Nvidia (NVDA) reported second quarter earnings after the bell Wednesday that blew away already sky-high expectations for the graphics chip giant as the AI hype train keeps pushing markets forward.

The company reported revenue of $13.51 billion, a 101% jump from last year, while adjusted earnings came in at $2.70 per share, up 429% from last year. Analysts had expected revenue to come in at $11.04 billion with earnings per share totaled $2.07, according to data from Bloomberg.

Nvidia also issued current quarter revenue guidance of $16 billion, plus or minus 2%, far outpacing Wall Street’s already lofty expectations for $12.5 billion in revenue.

Shares of the graphics chipmaker rose as much as 9% in after-hours trading on Wednesday to a record high of $515 per share.

Nvidia’s report had been seen as a key test for the ongoing AI hype cycle, which has pushed companies of all stripes to dive into the technology in hopes of cashing in on the mania. But none has seen the actual fortunes of their business change to extent already being enjoyed by Nvidia.

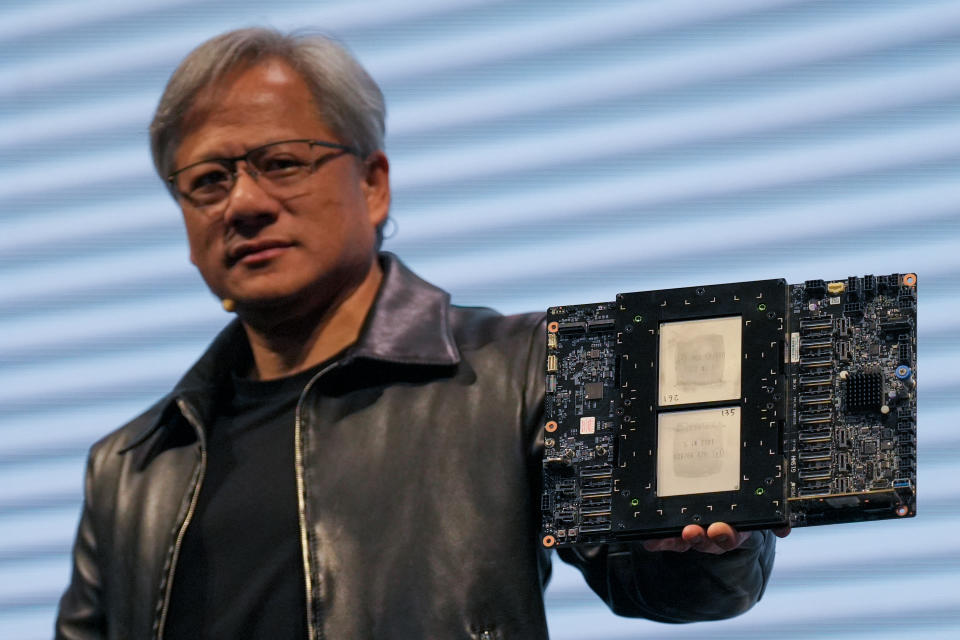

“A new computing era has begun,” Nvidia CEO Jensen Huang said in a statement.

“Companies worldwide are transitioning from general-purpose to accelerated computing and generative AI.”

By segment, Nvidia reported data center revenue of $10.3 billion and gaming revenues of $2.5 billion, topping forecasts for $8 billion and $2.4 billion, respectively. The company also announced a new $25 billion share repurchase plan and said it intends to buy back stock during its current fiscal year.

Investors were already expecting Nvidia to deliver a blowout quarter, after the company said revenue in its latest would be about $11 billion, plus or minus 2%.

Huang added: “During the quarter, major cloud service providers announced massive NVIDIA H100 AI infrastructures. Leading enterprise IT system and software providers announced partnerships to bring NVIDIA AI to every industry. The race is on to adopt generative AI.”

Software giant Snowflake (SNOW) also reported earnings after the bell on Wednesday that topped expectations, which, combined with Nvidia’s upbeat print, sent a slew of AI-related stocks higher in after-hours trading.

C3.ai (AI), Palantir (PLTR), Marvell Technology (MRVL), and MongoDB (MDB) all jumped more than 3% in post-market trade. C3.ai and MongoDB had been down roughly 10% over the past month prior to the report. Snowflake’s stock rose more than 3% in Wednesday’s after-hours session.

The rapid increase in demand for Nvidia’s chips lead some on Wall Street to question whether its key supplier TSMC could produce as many graphics processors as Nvidia’s customers needed.

In July, for instance, Tesla (TSLA) CEO Elon Musk said the company would “take Nvidia hardware as fas as Nvidia will deliver it to us.”

“Tremendous respect for [CEO] Jensen [Huang] and Nvidia,” Musk added. “They’ve done an incredible job.”

The AI craze kicked into high gear in November 2022 when OpenAI debuted its generative AI app, ChatGPT.

While artificial intelligence has been around for some time, ChatGPT’s popularity as one of the fastest-growing apps in history put the technology firmly on Wall Street’s radar.

Since then, tech companies ranging from Microsoft (MSFT) and Google (GOOG, GOOGL) to Meta (META) have debuted or announced that they’re working on their own generative AI tools and software.

Daniel Howley is the tech editor at Yahoo Finance. He’s been covering the tech industry since 2011. You can follow him on Twitter @DanielHowley.

Click here for the latest technology business news, reviews, and useful articles on tech and gadgets

Read the latest financial and business news from Yahoo Finance