A version of this post first appeared on TKer.co

Stocks closed lower last week with the S&P 500 shedding 1.1%. The index is now up 14.6% year to date, up 23% from its October 12 closing low of 3,577.03, and down 8.3% from its January 3, 2022 record closing high of 4,796.56.

I was recently at a happy hour with some of my colleagues in business news, and a question came up: What has surprised me in the market or the economy over the past year?

Regular readers of TKer know that major themes we talk about here haven’t really changed much in a long time. And when they do change, they happen very gradually. Just take a look at the “Putting it all together” section of the weekly newsletter: The language has essentially been unchanged for months.

So if there’s anything that’s really surprised me, it’s the degree to which most Wall Street economists have been wrong about the trajectory of the economy. Specifically, many have spent most of the past year warning that a recession was around the corner, and now they’re either retracting their calls or arguing the risks are fading.

While I think the odds of a recession may have risen from very low levels, I’m still not convinced the likelihood of a recession was ever particularly high. This is largely due to the fact that the economy has been and continues to be bolstered by some massive tailwinds.

3 massive economic tailwinds 🌬️

One of the most clicked and shared TKer newsletters ever has been the March 4, 2022 issue: Three massive economic tailwinds I can’t stop thinking about 📈📈📈

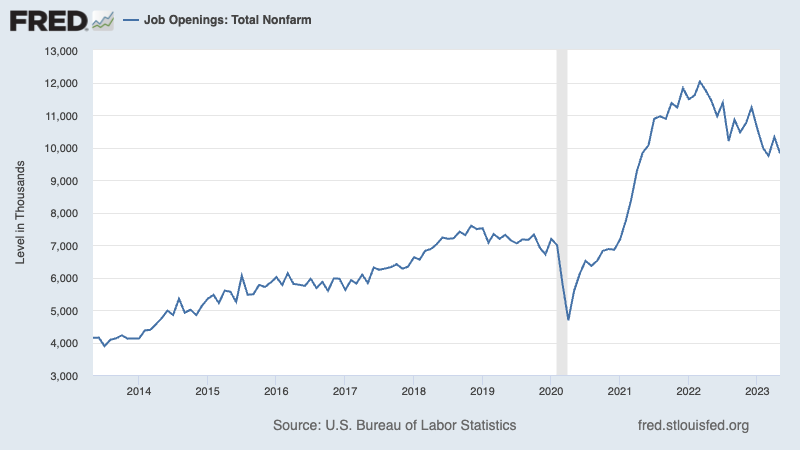

Those three tailwinds: The unprecedented trillions of dollars worth of excess savings accumulated by consumers, the eye-poppingly high number of job openings, and the record-high levels of core capex orders.

These metrics are notable because they’re leading indicators: Excess savings represent extra money that has yet to be spent; elevated job openings represent hiring that has yet to happen, which also means incremental consumer spending power that has yet to be realized; and core capex orders represent capital goods businesses have yet to put in place, which means there’s still work to be done by manufacturers and there’s more capacity coming for the businesses that ordered this stuff.

These narratives all emerged at around the same time in 2021 as the economy was “re-opening” amid the COVID-19 pandemic. I put spotlights on all of them in June 2021, back when I wrote the Axios Markets newsletter. See here, here, here, and here.

The economists I spoke to at the time were all super bullish about these developments. So I’ve been staying on top of these numbers ever since.

Despite threats, they persisted ⚠️

Over the past two years, there have been all sorts of developments in the economy and markets that presented threats to the tailwinds: Consumer sentiment plunged, new COVID-19 variants emerged, Russia invaded Ukraine, energy prices exploded, the Federal Reserve began hiking rates at an aggressive pace, the yield curve inverted, inflation rates surged to the highest levels in decades, the stock market went into a bear market, the housing market turned, the U.S. government faced a debt ceiling crisis, and a couple of big banks failed.

Honestly, I’ve been worried that any one of these developments would cause one or more of the tailwinds to fade and force the economy into recession.

But the data always suggested otherwise. Consumer finances remained strong, job openings remained high, and businesses continued to invest for future growth.

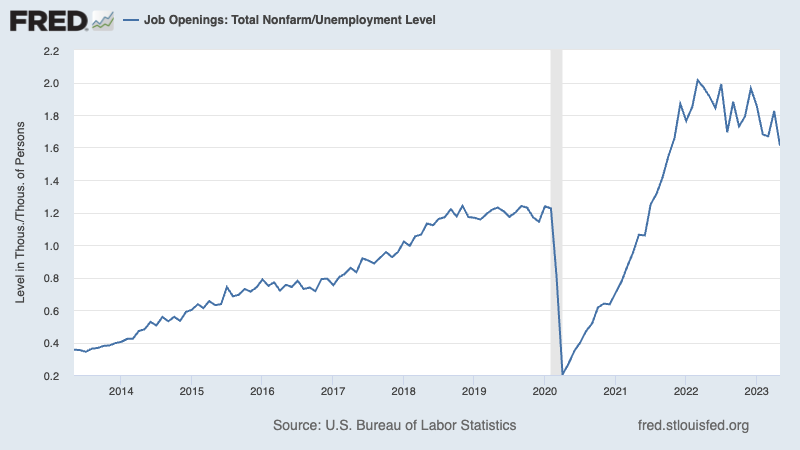

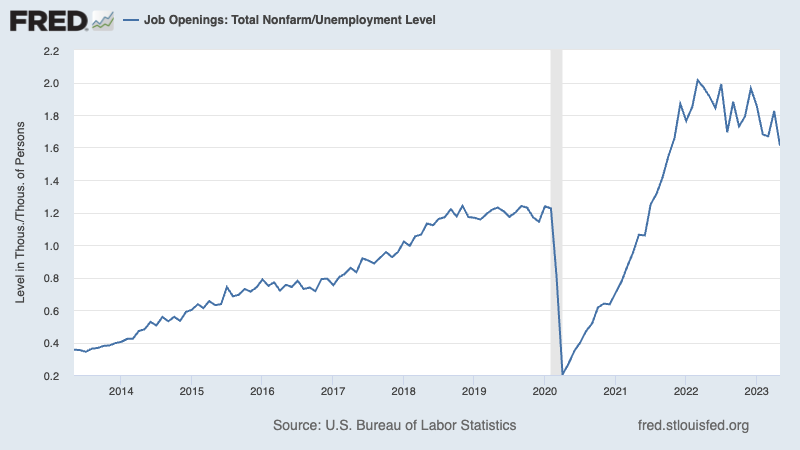

And now two years later — as you’ll read in TKer’s review of the macro crosscurrents below — these tailwinds are very much intact (while showing some signs of cooling). While excess savings have become increasingly difficult to estimate, most economists believe there’s still a couple hundred million dollars sitting in consumers’ bank accounts. While the level of job openings is off its high, there continues to be a very high 1.6 job openings per unemployed person. And while core capex order growth has been decelerating, they continue to be at a record high.

Putting it all together 🌎

In many ways, the economy is incredibly complicated.

But in some ways, it’s not that complicated. You give people money, and then they’ll spend it. When businesses create jobs, more people will have money to spend. When more people have money to spend, businesses have to expand to address higher demand. When businesses expand, they create more jobs.

It’s a virtuous cycle. And the three massive economic tailwinds continue to perpetuate this cycle.

For investors, all of this helps drive earnings, which helps to explain why strategists are looking for considerable earnings growth in 2024 and 2025. And earnings are the most important long term driver of stock prices, which explains why stocks are up this year.

If there is a downside to these tailwinds, it’s that they are keeping inflation from cooling faster. The good news is inflation has nevertheless been easing for months, and the tailwinds have helped make this happen while preventing the economy from going into recession.

An unexpected economic shock could certainly derail things. Though it’s worth remembering that the negative shocks of the past two years have had limited negative impact.

Who knows how long these dynamics persist. For now, things continue to look favorable for the economy’s near-term outlook.

Reviewing the macro crosscurrents 🔀

There were a few notable data points and macroeconomic developments from last week to consider:

🤯 Hard data > soft data. As we often say at TKer: What businesses do > what businesses say. Indeed, in recent months it’s been the case that actual hard data about the economy has been surprisingly strong while soft survey-based data has been disappointing. From Bloomberg’s Michael McDonough: “Jumping on the economic surprise index bandwagon, here is a look at it for hard vs soft (survey) data. It suggests the actual economy is doing better than expected, but economists think people’s opinions of the economy are better than they really are.”

💼 The labor market remains hot, but it’s cooling. According to the Bureau of Labor Statistics, U.S. employers added an impressive 209,000 jobs in June. While the pace of job gains has been cooling, the numbers continue to confirm an economy with robust demand for labor.

Employers have added 1.7 million jobs since the beginning of the year. Total payroll employment is at a record 156.2 million jobs.

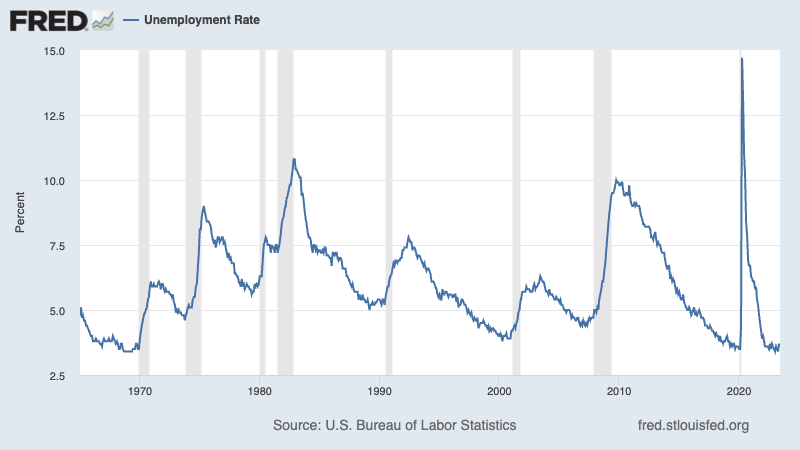

During the period, the unemployment rate fell to 3.6% from 3.7% the month prior — the lowest level since 1969. While it’s slightly above its cycle low of 3.4%, it continues to hover near 53-year lows.

Average hourly earnings rose by 0.4% month-over-month in June, unchanged from the pace in May. This metric is up 4.4% from a year ago, a rate that’s been cooling but remains elevated.

📈 Job switchers get better pay. According to ADP, which tracks private payrolls and employs a different methodology than the BLS, annual pay growth in June for people who changed jobs was up 11.2% from a year ago. For those who stayed at their job, pay growth was 6.4%.

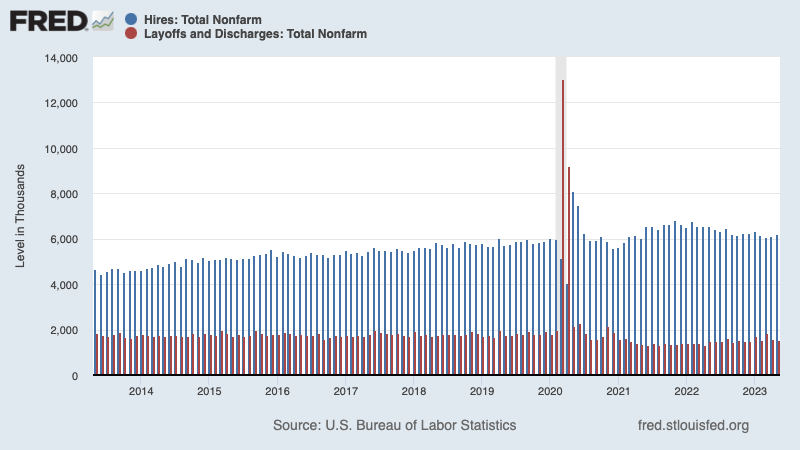

💼 Jobs openings cool, layoffs stay low. The May Job Openings & Labor Turnover Survey confirmed that the labor market, while still hot, continues to cool. Job openings declined to 9.82 million during the month, down from 10.32 million in April.

During the period, there were 6.09 million unemployed people — meaning there were 1.61 job openings per unemployed person. This continues to be one of the most obvious signs of excess demand for labor.

Employers laid off 1.55 million people in May. While challenging for all those affected, this figure represents just 1.0% of total employment. This metric continues to trend below pre-pandemic levels.

Hiring activity continues to be much higher than layoff activity. During the month, employers hired 6.21 million people.

From Indeed’s Nick Bunker: “If you look past some of the volatile topline data you’ll see today’s JOLTS report continues to reflect a gradually slowing yet still-robust labor market, one that is cooler than a year ago but still hot…. The labor market isn’t always going to be this strong. Recessions happen. But for now, demand for new hires remains elevated and employers are still holding onto the workers they have.”

💼 Unemployment claims tick up. Initial claims for unemployment benefits climbed to 248,000 during the week ending July 1, up from 236,000 the week prior. While this is up from the September low of 182,000, it continues to trend at levels associated with economic growth.

⛽️ Consumers are hitting the road. Weekly EIA data through June 30 show gasoline demand is up from a year ago.

🛢️Gas prices cool as summer driving season kicks off. From AAA: “Pump prices barely budged over the past week, despite the expected demand surge due to the July 4th holiday. AAA predicted that more than 43 million people would hit the road to celebrate the nation’s birthday. Despite the record number, the national average for a gallon of gas drifted two cents lower since last week to $3.52.”

⛓️ Supply chain pressures still loose. The New York Fed’s Global Supply Chain Pressure Index — a composite of various supply chain indicators — ticked up in June, but remains well below levels seen even before the pandemic. It’s certainly way down from its December 2021 supply chain crisis high.

From the NY Fed: “There were significant upward contributions from Great Britain and Euro Area backlogs as well as United States and Taiwan delivery times. Looking at the underlying data, the readings for Great Britain backlogs (the largest contributor to the upward move in the GSCPI this month) are above their historical average for the first time since February.”

💵 Consumers still seem to have excess savings. From Bank of America: “U.S. consumers had around $675bn in excess savings from pandemic-era fiscal stimulus and spending distortions. These savings were running down at a rate of $70bn per month. Therefore at the current rate, excess savings will run out in 9-10 months.”

BofA cautions that these are all just estimates. Indeed, depending on who you ask, these estimates vary widely. A recent San Francisco Fed study estimated U.S. households still had about $500 billion in excess savings. Apollo Global’s Torsten Slok, by contrast, estimated households were sitting on closer to $1.2 trillion in excess savings. A Federal Reserve Board study recently estimated that excess savings were depleted as of Q1.

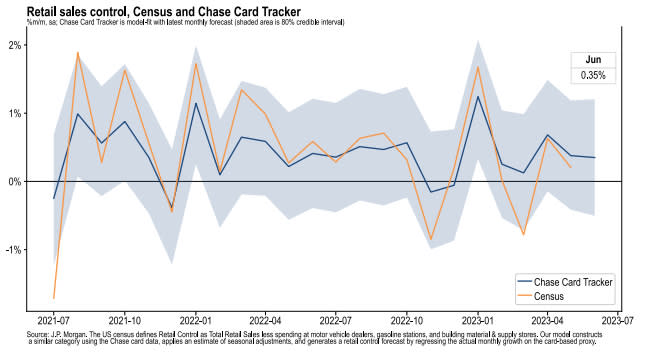

💳 Card spending growth is positive. From JPMorgan Chase: “As of 30 Jun 2023, our Chase Consumer Card spending data (unadjusted) was 1.3% above the same day last year. Based on the Chase Consumer Card data through 30 Jun 2023, our estimate of the US Census June control measure of retail sales m/m is 0.35%.”

🏭 Manufacturing surveys look bad. From S&P Global’s June U.S. Manufacturing PMI (via Notes): “The health of the US manufacturing sector took a sharp turn for the worse in June, adding to concerns over the economy potentially slipping into recession in the second half of the year.”

Similarly, the ISM’s June Manufacturing PMI (via Notes) signaled contraction in the sector for the eighth consecutive month.

These unfavorable survey results continue to come as hard broad measures of the economy continue to hold up.

HOWEVER, construction spending data from the Census Bureau suggests the state of manufacturing is much stronger than implied by the soft survey data.

Specifically, manufacturing construction spending (h/t Joseph Politano) grew to a new record high in May.

Also Orders for nondefense capital goods excluding aircraft — a.k.a. core capex or business investment — rose 0.7% to a record $74.1 billion in May.

👍 Services surveys look good. From S&P Global’s June U.S. Services PMI: “June saw encouraging resilience of the US services economy, which helped offset a renewed contraction of manufacturing output to ensure the overall pace of economic growth remained encouragingly solid. The surveys signal GDP growth of just under 2% for the second quarter as a whole, albeit with June seeing some loss of momentum.”

Similarly, the ISM’s June Services PMI signaled expansion in the sector for the sixth consecutive month.

📈 Near-term GDP growth estimates remain positive. The Atlanta Fed’s GDPNow model sees real GDP growth climbing at a 2.1% rate in Q2. While the model’s estimate is off its high, it’s nevertheless very positive and up from its initial estimate of 1.7% growth as of April 28.

Putting it all together 🤔

We continue to get evidence that we could see a bullish “Goldilocks” soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

The Federal Reserve recently adopted a less hawkish tone, acknowledging on February 1 that “for the first time that the disinflationary process has started.” On May 3, the Fed signaled that the end of interest rate hikes may be here. And at its June 14 policy meeting, it kept rates unchanged, ending a streak of 10 consecutive rate hikes.

In any case, inflation still has to come down more before the Fed is comfortable with price levels. So we should expect the central bank to keep monetary policy tight, which means we should be prepared for tight financial conditions (e.g. higher interest rates, tighter lending standards, and lower stock valuations) to linger.

All of this means monetary policy will be unfriendly to markets for the time being, and the risk the economy sinks into a recession will be relatively elevated.

At the same time, we also know that stocks are discounting mechanisms, meaning that prices will have bottomed before the Fed signals a major pivot in monetary policy.

Also, it’s important to remember that while recession risks are elevated, consumers are coming from a very strong financial position. Unemployed people are getting jobs. Those with jobs are getting raises. And many still have excess savings to tap into. Indeed, strong spending data confirms this financial resilience. So it’s too early to sound the alarm from a consumption perspective.

At this point, any downturn is unlikely to turn into economic calamity given that the financial health of consumers and businesses remains very strong.

And as always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have had a pretty rough couple of years, the long-run outlook for stocks remains positive.