[1/2]A trader works at the Frankfurt stock exchange in Frankfurt, Germany, February 22, 2022. REUTERS/Timm Reichert/File Photo

LONDON, July 27 (Reuters) – World shares were at a 15-month high and the euro climbed on Thursday as focus shifted from a widely-expected nudge up in U.S. interest rates to what is almost certain to be a similar move shortly by the European Central Bank.

With investors sensing that the most aggressive rise in world borrowing costs in the last 40 years is finally cresting, MSCI’s 47-country ACWI stocks index (.MIWD00000PUS) was at its highest level since April last year having surged 30% since November.

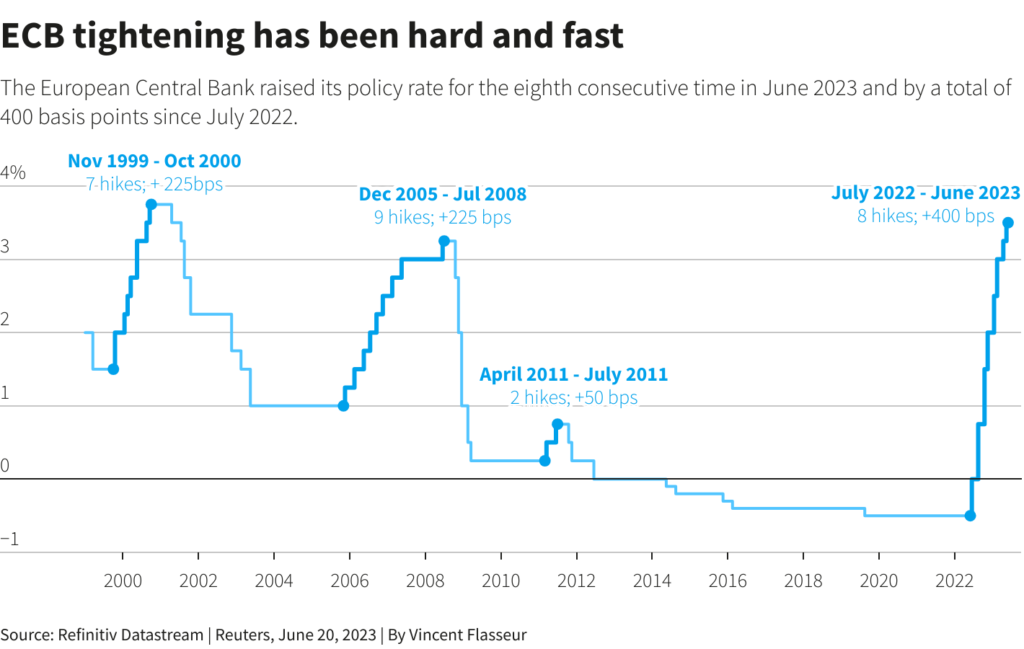

Investors are now waiting for the European Central Bank at 1215 GMT, which like the Fed is expected to hike by another quarter point as it approaches the end of its tightening cycle. On Friday there is also the Bank of Japan, where speculation has risen that it could begin shifting too.

The pre-ECB moves saw gains across Europe with the STOXX 600 (.STOXX) up 1%, Italian (.FTMIB) and Spanish (.IBEX) stocks hitting their highest levels since 2008 and 2020 respectively and the euro up 0.5%. /FRX

Nasdaq futures advanced 1.25%, helped by a 6.8% jump in Meta Platforms (META.O) in after-hours trading. Facebook’s parent company reported a strong rise in advertising revenue, topping Wall Street targets.

In Asia, MSCI’s broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) had risen 1% to reach its highest level in five months.

Hong Kong’s Hang Seng index (.HSI) rallied, driven by a near 5% surge in Chinese property stocks as they extended a rebound started this week when a Politburo meeting fuelled hopes that more support to a battered sector is on the way. Japan’s Nikkei (.N225) advanced 0.7% to a three-week top.

Jens Eisenschmidt, Chief European Economist at Morgan Stanley, said the main question for the ECB – assuming it does hike rates – will be what it does in September when it will have had two more months of inflation data to digest.

“I would be highly surprised if President (Christine) Lagarde says anything that brings market expectations much above 4%,” Eisenschmidt, said referring to the ECB’s maximum rate.

“Something that sees September either totally priced in or totally priced out is very unlikely.”

Overnight, the U.S. Federal Reserve had delivered a quarter-point rate hike as widely expected. Chair Jerome Powell in his press conference said the Fed no longer expects a recession.

“Even though the Fed has left the door open for an additional rate hike before the end of the year, we believe that we’ve now reached peak cycle – the Fed tightening cycle is done,” said David Chao, a global market strategist at Invesco.

“We expect an increasing global risk appetite as markets continue to positively re-price recession risks, and ultimately look forward to and discount an economic recovery that could begin to unfold late this year.”

Futures only imply a slim chance – about 20% – that the U.S. central bank could surprise with a quarter-point increase in September. They also moved to price in sizeable rate cuts of 125 basis points by the end of next year.

ECB AHEAD

The European Central Bank is widely expected to raise interest rates by a quarter-point at its rate decision, but markets sense the end is also in sight, with at most one more hike expected after this week.

However, the slow retreat in euro zone inflation could pile pressure on policymakers to keep going or at least keep rates higher for longer.

“We, and the market, expect a 25 basis point (hike),” Jefferies economist Mohit Kumar said.

“But the key would be the guidance for future policy meetings… The market is pricing in a peak rate of 3.96%. In our view a 50/50 chance of another hike will be closer to fair.”

Another major event this week is the Bank of Japan meeting on Friday amid speculation of more tweaks to its ultra-loose monetary policy known as yield curve control, where its keeps market borrowing costs in a tight range.

The majority view is policymakers won’t change that just yet, according to a Reuters poll, although some respondents do, including JPMorgan, which sees the key 10-year band being widened to +/- 100 basis points.

The yen climbed to as high as 139.35 per dollar but last hovered near the 140 level. Overnight dollar/yen implied volatility jumped to 36.3%, the highest since March.

The U.S. dollar continued to be pressured in Europe, off 0.2% against a basket of major currencies . Both the risk-sensitive Australian dollar and New Zealand dollar had been up as much 0.8%.

In the debt markets, euro zone government bond yields – a proxy for borrowing costs – were edging down again ahead of the ECB’s decision and its 1245 GMT news conference.

Treasury yields were mostly steady too. The yield on the 10-year U.S. note held at 3.86%, after a drop of 6 basis points overnight, while the rate-sensitive two-year was little changed at 4.8329%, having also eased 7 bps.

Elsewhere, oil prices were higher. Brent crude futures were up 0.6% at $83.41 per barrel and U.S. West Texas Intermediate crude futures rose 0.85% to $79.46.

Gold prices edged up 0.2% to $1,976.18 per ounce.

Additional reporting by Stella Qiu in Singapore, Editing by William Maclean and John Stonestreet

: .