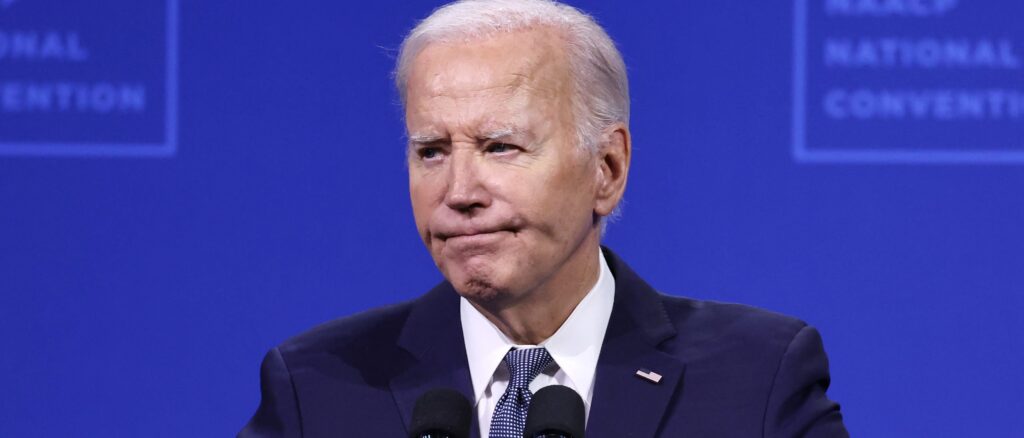

Persistently high government spending under the Biden administration propped up U.S. economic growth in the second quarter of 2023, economists told the Daily Caller News Foundation.

Real gross domestic product (GDP) grew 2.8% in the second quarter of 2024, far higher than economists’ expectations of 2.1%, according to the Bureau of Economic Analysis (BEA). However, a significant portion of the recorded growth in the quarter was driven by government spending, both directly through a rise in government expenditures and indirectly through growth in sectors that benefit heavily from taxpayer dollars, according to economists who spoke to the DCNF. (RELATED: Smoke And Mirrors: NYC’s ‘Jobs Boom’ Was Really Just Taxpayer-Funded Spending Spree)

“Government spending has played a large role in much of the economic growth seen over the past few years,” Peter Earle, a senior economist at the American Institute for Economic Research, told the DCNF. “The problem with that, of course, is that government spending is redistribution: taxing certain citizens or floating more trillions of dollars in debt to send those dollars to other citizens. It’s not innovative entrepreneurship or other productive commercial undertakings.”

In the second quarter of 2024, government consumption grew 3.1%, up from 1.8% the quarter prior, and was responsible for approximately 19% of the quarter’s total growth, according to the BEA.

“We’re borrowing $1.8 trillion this year to get 2.8% growth this quarter, and we got 1.4% last quarter. So we’re getting approximately 2.1% growth by spending almost $2 trillion,” Michael Faulkender, chief economist at the America First Policy Institute, told the DCNF. “How do you not get 2% GDP growth when you’re borrowing $2 trillion? It is not an accomplishment… It’s not a reflection of sustainable economic policy.”

E.J. Antoni, a research fellow at the Heritage Foundation’s Grover M. Hermann Center for the Federal Budget, told the DCNF that even the increase in consumer spending, which totaled 2.3% in the second quarter — up from 1.5% in the previous quarter — was also partially driven by government expenditures.

“Government purchases do not include all of government spending. When government takes money from one person and gives it to another in the form of welfare, for example, it gets counted as consumer spending,” Antoni told the DCNF. “Currently, about $4.2 trillion of annual consumer spending is government transfers, illustrating how total government spending is much larger than the GDP report indicates.”

Consumer spending in the second quarter totaled an annualized $19.38 trillion, meaning over one-fifth of personal consumption expenditures come from government transfers, according to the BEA.

The U.S. national debt currently sits at around $35 trillion as of July 29, an increase of around $7.3 trillion from when Biden first took office on January 20, 2021, according to the Treasury Department.

“What were the big things that contributed to the GDP number? You have a big increase in health care spending, which is consistent with all the jobs we’ve seen in health care, and a lot of that is paid for by government,” Faulkender told the DCNF. “You have money going into transportation investment, which is deficit-funded [Inflation Reduction Act] money [and] you had the increase in government spending.”

Healthcare spending was responsible for approximately 16% of GDP growth in the second quarter, according to the BEA. In 2022, government sources accounted for just over 45% of healthcare spending, according to the Congressional Research Service.

The healthcare industry has also underpinned recent U.S. job gains, accounting for 49,000 of the 206,000 nonfarm payroll jobs added in June, and approximately 29% of all jobs added in the last twelve months, according to the Federal Reserve Bank of St. Louis (FRED).

I’m starting to think all this “economic growth” is really just a debt bomb: pic.twitter.com/h3cEnn9HYc

— E.J. Antoni, Ph.D. (@RealEJAntoni) July 25, 2024

GDP figures also benefited from sustained consumer spending despite the personal savings rate falling from 3.8% in the first quarter of 2024 to 3.4% in the second quarter, far from its peak of 32% during the COVID-19 pandemic, according to FRED.

The second quarter also brought record credit card delinquencies. At the end of March, 2.59% of credit card balances were more than 60 days overdue, more than double the lows seen during the COVID-19 pandemic.

“It’s very surprising that U.S. consumers are continuing to spend, even as savings rates are plummeting, unemployment is beginning to tick up, and 30/90 day payment arrears on several types of consumer loans are rising,” Earle told the DCNF. “It’s difficult to say where it’s coming from — maybe home equity loans, maybe buy-now-pay-later plans, or maybe the data we use doesn’t accurately capture consumer spending wherewithal — but in any case, it’s surprising that it has gone on for as long as it has, and the runway must be running out. Inflation is still almost twice what it was four or five years ago, interest rates are much higher and the pandemic stimulus savings are gone.”

Earle and Antoni were also skeptical about the BEA’s topline GDP number, expecting it to be revised down in future estimates, due to the possibility of statistical issues, more complete data and weakness in the manufacturing industry.

“While revisions are standard operating procedure, they balance out in the long run. In other words, some are up, others down, and they average out to zero over time,” Antoni told the DCNF. “That’s not what we’ve seen recently and it’s clear that statistical problems have developed in the post-pandemic world, causing problems with our economic metrics.”

“What we do know is that during the COVID-19 pandemic, GDP revisions were notably more volatile due to unprecedented economic conditions and difficulty in collecting the data,” Earle told the DCNF. “Given the rapid increase in [the unemployment rate for people without jobs who have looked for work in the past four weeks], an upward trend in both initial and continuing claims, and weakness in the manufacturing indices of the regional Fed banks, I suspect that the second and third runs of the second quarter 2024 GDP will be lower, but I couldn’t guess by how much.”

First quarter growth was revised down to 1.4% from an initial estimate of 1.6%, while fourth quarter growth in 2023 was revised up from an initial estimate of 3.3% to 3.4%, according to BEA data.

“All — or nearly all — the apparent growth in the economy has really just been pulling future growth forward to today, at the expense of future growth,” Antoni told the DCNF. “It’s like when a consumer goes deeply into credit card debt to get a higher standard of living today, only to be drowning in debt payments tomorrow.”

The White House did not respond to a request for comment from the DCNF.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.