Biotech stocks make for an interesting study. They represent a high-risk sector, characterized by famously high overhead and long lead times to develop new products. However, they also hold the potential for high rewards when new drugs open up markets with potential sales targets sometimes reaching billions of dollars. It’s not just the future sales potential that fuels the possibilities for rewards; a successful small-cap biotech company, with a newly approved drug, will frequently attract merger and acquisition interest from bigger names in the sector.

That’s the subject of a recent statistical study of biotech mergers conducted by Needham analyst Joseph Stringer. Stringer examined M&A activity in the biotech sector from 2018 through 2Q23 and uncovered data points that should garner investor attention. Firstly, M&A activity has increased in Q2 of this year and is above the historical average. Furthermore, among the 104 public company acquisitions that have occurred since 2018, a 73% involved companies that had reached at least Phase 3 of development. Within this category, 46% of the acquisitions featured companies with a drug already on the market, while 6% involved companies with a drug undergoing regulatory review. Additionally, 21% of the acquisitions were related to companies whose lead program was in Phase 3 development.

For investors, this presents a ‘target profile’ to look for in biotech stocks. Biotechs with either an approved drug on the market or a late-stage clinical program – or better yet, both – are the place to go for investor seeking to benefit from an acquisition.

Fortunately, Stringer didn’t just analyze the M&A activity; he has also been pointing out stocks that fit this profile. Using the TipRanks platform, we’ve pulled up the latest details on two of his picks, which have over 60% upside potential. Let’s take a closer look.

Rhythm Pharmaceuticals (RYTM)

The first name which could make for a strong acquisition candidate is Rhythm Pharmaceutical, a biotech firm working on treatments for rare genetic conditions, particularly hyperphagia and severe obesity caused by diseases of the melanocortin-4 receptor (MC4R) pathway. This is a brain pathway that regulates both hunger and weight, and is a root cause of several obesity conditions with genetic components.

Rhythm’s product line and research program are both based on its drug setmelanotide, an MC4R agonist designed to reduce hunger and obesity in pediatric and adult patients suffering from POMC, PCSK1 or LEPR deficiency or Bardet-Biedl syndrome (BBS). The drug is the subject of several ongoing and planned Phase 2 and 3 clinical trials, and has been approved by the FDA for the treatment of BBS. The approval, announced in June of last year, was based on positive Phase 3 study results, and the company has been working since then to both promote commercialization of the drug, branded as Imcivree, and to expand the indications through the clinical trial program.

In its financial and business update for 1Q23, Rhythm announced solid progress in the commercialization of Imcivree. The company notes that more than 175 doctors in the US have prescribed the drug since its approval, and that there have been more than 300 prescriptions written. Over 100 of those came in Q1 alone. As of the end of 1Q23, the company has received payor approval for over 160 written prescriptions.

Since the release of the Q1 report, Rhythm announced that Imcivree has been approved for use in Germany to treat BBS and was launched commercially in that country in April. This was followed by the May 8 announcement that Health Canada has also approved the drug. The Health Canada approval was for Imcivree as an injection, used to treat Bardet-Biedl syndrome (BBS) or genetically-confirmed biallelic pro-opiomelanocortin (POMC), proprotein convertase subtilisin/kexin type 1 (PCSK1), or leptin receptor (LEPR) deficiency.

Also in June of this year, Rhythm announced positive clinical results from the long-term extension of the Phase 2 study of Imcivree in the treatment of hypothalamic obesity. The results were released at ENDO 2023, the Endocrine Society Annual Meeting & Expo, held in Chicago.

Due to Rhythm’s progress in commercialization, as well as its continued success in clinical trials and regulatory approvals, RYTM emerges as a potential candidate for acquisition, according to Needham’s Stringer.

“We think the early launch metrics are solid, and the +100 TRx add in 1Q23 was the highest quarterly add to date. While some bears may point to the relatively soft q/q sales growth, we think it’s important to focus on the underlying launch metrics, which we think continue to be solid (steady q/q TRx adds, rate of secured reimbursements going up, low drug discontinuations). We believe the launch will gain momentum in 2023,”Stringer opined.

Turning to the clinical side, Stringer went on to say, “Imcivree continues to show good durability of effect in the OLE… We think the data presented at ENDO generally tracks very well with the previous Ph2 HO data and suggests to us that Imcivree is showing a progressive and sustained improvement in BMI (Ph3 registrational endpoint) and other important measures related to obesity.”

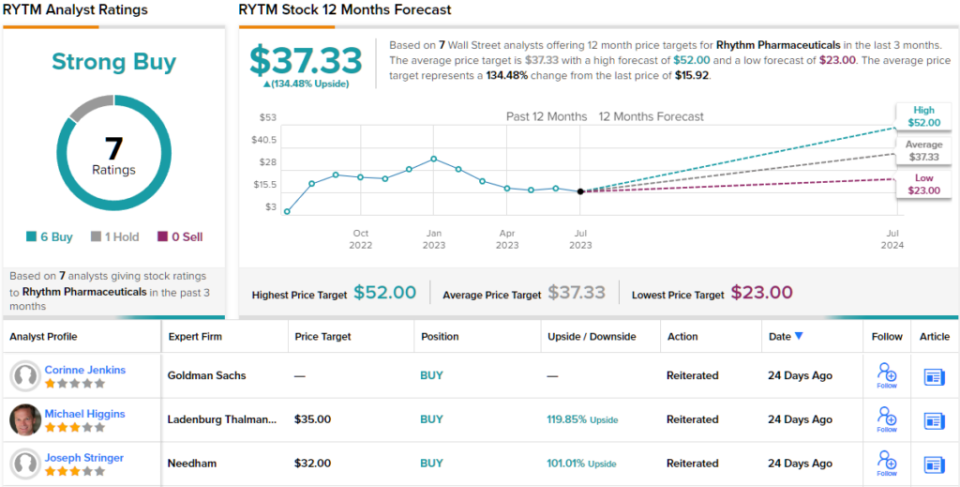

In Stringer’s view, this justifies a Buy rating on the stock, and his $32 price target implies a robust one-year upside potential of 101%. (To watch Stringer’s track record, click here)

Overall, the 7 recent analyst reviews on file for this stock include 6 Buys against a single Hold, for a Strong Buy consensus rating. The shares are trading for $15.92 and their $37.33 average price target suggests a gain of 134%, even more bullish than Stringer’s stance, for the next 12 months. (See RYTM stock forecast)

Phathom Pharmaceuticals (PHAT)

The next acquisition candidate is Phathom, a commercial and clinical stage biopharmaceutical company working on new treatments for patients with acid-related gastrointestinal diseases. Phathom has the exclusive rights of vonoprazan, a potassium-competitive acid blocker (PCAB) that has shown promise in the treatment of several gastrointestinal disorders. Phathom’s license includes development and commercialization rights in the US, Europe, and Canada.

The company’s clinical program is focused on the treatment of H. pylori infection, a viral disease that is connected to stomach and intestinal ulcers, as well as erosive gastrointestinal reflux disease (GERD) and non-erosive GERD. Phathom is currently conducting Phase 3 clinical studies in non-erosive GERD.

The FDA granted approval of vonoprazan, branded as Voquenza, in May of last year, for use in the treatment of H. pylori in adults. The drug was approved in two treatment regimens, the triple pack, which includes vonoprazan, amoxicillin and clarithromycin, and the dual pack, which includes just vonoprazan and amoxicillin. The two approved modes were planned to launch commercially in the US in the third quarter of 2022, but a CRL from the FDA, requesting additional stability data, delayed that.

However, in June of this year, the FDA accepted the company’s resubmission of the New Drug Application (NDA), and the PDUFA date has been set for November of this year. Assuming a positive regulatory outcome, the company is now aiming to launch the drug in the fourth quarter of 2023, targeting both the erosive GERD and H. pylori indications.

Checking in again with Stringer, we find the analyst upbeat about Phathom, writing, “With the positive regulatory update in late May 2023 and the NDA resubmission acceptance announcement, we have confidence the stability data will continue to track well, and think the 6-month data outlook is very favorable. We have a high level of conviction in vonoprazan EE FDA approval by the Nov 2023 PDUFA date… We believe vonoprazan has the potential to be a best-in-class acid blocker and generate ~$675M US peak sales in Erosive Esophagitis.”

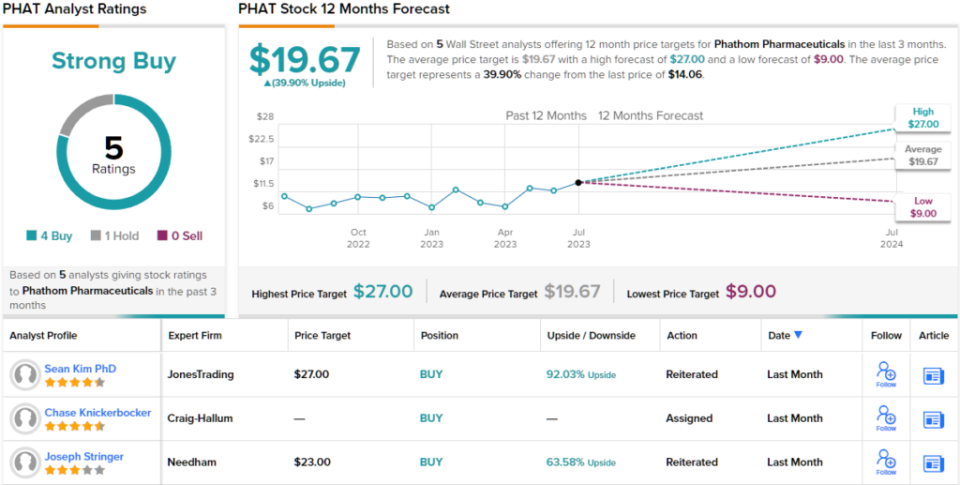

Stringer goes on to rate PHAT as a Buy, with a $23 price target that indicates room for a 64% upside in the course of the next year. (To watch Stringer’s track record, click here)

Overall, Phathom gets a Strong Buy consensus rating based on 4 recent Buys and 1 Hold from Wall Street’s analysts. The shares are priced at $14.56 and the $19.67 average price target suggests they will gain ~40% on the one-year horizon. (See PHAT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.