(Bloomberg) — Employment growth in the world’s largest economy probably cooled and wage increases moderated in August, suggesting a further tempering of inflation risks that reduces the urgency for another Federal Reserve interest-rate hike.

Most Read from Bloomberg

Friday’s US jobs report is forecast to show employers boosted their payrolls by nearly 170,000 in August, while the unemployment rate held at a historically low 3.5%. The average increase in job growth over the past three months would be the smallest since the start of 2021.

Getting inflation down to 2% is expected to require softer labor-market conditions and a period of below-trend economic growth, Fed Chair Jerome Powell said Friday at the Kansas City Fed’s annual conference in Jackson Hole, Wyoming.

Read more: Powell Signals Fed Will Raise Rates If Needed, Keep Them High

Other labor market data in the coming week are seen showing fewer July job openings than a month earlier, indicating labor supply and demand are coming into better balance. That may help limit wage pressures and, ultimately, inflation.

“This rebalancing has eased wage pressures. Wage growth across a range of measures continues to slow, albeit gradually,” Powell said at Jackson Hole.

Fed officials on Thursday will also get a fresh read on their preferred inflation gauge — the personal consumption expenditures price index minus food and energy. The median forecast calls for a second-straight 0.2% monthly increase in July, which would represent that smallest back-to-back advance in the underlying inflation measure since the end of 2020.

What Bloomberg Economics Says:

“One of the most interesting points Powell made in his Jackson Hole speech was that he thinks the Phillips Curve may have steepened: ‘There is evidence that inflation has become more responsive to labor-market tightness than was the case in recent decades.’ Nonfarm payrolls — which includes average hourly earnings — and JOLTS data will like reinforce this belief, with wage growth coming down quickly with just a slight easing in the labor market.”

— Anna Wong, Stuart Paul and Eliza Winger, economists. For full analysis, click here

Elsewhere, euro-area inflation readings for August will be in focus, while China’s PMI data are expected to reinforce that the economy is going from bad to worse.

Click here for what happened in the past week and below is our wrap of what’s coming up in the global economy.

US Economy and Canada

In addition to US jobs and PCE price data, reports on personal income and spending as well as consumer confidence are on the calendar, as is the first revision to second-quarter gross domestic product.

In Canada, second-quarter GDP will reveal whether the economy is gearing down enough for the Bank of Canada to hold rates steady the following week. Preliminary data suggest growth at an annualized pace of 1%, weaker than the 3.1% increase in the first quarter.

Asia

Investors will watch China’s PMI data on Thursday to gauge the latest state of jitters in the world’s second-largest economy and its implications for the rest of the world.

Trade figures are also expected from South Korea, Thailand and Vietnam in a further pulse check on the state of global commerce. Meanwhile, data due Thursday are likely to show that India’s economy expanded in the second quarter at the fastest pace in a year, riding on strong service sector growth and a pickup in manufacturing.

In Japan, a slew of data from jobs to industrial production should reflect the state of both domestic and external demand. Bank of Japan board members Naoki Tamura and Toyoaki Nakamura speak midweek, following the decision last month to essentially widen the 10-year yield range, a move that jolted markets around the world.

On Tuesday, the Reserve Bank of Australia’s incoming Governor Michele Bullock will give her first speech since being appointed to the central bank’s top job, while the latest Australian consumer price data on Wednesday may give investors an idea of the RBA’s likely next step.

Europe, Middle East, Africa

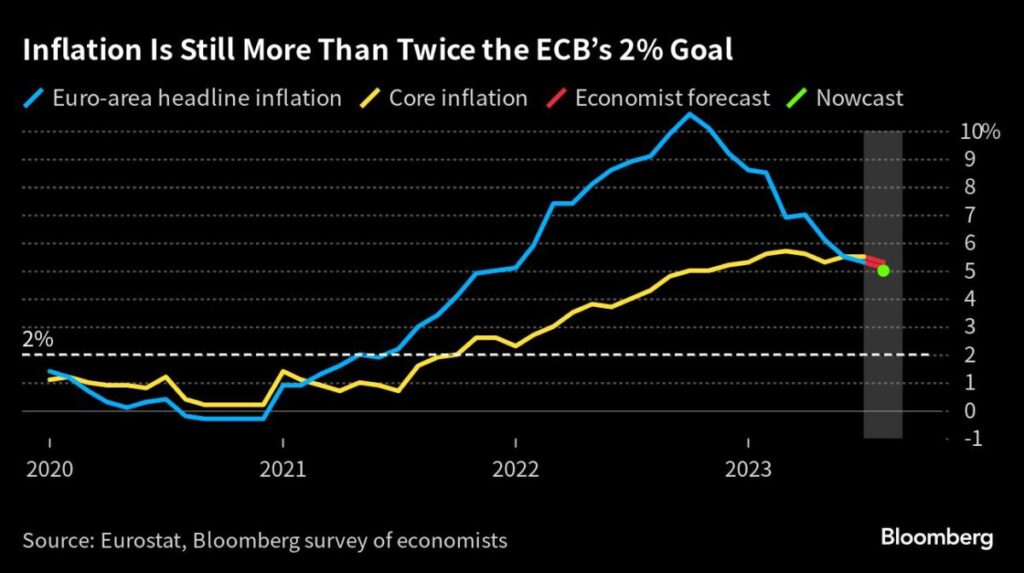

Euro-area inflation readings will provide a key data point ahead of September’s highly anticipated European Central Bank rate decision.

Underlying inflation in the euro area probably only dipped a touch, which might strengthen arguments for one final rate hike.

Ahead of those data on Thursday, the week kicks off with Governing Council hawks Joachim Nagel and Robert Holzmann speaking in the Austrian Alps. Executive Board member Isabel Schnabel and Vice President Luis de Guindos speak after the inflation numbers. An account of the July rate decision and the latest set of euro-area confidence gauges are also due.

Further north, fresh British housing figures are likely to highlight how the Bank of England’s rate aggression continues to reverberate.

Meanwhile, on Tuesday, GDP numbers for Sweden are predicted to show that the economy contracted in the second quarter, which will likely mark the start of a sizable recession.

In Eastern Europe, Hungary’s central bank is poised to continue its monetary-easing cycle, shaving another percentage point off of the European Union’s highest key rate as disinflation gathers place. Later in the week, the country’s credit rating will be in focus at Moody’s, with a cut in the outlook to negative from stable a potential outcome.

Polish inflation on Thursday is predicted to show another slowdown.

Turkey on Tuesday will publish its trade balance for June. Investors will watch for signs of whether the lira’s depreciation, a month after President Recep Tayyip Erdogan’s reelection, caused a drop in imports and helped exporters.

Two days later, the nation will report on second-quarter GDP. Traders are keen to see if the government’s extra spending ahead of the election boosted growth.

In Kenya, annual inflation data for August will be the first since a court overturned the freeze on new government taxes, pending a judgment on the matter. The central bank will closely monitor the figures to see what implications the levies have had on inflation, which fell back into its target range of 2.5% to 7.5% in July, three months earlier than expected.

Also on Thursday, the South African Reserve Bank will kick off its two-day biennial conference. Speakers include its Governor Lesetja Kganyago, Atlanta Fed Bank President Raphael Bostic, and International Monetary Fund First Deputy Managing Director Gita Gopinath.

Latin America

A series of indicators this week will shed light on the magnitude of the economic deceleration in Latin America.

On Tuesday, Mexico publishes final second-quarter GDP data that’s expected to confirm a resilient performance by the region’s second-largest economy, which continues to benefit from strong exports to the US.

Chile on Thursday posts numbers for manufacturing, industrial and copper production in July, following a GDP report that showed its economy contracted less than expected in the second quarter.

Also Thursday, Brazil, Mexico and Colombia release unemployment figures for July.

Brazil on Friday publishes second-quarter GDP data that will show the lagged impact of high interest rates on growth. Latin America’s largest economy is forecast to decelerate sharply after a better-than-expected performance in the first quarter of 2023.

–With assistance from Walter Brandimarte, Laura Dhillon Kane, Andrea Dudik, Paul Jackson, Monique Vanek and Paul Wallace.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.