The Credit Suisse logo seen displayed on a smartphone and UBS logo on the background.

Sopa Images | Lightrocket | Getty Images

Allowing the bankruptcy of troubled lender Credit Suisse would have crippled Switzerland’s economy and financial center and likely resulted in deposit runs at other banks, Swiss regulator FINMA said Wednesday.

FINMA (the Swiss Financial Market Supervisory Authority) and the Swiss central bank brokered UBS’ takeover for embattled Zurich rival Credit Suisse for 3 billion Swiss francs ($3.3 billion), in a deal announced on March 19. As part of the transaction, the regulator instructed Credit Suisse to write down 16 billion Swiss francs worth of AT1 bonds — widely regarded as higher risk investments — to zero, while entitling equity shareholders to payouts at the stock’s takeover value.

The bankruptcy plan, FINMA CEO Urban Angehrn said in a statement, was “de-prioritised early on due to its high tangible and intangible costs.” It would have erased the holding company Credit Suisse Group, along with the parent bank Credit Suisse AG and its branches, while retaining the Credit Suisse (Schewiz) AG entity because of its “systemic importance.”

“The parent bank Credit Suisse AG would have gone under – a Swiss bank with total assets of over CHF 350 billion and ongoing business also running into many billions,” Angehrn warned. “It is not difficult to imagine the disastrous impact the bankruptcy of a bank and wealth manager as large as Credit Suisse AG would have had on Switzerland’s financial centre and private banking industry. Many other Swiss banks would probably have faced a run on deposits, as Credit Suisse itself did in the fourth quarter of 2022.”

Angehrn noted that the emergency measure would have rescued Credit Suisse’s payments and lending functions to the Swiss economy, but come at a higher overall cost that dis-aligned with the “principle of proportionality.”

“The damage to the Swiss economy, financial centre and Switzerland’s reputation would have been enormous, with unquantifiable effects on tax revenues and jobs.”

Among FINMA’s other options, the resolution recourse would have downsized Credit Suisse, with the Swiss National Bank supplying liquidity assistance loans backed by a federal default guarantee. The bank’s equity and AT1 bonds would still have been written down to zero, with other bondholders being bailed in. FINMA estimates these measures would have altogether freed up 73 billion Swiss francs of capital, but this liquidity buffer would have heavily eroded investor sentiment.

The merger plan was ultimately preferred both to stabilize Credit Suisse and to prevent an overspill of the crisis into the international banking sector, FINMA argues.

“The current fragile state of the financial markets due to the shift to monetary tightening in 2022, the uncertain economic outlook, the crisis at certain banks in the US and the whole geopolitical backdrop were also relevant to our decision,” Angehrn said. “There was a high probability that the resolution of a global systemically important bank would have led to contagion effects and jeopardised financial stability in Switzerland and globally.”

The failure of Credit Suisse on the recent footsteps of U.S. bank collapses have stoked concerns over the strain testing the banking sector as a result of aggressive central bank interest rate hikes to combat inflation. The European Central Bank and U.S. Federal Reserve nevertheless proceeded with further increases in March.

Angehrn said the regulator has been in recent dialogue with the U.S., but did not experience international pressure in its supervision of Credit Suisse.

‘Too big to fail’ fine print

FINMA’s management of Credit Suisse’s unravelling and union with UBS have drawn intense public scrutiny, forcing the regulator to unprecedented levels of public disclosure, said Marlene Amstad, chair of FINMA’s board of directors.

“In this case, however, there is a particular supervisory need to set out the most important facts and to set rumours and assumptions straight.”

Domestically, Switzerland’s Federal Prosecutor has now opened an investigation into the takeover, looking into potential breaches of the country’s criminal law by government officials, regulators and executives at the two banks, according to Reuters. Several bondholders are studying legal action over the AT1 writedown.

FINMA said its management of the Credit Suisse crisis drew on the “too big to fail” standard developed after the financial crisis, with Switzerland emerging as the “first country to have to deal with the practical application of the second part of the TBTF legislation.” Namely, FINMA tackled a “gone concern,” for which TBTF requirements call for systematically important banks to have sufficient capital so that they might be restructured or liquidated in response to grave financial difficulties.

“For the first time, AT1 buffers were used at a global systemically important bank – they are an essential element in the TBTF legislation,” Amstad noted, adding that a TBTF instrument applying to resolutions or bankruptcies constitutes a drastic last-resort measure created to restrict financial contagion.

“On 19 March, however, we were in a different situation. The authorities would have risked not stopping a looming financial crisis by using the tool of resolution, but rather triggering such a financial crisis.”

Peter V. Kunz, chair in economic law and comparative law at the University of Bern, told CNBC on Wednesday that it was likely the Swiss Parliament will assemble a committee to investigate the relevant authorities’ handling of the rescue deal.

Wedded bliss

The takeover has reined in Credit Suisse’s independent troubles but heightens the risks posed by the bolstered scale of the new UBS-led entity spawned by the merger. The regulator downplayed these dangers in the context of UBS’ historical heft.

“As a proportion of Switzerland’s GDP, UBS will actually only be half the size it was before 2008, even after the merger with CS,” Angehrn said, describing UBS as a “robustly capitalised and well-organised bank” whose strategic plans are “well-founded” and which will face growing regulatory requirements following the completion of the takeover.

“In Switzerland’s ‘too big to fail’ regime, banks’ capital requirements grow progressively with a bank’s size. In other words a bank that is double the size has to hold more than double the capital. After an appropriate transition period, these higher capital requirements will apply to the new UBS. FINMA will monitor and enforce these capital requirements. “

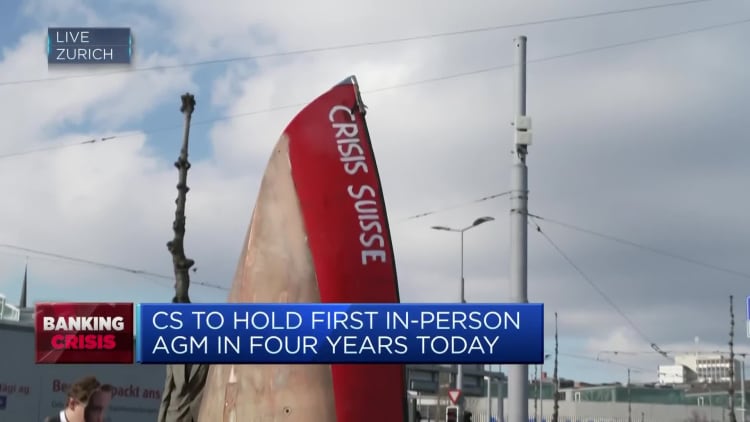

The FINMA comments come on the same day as a UBS annual general meeting, where investors are turning to the bank — and returning CEO Sergio Ermotti — for guidance on next steps following the takeover.

Credit Suisse held its own AGM on Tuesday, whereby Axel Lehmann, who was re-elected as bank chairman later in the session, told shareholders he was “truly sorry” for the bank’s collapse.

— CNBC’s Elliot Smith and Hannah Ward-Glenton contributed to this report.