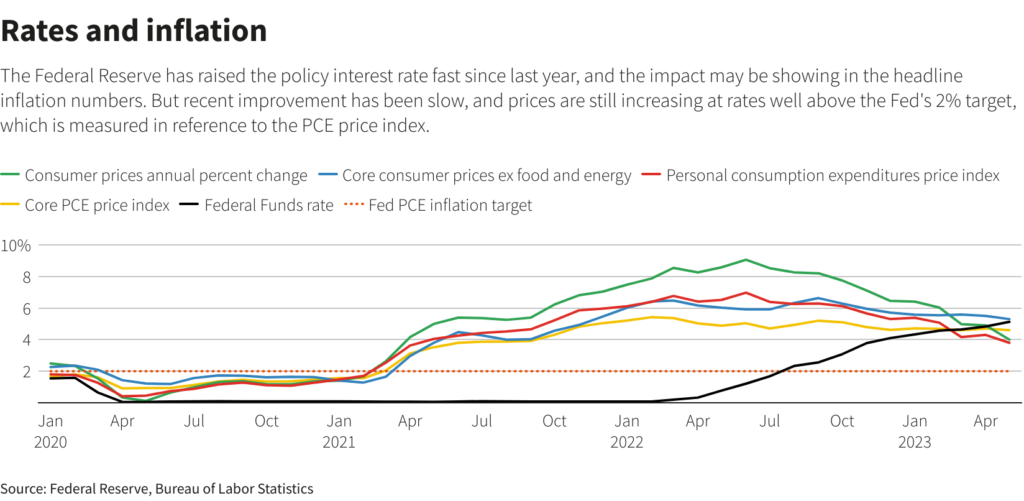

The Fed minutes out later will sketch out how close that is to the thinking in Washington. Going into the release, futures markets are 80% priced for another quarter-point policy rate rise to 5.5-5.75% this month and have 33 basis points of hikes pencilled in by November.

After more encouraging data on disinflation during May, a Fed research paper released on Friday showed financial conditions were at their tightest since the banking crash more than a decade ago.

Two-year Treasury yields hovered about 4.90% on Wednesday, well back from Monday’s 4.96% high. The dollar (.DXY) was steady to firmer, with China’s offshore yuan reversing all of Tuesday’s gains.

U.S. stock futures were down about 0.2% ahead of the bell, with the VIX index of implied volatility (.VIX) popping back above 14 as the new quarter gets underway in earnest.

Along with China, and likely affected by it, updated euro zone composite business survey readings for last month showed activity contracting again for the first time this year and producer prices falling at an annual rate of 1.5% in May.

The global industrial picture saw crude oil prices slip back again on Wednesday despite fresh attempts by Saudi Arabia and Russia this week to further limit supplies.

Events to watch for later on Wednesday:

* U.S. May factory orders

* Federal Reserve releases minutes of its latest policy meeting

* New York Fed President John Williams speaks

By Mike Dolan, editing by Christina Fincher, <a href=”mailto:mike.dolan@thomsonreuters.com” target=”_blank”>mike.dolan@thomsonreuters.com</a>. Twitter: @reutersMikeD

: .

Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias.