The markets have been exhibiting some wobbly tendencies recently, with the strong rally seen in the first half of the year appearing to have wilted a bit under the summer sun.

Fear not, however, appears to be the advice of one prominent stock picker. With US inflation falling to 3% recently compared to last summer’s 9%, and with GDP growth in the last quarter coming in at 2.4%, famous value investor Bill Miller, whose net worth is valued at $1.4 billion, thinks the rest of the year looks pretty good for the stock market.

“It’s entirely possible that we’re going to get back to a 2% inflation rate by the end of this year,” says Miller. “If we do so without experiencing a recession and with earnings being okay, that would give you a much, much higher justified valuation in the market than we’re at right now.”

With such a positive outlook, then, it makes sense to find out which stocks Miller believes will keep on delivering the goods. In this regard, we took a closer look at two dividend stocks, offering yields of up to 9%, which are currently held by Miller’s firm, Miller Value Partners. Here’s what we found.

CTO Realty Growth (CTO)

We’ll start with CTO Realty Growth, a real estate investment trust (REIT) focused on shopping mall and retail niche properties. The company’s portfolio features assets in Southeast and Southwest of the US, and leans heavily on high-quality, income-generating properties. CTO also holds a significant stake in Alpine Income Property Trust, another retail-oriented REIT.

CTO doesn’t choose its property investments solely for their ability to generate current income; the company is also focused on future income potential. More than half of its portfolio investments – 13 out of 21 properties – are located in Florida, Georgia, or Texas, three of the fastest-growing US state economies. By GDP growth, all three states rank in the top 10.

Continuing on the momentum seen during the first quarter, the company delivered a strong set of results in Q2. The top line came to $26.05 million, for a 34% increase year-over-year and beating the forecast by $1.82 million. The firm’s bottom line number, a net income per diluted share of 3 cents, compared favorably to the year-ago quarter’s 0-EPS – and was 11 cents per share better than expected.

Of particular interest to dividend investors, CTO reported a Q2 funds from operations, or FFO, of 43 cents per diluted share. This was 6 cents better than anticipated, and fully covered the 38-cent dividend payment. That common stock dividend, last declared in May and paid out on June 30, represented a 1.8% y/y increase. The annualized rate, at $1.52 per common share, gives a yield of 9.2%.

Shifting our focus to Miller’s involvement with CTO, we find that the billionaire’s firm is holding 436,900 shares, worth $7.2 million.

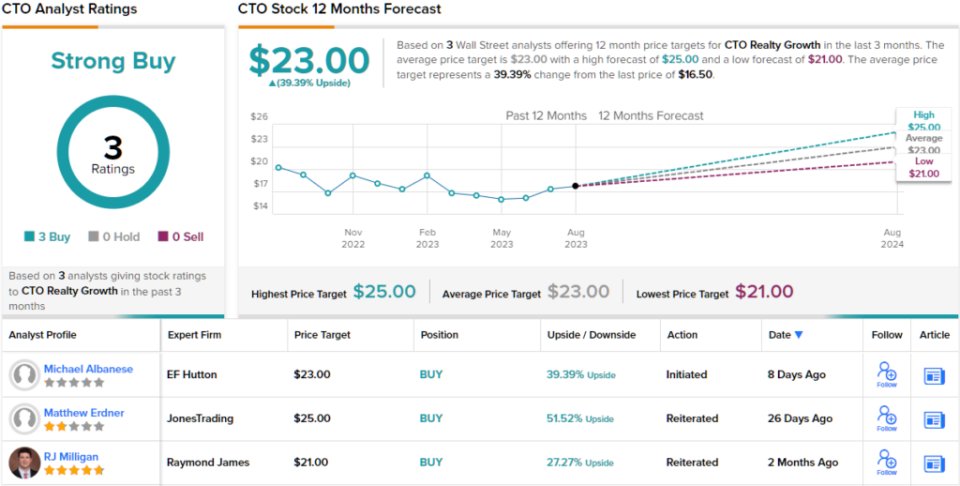

CTO’s attractive valuation and return potential have also caught the eye of analyst Matthew Erdner, from Jones Research, who writes of the stock: “We remain constructive on the portfolio and believe there is significant upside to current trading levels. CTO shares remain substantially discounted relative to peers based on traditional valuation metrics. CTO trades at a 29% discount to our $24.95 2Q23 NAV estimate and a dividend yield of [9.2%].”

Erdner’s comments back up his Buy rating here, and his $25 price target implies a 51% return for the coming year. (To watch Erdner’s track record, click here)

Overall, all three of the recent analyst reviews on CTO are positive, for a unanimous Strong Buy consensus rating. The $23 average price target suggests a 39% share appreciation from the current $16.5 trading price. (See CTO stock forecast)

Jackson Financial (JXN)

For the next stock, we’ll shift from REITs to the world of long-term finance. Jackson Financial is a holding company, based in Lansing, Michigan, with subsidiaries in life insurance and asset management. The company is well-known as a provider of RILAs, or registered index-linked annuities, insurance-based, tax-deferred, long-term savings options that offer controlled-risk growth options for retail investors.

Jackson’s product lines are based on variable annuities, allowing customers to benefit from a wide range of investment options. Variable annuities bring higher risk than fixed or index annuity products, including the risk of principal loss, but also bring the prospect of greater long-term rewards. Among the added benefits that Jackson offers with its annuities are a diversified asset spread, guaranteed income for life, and a legacy option for the purchaser’s heirs.

While there is risk involved in long-term annuity products, those are mitigated by regulatory requirements stipulating the minimum reserves financial institutions need to maintain to cover claims. Jackson has ‘floored out’ its reserves in the state of Virginia, but has been engaged in discussions with regulators in its home state of Michigan, with the aim, among other things, of increasing transparency in its Virginia block. This is a viable solution, as the company’s fees are likely to outweigh claims long-term.

Near-term, looking at Jackson’s 2Q23 financial report, the last reported, we find that the company’s top and bottom lines are down y/y – and below expectations. Revenue, at $410 million, was far below the $6.7 billion reported in 2Q22 and missed the forecast by $1.2 billion. On the bottom line, the non-GAAP EPS number of $3.34 per share came in 15 cents below the estimates.

Despite the earnings misses, Jackson still returned $100 million in capital to investors during Q2. This included $53 million in dividend payouts. In the company’s last dividend declaration, made on August 8 for Q3, the payment was set at 62 cents per common share for a September 14 payout. This annualizes to $2.48 and gives a yield 7.3%, far above the market average.

Bill Miller is clearly of a sanguine view when it comes to JXN, as he holds 215,050 shares of the stock. This stake is currently valued at $7.13 million.

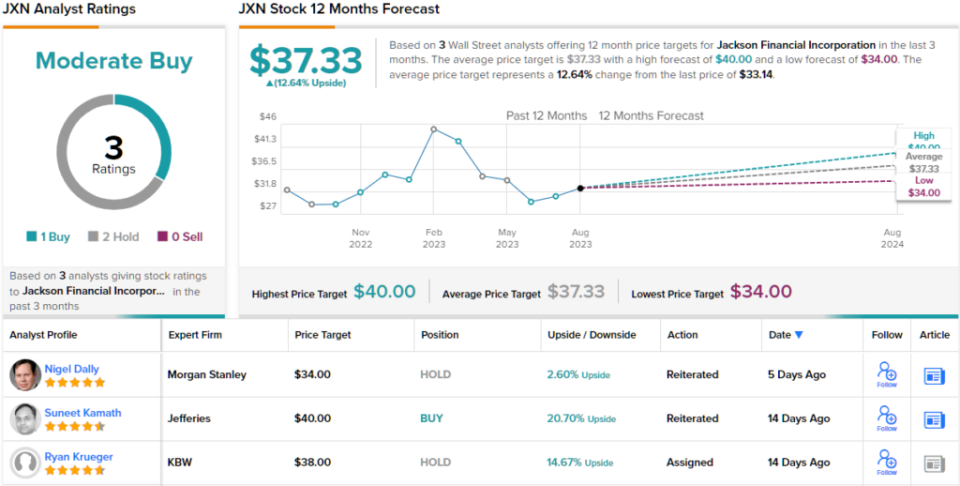

Miller is not the only bull here. Jefferies analyst Suneet Kamath has noted that the company is likely to successfully resolve its ‘VA book’ issues and is currently offering solid capital return. He writes of JXN, “Our Buy-rating on JXN is in large part due to our view that its high-quality VA book is not appropriately reflected in its valuation. We are optimistic that the Michigan solution could correct this disconnect somewhat. In the meantime, we believe the stock offers one of the most attractive capital return yields in the space…”

Kamath’s Buy rating is complemented by a $40 price target that indicates potential for ~21% upside in the year ahead. (To watch Kamath’s track record, click here)

Overall, JXN shares have a Moderate Buy from the analyst consensus, based on 3 recent reviews that include 1 Buy and 2 Holds. The shares are trading for $33.14 and have a $37.33 average price target, a combination suggesting ~13% upside in the next 12 months. (See JXN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.