(Bloomberg) — A worrisome thought for the stock faithful: You won’t have the bears to kick around anymore.

Most Read from Bloomberg

Fresh off the strongest first half for the S&P 500 in five years, the rooting out of unbelievers has shown signs of picking up speed. A source of anxious buying when the tide turned upward, short sellers who came into 2023 preparing to feast have been backing away from positions as stocks rally.

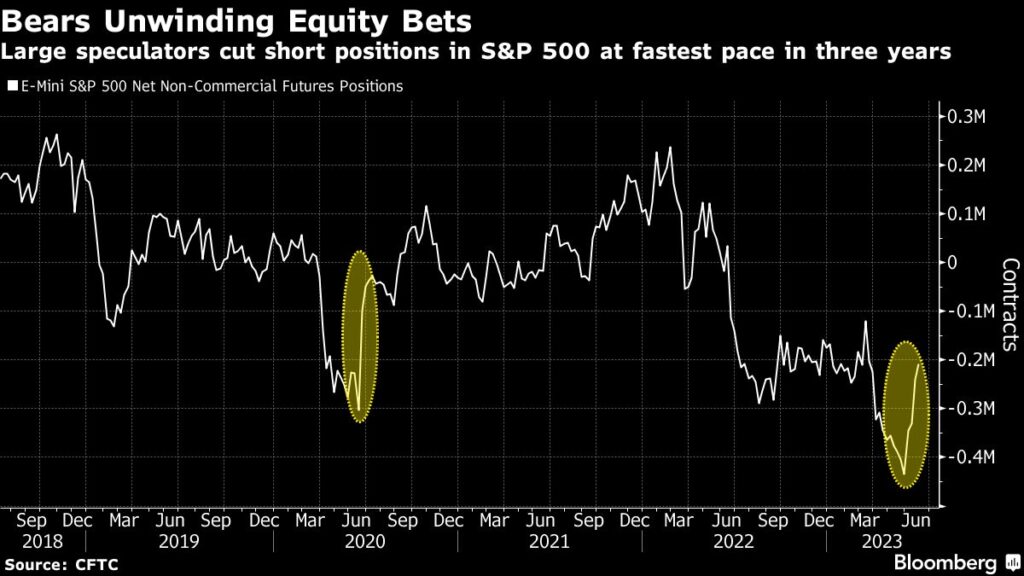

Shifting sentiment can be seen in data showing bearish positions in exchange-traded funds slipped to three-year lows while shorts in S&P 500 futures were unwound at the fastest pace since 2020. Meanwhile, the population of optimists is exploding, with bullish newsletter writers in Investors Intelligence survey outstripping bearish ones by 3-to-1, the highest level since late 2022.

It’s an axiom of investing that one of the best setups a long-oriented trader can hope for is one where everybody else is braced for disaster. That was the situation as doubts about the economy surfaced in 2022, and helps explain how well bulls have done since markets bottomed nine months ago.

Now, the strength of the rebound is putting pressure on bears, leaving the market with one fewer accelerant as concern about the Federal Reserve’s war on inflation reasserts itself at a time when corporate earnings are forecast to drop for a third straight quarter.

“Sentiment is not extreme but it is stretched, and recent surveys suggest it won’t provide the same tailwind to stocks going forward,” said Adam Phillips, managing director of portfolio strategy at EP Wealth Advisors. “As we look to the second half, we expect the market to be put to the test as investors demand results to justify recent performance.”

Stocks fell in the holiday-shortened week as solid data on the labor market and services activity rekindled concern the Fed will keep raising rates to tame inflation. Treasury yields hit fresh highs. All major equity benchmarks were in the red with the S&P 500 sliding 1.2%.

Short sellers likely lost $37 billion in June, according to an estimate by analytics provider Ortex. Losses have been piling up for bears all year as optimism over artificial intelligence propel technology giants, lifting the S&P 500 to double-digit returns that have defied doomsayers.

Signs are multiplying that skeptics, willingly or not, are in retreat after initial resistance. Large speculators, mostly hedge funds that saw their net short positions in S&P 500 swell to a record at the end of May, were busy unwinding bets in the following four weeks. Their bearish holdings fell by 226,000 contracts over the stretch, the largest drop since mid-2020, according to data from the Commodity Futures Trading Commission compiled by Bloomberg.

Among newsletter writers tracked by Investors Intelligence, those classified as bullish rose to 54.9% while the proportion of bears fell to 18.3%. That’s in stark contrast from the end of last year, when bears exceeded bulls.

The swift sentiment shift prompted even Ed Yardeni, an early advocate of this bull run, to ask whether there are too many optimists.

“High bullish sentiment can be a caution flag,” said the president of Yardeni Research, whose bold call in January for a sustained equity advance proved prescient.

In ETFs, short interest is near a three-year low based on its percentage of market value, according to Markit data compiled by Morgan Stanley’s sales and trading team. Short interest in individual companies — while not dissipating completely — has sunk back toward median levels across most industries.

Count rules-based money managers among those who have been driven to snap up shares as the market marches higher. Systematic funds, including those that make asset allocations based on price momentum and volatility signals, were net buyers of $40 billion to $45 billion of global stocks in June, the Morgan Stanley team estimated, noting their purchases since January marked the second-fastest ever over any six-month period.

As things stand now, the quant cohort’s equity exposure has increased to the highest level since February 2020, sitting around the 80th percentile over the past five years.

“That translates to greater fragility to any continued equity demand from the group,” the team led by Christopher Metli wrote in a note. Should their exposure return to the historic median, that’d result in share disposals of as much as $160 billion, they estimated.

For now, equity pullbacks remain shallow in part because traders are waiting for more economic and earnings data to get a better picture on the fundamental outlook. The S&P 500 has gone without a weekly decline of 2% for 17 weeks in a row — the longest streak of resilience in almost two years.

Big banks are slated to kick off earnings season next week and analysts expect a 9% contraction in second-quarter profits for S&P 500 firms, according to data compiled by Bloomberg Intelligence.

Going by investor positioning, there is still a prevailing lack of confidence in the economy. While active funds have chased gains in the AI-fueled tech rally this year, they’ve cut exposure in economically sensitive companies like energy, an analysis by Bank of America Corp. showed. In fact, the group’s cyclical versus defensive exposure hovers near all-time lows, according to the firm’s strategists led by Savita Subramanian.

The persistent aversion toward cyclical shares reflects the view that an economic recession is delayed, but not averted completely, said Matt Frame, a partner at Bornite Capital Management, a stock-picking hedge fund.

“At the index level we went from deeply bearish sentiment in the fall to the other extreme right now especially in tech. I don’t think it’s fair to say that’s true for every sector,” he said. “It’s really been a tale of two markets with tech and the overall market rerating higher year-to-date while cyclicals have derated around the recession theme. You need to see some participation outside of technology if stocks are going to continue to move higher.”

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.