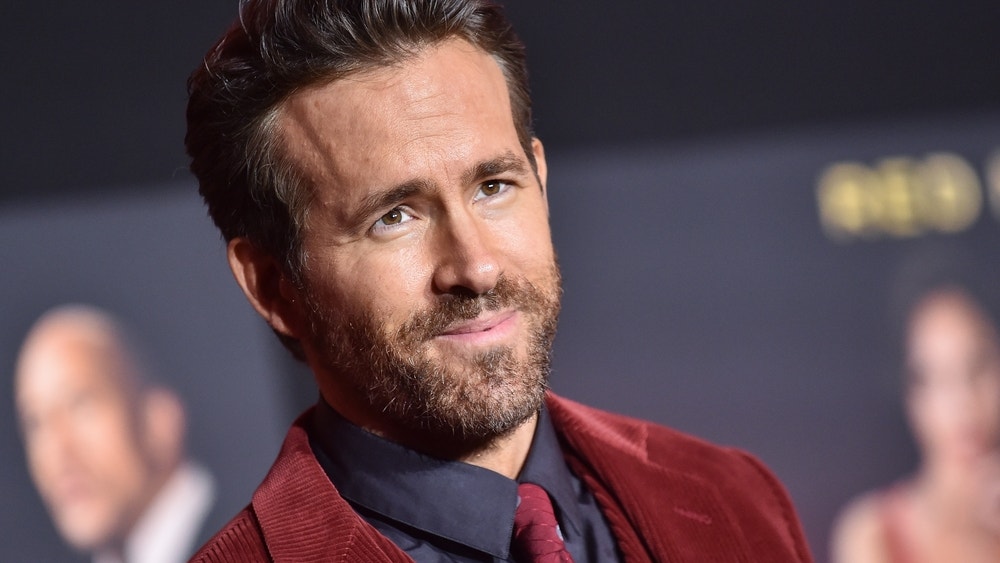

Hollywood actors Ryan Reynolds and Rob McElhenney have reportedly acquired a stake in the Alpine Formula One team as part of a $218 million deal without putting in any of their own money.

According to The Mail, Reynolds and McElhenney agreed to join a consortium that purchased a 24% stake in the team, which is now valued at around $900 million following the investment. The consortium includes American investment firms Otro Capital and RedBird Capital Partners. Reynolds and McElhenney are expected to leverage their fame and storytelling skills to generate revenue, potentially through a documentary series.

The Alpine team hopes to capitalize on the high-profile status of Reynolds and McElhenney, similar to the rapid rise of Reynolds’s football club Wrexham. The actors, along with actor Michel B. Jordan, co-own Maximum Effort Investments, an investment company that is expected to own approximately 2% to 3% of the 24% stake in Alpine.

While Reynolds may not necessarily have used his own funds for this deal, he has amassed significant wealth through his investments in startups and diverse business ventures. He is renowned for his willingness to take calculated risks on companies he believes in, a strategy that has yielded impressive financial gains. This is likely due to the high-risk, high-reward nature of investing in early-stage ventures. Many of the top venture capital firms in the world average as high as 27% returns. Retail investors have even begun replicating this method through platforms like StartEngine.

Alpine expressed its optimism about the new investment group, stating that the F1 team will gain significant advantages from their involvement. The group’s expertise and successful track record in the sports industry, encompassing areas such as media, sponsorship, ticketing, hospitality, commercial rights management, licensing and merchandising strategies, are believed to hold the key to unlocking additional value and driving new avenues of growth for the Alpine team.

The cash injection has already yielded results, as Alpine recently paid off a $27 million loan on its headquarters in Oxfordshire, England. According to The Mail, Apline declined to comment on the details of the consortium’s investment structure. Reynolds and McElhenney have demonstrated their business acumen and gained global attention through their successful documentary “Welcome to Wrexham,” which chronicles their acquisition of the Welsh football club.

The upcoming season of the show will feature the club’s triumphant return to the Football League in the 2022-23 season, coinciding with its summer tour in the United States, where the documentary has enjoyed significant popularity. The actors’ involvement has significantly boosted the commercial appeal of Wrexham, resulting in a sponsorship deal with United Airlines Inc. United Airlines’ name and logo will be prominently displayed on the club’s home, away and third shirts, as well as the women’s kits.

Reynolds has a net worth of around $374 million and rising. In addition to his earnings from blockbuster movies, he previously held a stake in Aviation American Gin, a brand that was acquired by Diageo in 2020 for nearly $667 million, just months before his acquisition of Wrexham. T-Mobile’s acquisition of Mint Mobile for $1.35 billion resulted in Reynolds receiving approximately $300 million from the deal, according to The Wall Street Journal.

McElhenney is an accomplished American actor, writer, producer and director. He gained widespread recognition for his notable work as the creator, co-writer and star of the popular FX comedy series “It’s Always Sunny in Philadelphia.” McElhenney’s creative contributions to the show have garnered critical acclaim and a dedicated fan base.

Don’t miss real-time alerts on your stocks – join Benzinga Pro for free! Try the tool that will help you invest smarter, faster, and better.

This article Ryan Reynolds And Rob McElhenney Used Only Their Fame And Star Power For The $218 Million Alpine F1 Racing Deal – None Of Their Own Money Invested originally appeared on Benzinga.com

.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.