BUENOS AIRES/LONDON, Nov 20 (Reuters) – Far-right libertarian Javier Milei’s strong win in Argentina’s presidential election is boosting bonds and equities but putting downward pressure on the peso currency, investors said on Monday.

The outsider radical, who has pledged to take a chainsaw to public spending, “burn down” the central bank and dollarize the economy, beat Peronist economy chief Sergio Massa in Sunday’s vote, though he struck a measured tone in his first speech as president-elect.

The South American country’s markets are closed on Monday for a local holiday. But its overseas dollar bonds, which largely trade deep in distressed territory near 30 cents on the dollar, rallied more than 2 cents in early trading before retracing some gains, according to MarketAxess data.

Anders Faergemann, co-head of global fixed income with PineBridge Investments, said investors were happy with the outcome, but would proceed cautiously until Milei announced his cabinet.

“We think it’s a positive outcome to markets, but there may be some adjustments in the coming days, the coming weeks … to see what his approach will be,” he said.

JPMorgan, in a note to clients late on Sunday, said it would not change its recommendation on Argentina’s international bonds from its measured “market weight” stance while it awaited clarity on his policy path and ability to enact his plans.

Equities were less measured, with U.S.-listed shares of Argentinian energy company YPF rallying more than 40% after Milei said he would look to privatize it. It cooled to a 33% gain at 1544 GMT.

Banks Grupo Supervielle, Banco Macro, Banco Bbva Argentina and Grupo Financiero Galicia were up between 15.6% and 22.1%, while the $50.8 million Global X MSCI Argentina ETF added 12.2%, hitting its highest since September.

YPF international dollar bonds were also trading 1.5 cents higher.

Milei, who will not take office until Dec. 10, did not refer to “dollarization” in his first speech, raising questions about how quickly he might pursue scrapping the peso entirely.

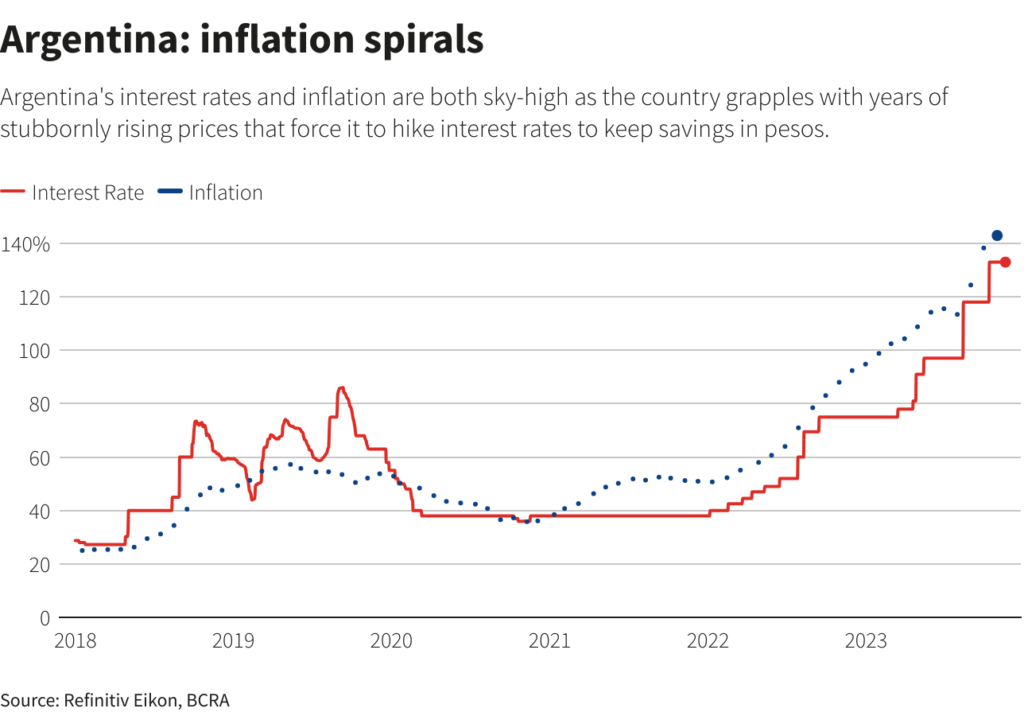

He did pledge rapid reforms to fix an economy mired in crisis. Inflation is at 143%, foreign currency reserves are more than $10 billion in the red and a recession is looming. He also signaled moderation and thanked his mainstream conservative backers Mauricio Macri and Patricia Bullrich.

“It is indisputable that a swift change from the failed economic policies of the past is imperative. The accumulated imbalances in the economy have grown too large and must be addressed promptly,” Sergio Armella of Goldman Sachs said in a note.

The peso currency lost ground on crypto exchanges, watched by investors as a proxy for the black market. The price of one tether – a cryptocurrency pegged to the U.S. dollar – rose as high as 1120.40 Argentine pesos on Sunday, and traded at 1067.90 early on Monday, compared with Friday’s opening price of 913.7, according to the Binance website. By 1544 GMT, it had fallen to 975.60.

Bruno Gennari, Argentina expert at KNG Securities, said the precarious international reserves would likely force a quick devaluation; Morgan Stanley said it expected at least an 80% adjustment of Argentina’s official forex in December.

Milei, a TV pundit-turned lawmaker with little political experience, rode a wave of voter anger, pledging aggressive plans to slash state spending and the size of government.

Investors said they would be watching for him to stick to spending cut promises – and quickly – to buoy markets, despite fear about the pain of austerity with two-fifths of the population already in poverty.

“They cannot afford to kick the can down the road any longer,” said Riccardo Grassi of Mangart Advisors, which holds Argentine bonds.

He added that Milei also needed to immediately initiate talks to get the $44 billion loan programme from the International Monetary Fund back on track.

“The IMF cannot fail this time.”

Milei will be buoyed by his larger-than-expected vote take of 56% in the run-off after he got 30% in the first round vote last month. But he still faces a divided Congress where his Liberty Advances bloc only has a small share of seats.

“Having a resounding outcome like he did yesterday … gives him a strong public mandate, particularly given his position of weakness in congress,” Jimena Blanco, head of Americas with Verisk Maplecroft, said.

Reporting by Jorgelina do Rosario in Buenos Aires and Libby George in London; Additional reporting by Elizabeth Howcroft and Marc Jones in London, Walter Bianchi, Jorge Otaola and Hernán Nessi in Buenos Aires; Editing by Christopher Cushing and Andrew Heavens

: .