[1/2]Saudi riyal, yuan, Turkish lira, pound, U.S. dollar, euro and Jordanian dinar banknotes are seen in this illustration taken January 6, 2020. REUTERS/Dado Ruvic/Illustration Acquire Licensing Rights

Jackson Hole, Wyoming, Aug 26 (Reuters) – The steep jump in public debt loads over the past decade and a half, as governments borrowed large amounts of money to battle the Global Financial Crisis and the fallout from the COVID-19 pandemic, is probably irreversible.

That’s the unhappy conclusion of a research paper being presented on Saturday to some of the world’s most influential economic policymakers at the Kansas City Federal Reserve’s annual central banking symposium in Jackson Hole, Wyoming.

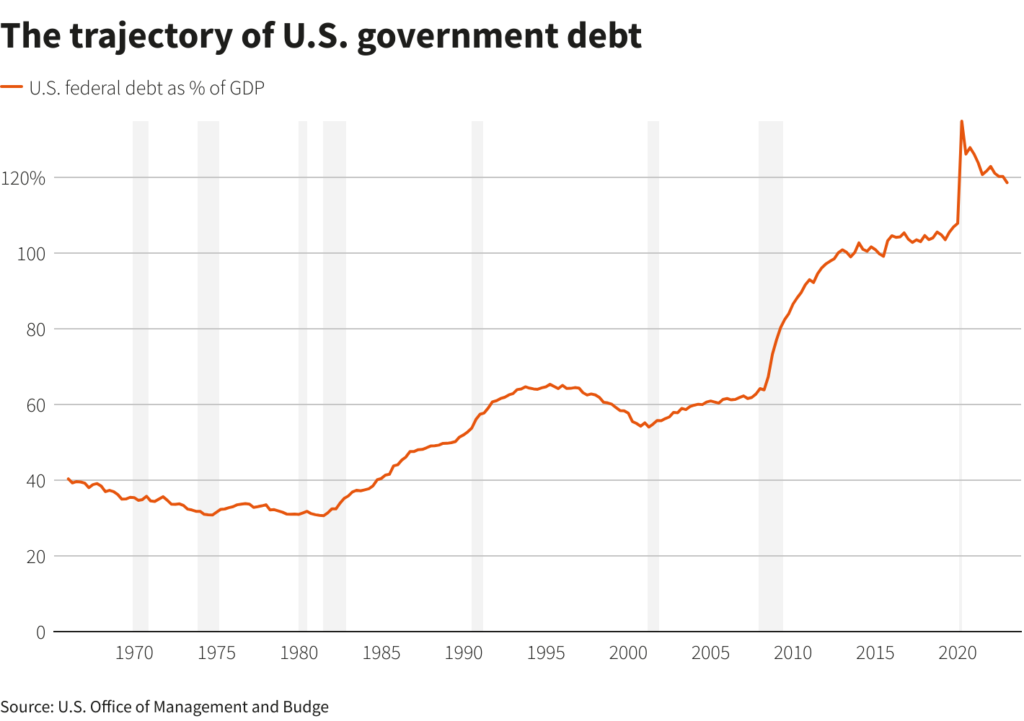

Since 2007, worldwide public debt has ballooned from 40% to 60% of GDP, on average, with debt-to-GDP ratios even higher in the advanced countries. That includes the United States, the world’s biggest economy, where government debt is now more than equal to the nation’s yearly economic output. U.S. debt was about 70% of GDP 15 years ago.

Despite mounting worries about the growth-crimping implications of high debt, “debt reduction, while desirable in principle, is unlikely in practice,” Serkan Arslanalp, an economist at the International Monetary Fund, and Barry Eichengreen, an economics professor at the University of California, Berkeley, wrote in a paper.

That’s a change from the past, when countries have successfully reduced debt-to-GDP ratios.

But many economies will not be able to outgrow their debt burdens because of population aging, and will in fact require fresh public financing for needs like healthcare and pensions, the authors argued.

A sharp rise in interest rates from historically low levels is adding to the cost of debt service, while political divisions are making budget surpluses difficult to achieve and more so to sustain.

Inflation, unless it surprises to the upside over an extended period, does little to reduce debt ratios, and debt restructuring for developing countries has become more elusive as the pool of creditors has broadened, Arslanalp and Eichengreen wrote.

“High public debts are here to stay,” they wrote. “Like it or not, then, governments are going to have to live with high inherited debts.”

Doing so will require limits on spending, consideration of tax hikes, and improved regulation of banks to avoid costly blow-ups, they wrote.

“This modest medicine does not make for a happy diagnosis,” they wrote. “But it makes for a realistic one.”

(This story has been corrected to clarify that the size of U.S. debt is more than equal to U.S. GDP, not more than double, in paragraph 3)

Reporting by Ann Saphir; Editing by Paul Simao

: .