What should we make of today’s market conditions? Investors have started digesting how the Federal Reserve’s ‘higher for longer’ interest rate policy will impact the economy, and they’re not pleased with the prospect. Other challenges on the horizon include an increasing probability of a government shutdown as Congress grapples with partisan disagreements over annual budget resolutions, declining consumer confidence as worries mount, and a sharp surge in oil prices on the commodity trading floors.

All of these factors should rekindle interest in strong defensive plays, particularly high-yield dividend stocks. These stocks offer both protection and passive income during these challenging times.

Wall Street analysts seem to concur, as they have identified high-yield dividend payers as attractive buys right now. Let’s delve into two of these picks: ‘Strong Buy’ stocks with at least 10% dividend yields and the potential for share appreciation of up to 40% in the coming year.

Wall Street analysts seem to concur, as they have identified high-yield dividend payers as attractive buys right now. Let’s delve into two of these picks: ‘Strong Buy’ stocks with at least a 10% dividend yield and the potential for share appreciation of up to 40% in the coming year.

OneMain Holdings (OMF)

First up is OneMain Holdings, a financial services company with a particular focus on providing consumer services to customers in the sub-prime banking loan segment.

The company offers this demographic a full range of financial services, including personal loans and insurance products, designed to make quality banking services available to a customer base that may not qualify for service from more traditional bank providers. OneMain takes great care on the front end, vetting its customers, and ensures its screening process keeps the default rate down. OneMain is best known for its online presence, but it also maintains an extensive network of physical branch offices totaling some 1,400 locations spread across 44 states.

OneMain’s asset portfolio is valued at $23.5 billion, of which $1.02 billion is cash and liquid assets. The company also has $1.25 billion in undrawn capacity from its unsecured corporate revolver, along with undrawn revolver conduit facilities totaling $6.2 billion. This gives the company substantial liquidity and allows it to carry outstanding debt balances of $19.5 billion. Of the debt balances, 55% are secured.

During the recently reported second quarter of the year, OneMain showed a total of $3.7 billion in personal loan obligations and a personal loan yield of 22.2%. Interest income, derived from the company’s total portfolio of assets, came to $1.1 billion.

On the revenue side, OneMain had a top line in Q2 of $1.06 billion, up 4% year-over-year and some $10 million ahead of estimates. The bottom line, which was reported as a non-GAAP EPS of $1.01, was 26 cents below expectations.

Despite the earnings miss, OneMain remained committed to its policy of generous capital returns. The company accomplishes this through both share buybacks and common share dividend payments. In the quarter, OneMain bought back 169,000 shares for a total of $7 million. Of more immediate interest to dividend investors, the company in July declared its Q2 dividend for $1 per share. This marked the third quarter in a row with a dividend at this level, and the annualized rate of $4 per common share gives a strong forward yield of 10.2%.

In his coverage of OneMain for Piper Sandler, 5-star analyst Kevin Barker explains why this company holds a solid position to survive a market turndown. In particular, he notes that the company’s write offs remain well below pre-pandemic levels, giving OneMain plenty of slack.

“The August securitization results were relatively in-line with our expectations (status quo), with net charge-offs (NCOs) and 30D+ delinquencies (DQs) seeing a slight re-acceleration in growth trends, but still remaining below pre-pandemic levels. As a result, we have slightly increased our NCO estimate and slightly lowered our EPS estimates. We still believe OMF is well positioned to weather any macro headwinds,” Barker opined.

At his own bottom line, Barker sees fit to set an Overweight (i.e. Buy) rating on OMF, along with a $57 price target, which implies a one-year potential upside of 44%. Add in the dividend, and the total return for the coming year will reach 54%. (To watch Barker’s track record, click here)

Overall, this non-traditional financial company has 8 recent analyst reviews, including 7 Buys and 1 Hold, to back up its Strong Buy consensus rating. Shares are priced at $39.24 and their $51.63 average price target suggests they will gain ~32% going forward. (See OMF stock forecast)

Kimbell Royalty Partners (KRP)

Next up is an energy firm, Kimbell Royalty Partners. This company is based in Texas but it focuses its operations in various ‘areas of interest’ across some of North America’s most productive hydrocarbon regions. Specifically, Kimbell buys mineral rights; it holds more than 17 million gross acres across 28 states. The company has a footprint in all of the major onshore oil and gas basins of the continental US, and owns 129,000 gross wells. Of these wells, 50,000 are in the Permian basin of Texas.

What Kimbell does is simple. The company owns lands, wells, and royalty rights – and allows third-party operators to conduct the extraction business. Kimbell receives royalties on the oil and gas produced, and uses those funds to buy additional holdings, generating increased royalties.

At the beginning of August, the company announced the largest such buy in its history, a $455 million accretive acquisition of royalty holdings in the Permian and Mid-Continental basins. This transaction, conducted in cash with a private seller, was closed on September 13. Kimbell funded the transaction partly through a $325 million private placement of cumulative convertible preferred units, and partly through credit under a $400 million revolving credit facility. In an important detail, Kimbell’s purchase included entitlement to all cash flow from production on the acquired holdings starting on June 1 of this year.

That buy was a big deal. Kimbell estimates that the acquired assets will produce 5,049 Boe/d in 2024 – and every barrel will generate royalties.

Even before this addition to its holdings, Kimbell was setting company records on quarterly production. In the 2Q23 report, Kimbell’s daily production reached 17,573 Boe/d. This supported revenues of $60.75 million, which, while down over 6% year-over-year, still beat the forecast by $6.44 million. The firm’s earnings came to 23 cents per diluted share, down from 55 cents in the prior year quarter but 9 cents per share ahead of the estimates.

The company paid out a solid dividend for Q2, of 39 cents per common share. This represented 75% of the firm’s cash available for distribution, a high proportion by any standard. The annualized dividend payment, at $1.56, gives a yield of 10% exactly.

Stifel analyst Derrick Whitfield is impressed by Kimbell, and especially so by the recent $455 million acquisition. Whitfield writes of that transaction in a special note, saying, “We are positive on the transaction as it adds significant scale in core basins with exposure to top operators and, based on our estimates, was done at an accretive transaction multiple…. the deal balances Kimbell’s commodity mix to around 50% liquids (33% oil). Net-net, Kimbell was able to add significant scale in a competitive mineral M&A environment at an accretive price while maintaining a strong balance sheet to continue to support attractive distributions.”

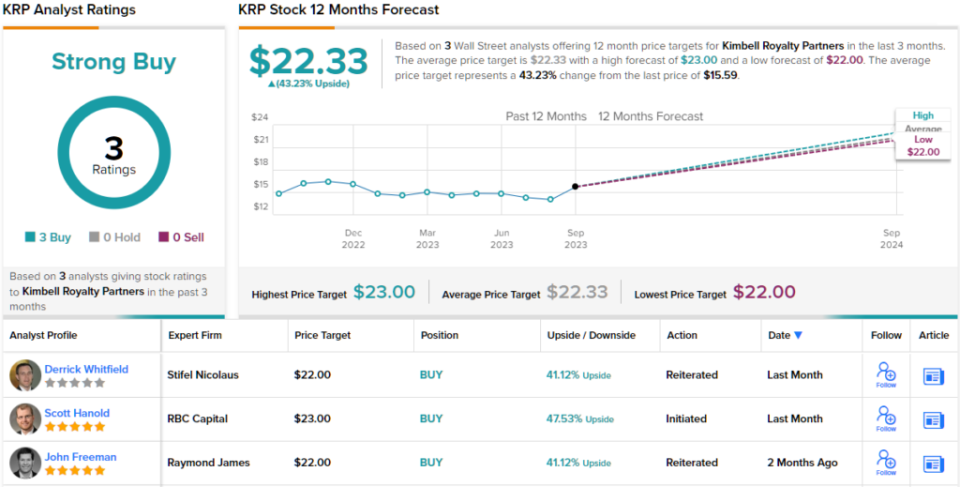

Whitfield goes on to rate KRP stock a Buy with a $22 price target that suggests ~41% upside for the next 12 months. (To watch Whitfield’s track record, click here)

Overall, Kimbell’s Strong Buy consensus rating is backed up by 3 positive analyst reviews. The shares have a $22.33 average price target, pointing toward a 43% one-year gain from the current share price of $15.59. (See KRP stock forecast)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.