Energy stocks ended the week on a positive note, with the energy sector ETF, the XLE, closing out Friday’s trading up by over 2%, its largest one-day uptick in a month. In recent times there have been uncertainties regarding global demand, but there may be reason to believe that the oil market is starting to show signs of tightening.

Shares of energy firms pushed higher in the session, but the question is, which stocks are set for further gains? A dive into the data will help us sort out the most likely winners in this sector – and that brings us to the Smart Score.

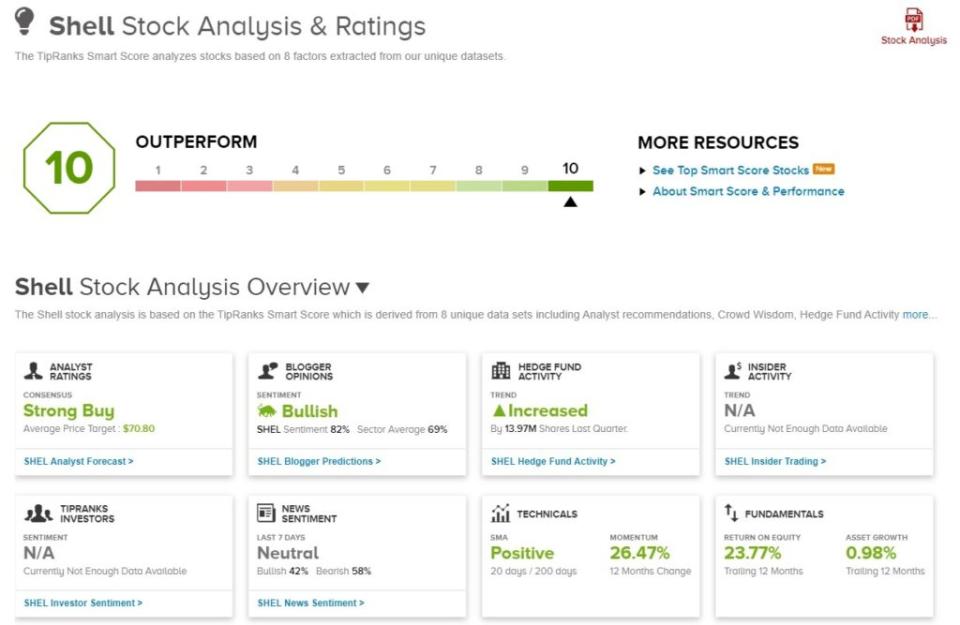

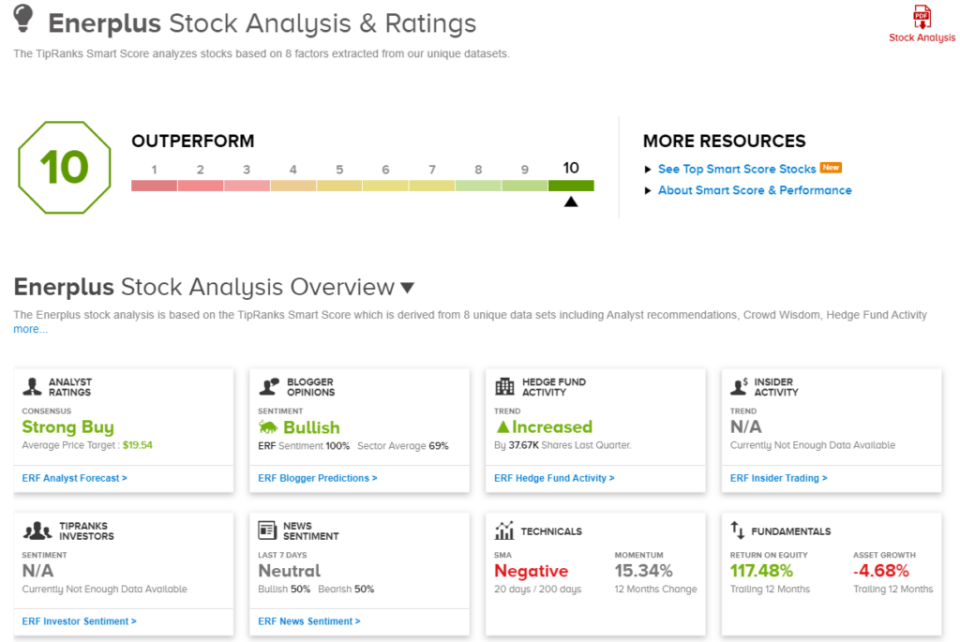

The Smart Score uses sophisticated AI data algorithms to measure every publicly traded stock according a set of factors known to contribute to forward outperformance, and then it collates those measurements and gives each stock a single-digit score, on a scale of 1 to 10, indicating the shares’ likely path for the near-term. It sounds like a mouthful, but what it comes down to is simple: a stock that ticks all the boxes with a ‘Perfect 10’ on the Smart Score deserves a closer look.

So we’ve taken a closer look at two energy stocks that have earned that ‘Perfect 10.’ Here are their details, along with comments from the Street’s analysts.

Shell (SHEL)

We’ll get started with a giant of the energy industry, Shell Oil. This British-based oil and gas production company is one of the world’s largest, when counted by total revenue or by assets – Shell finished last year with $443 billion in total assets, and more than $380 billion annual revenues. The company has particularly strong positions in the liquified natural gas sector, the deep water exploration and extraction business, and the shale oil and gas extraction segment. The first of these is a major business, especially in the global trade for natural gas; the latter two are important operations in the extraction of fossil fuel energy from less-accessible sources and formations.

Shell’s overall business is divided into four segments, upstream, integrated gas, renewables & energy solutions, and downstream. On the B2C end, Shell provides direct energy delivery, including fuels, to more than 32 million customers. In addition, the company has a projects & technology division working on innovative new projects in energy technology, as well as improvements in the technical capabilities that underpin the company’s operations.

For the last reported quarter, 1Q23, Shell saw a top line of $86.96 billion. While down from $101.3 billion in the previous quarter, the Q1 top line was up 3.27% year-over-year. The company’s bottom-line adjusted earnings came to $9.65 billion, or an adjusted non-GAAP EPS of $1.39. The EPS figure was flat quarter-over-quarter, and was up 19 cents year-over-year.

While Shell’s cash generation was down year-over-year, the company still generated strong cash results in Q1. The cash flow from operations was reported at $14.16 billion, for a 4.4% y/y decline, while the free cash flow was listed as $9.9 billion, down 6% from the prior year. The company’s cash flow supported the dividend payment, of 57.5 cents per American depositary share. This offers a 3.67% yield.

Shell’s ‘Perfect 10’ from the Smart Score is based on positive metrics almost all across the board. Of particular note, we’ll point out the blogger sentiment, which is 82% positive, the crowd wisdom, which is positive and based on a 2.2% increase in private holdings over the past 30 days, some sound technical and fundamental factors: a 26% 12-months-change momentum, and a 23% trailing-12-month return on equity.

Covering this stock for Goldman, analyst Michele Della Vigna lays out the reasons for his bullish stance on this energy giant. He writes, “Ongoing capital discipline has aided the repositioning of Shell’s upstream portfolio higher on the profitability cost curve. We expect this positive trend to continue, driven by material upside to operational performance in both deepwater (Brazil and GoM) and LNG asset uptime. Leveraging our Top Projects analysis, strong pipeline of oil & gas projects can help sustain high cash flows for a number of European Big Oils, with Shell screening among one of the best on production and cash flow uplift over the next four years.”

Looking forward, Della Vigna rates SHEL stock as a Buy, with a price target of $83 per American depositary share suggesting a 39% one-year upside potential. (To watch Della Vigna’s track record, click here.)

The 10 recent analyst reviews on SHEL, with a 9 to 1 breakdown favoring Buy over Hold and a Strong Buy consensus rating, show that the Street is bullish here. The stock’s average price target of $71.18 implies a 19% one-year gain from the current trading price of $59.65. (See Shell’s stock forecast.)

Enerplus (ERF)

Enerplus, the second stock we’re looking at, started out as Canada’s first oil and gas royalty trust, and today holds a strong position as an independent exploration and production company operating in the Bakken-Three Forks light oil shale play of North Dakota. This formation has, in the last 15 years, become one of the richest production regions in North America, and has powered strong economic growth in both North and South Dakota.

The company holds approximately 235,600 net acres in the North Dakota reaches of the Bakken, making this the largest of the company’s holdings. In addition, Enerplus has 32,500 net acres in the Marcellus shale, the major Appalachian dry gas production region of Pennsylvania. Last year, Enerplus saw 65,370 barrels of oil equivalent daily production from the Bakken position, and 169 MMcf per day of dry gas production from the Marcellus. Total 2022 production came to 100,326 barrels of oil equivalent per day, of which 39% was natural gas and 61% was crude oil and natural gas liquids.

Production on that scale will generate solid financial results, and Enerplus saw revenues of $441 million in the first quarter of this year. This was up from $306 million in 1Q22, for a 44% y/y increase. At the bottom line, Enerplus had a net income of $137.5 million for Q1, or 63 cents per share. This was a strong improvement from the year-ago quarter’s 14-cent EPS figure. In addition, 1Q23’s EPS came in 2 cents ahead of the forecasts.

Enerplus also has taken a leading position in the ESG field. This is essentially a measure of ‘good corporate citizenship,’ and Enerplus has initiatives to promote health and safety at work, along with good environmental stewardship. The company has developed a Social and Governance Policy to ensure these initiatives while maintaining regulatory compliance and stakeholder profits.

On that ‘Perfect 10’ Smart Score, ERF shares benefit from solidly bullish – 100% positive – sentiment from the financial bloggers. In addition, the stock’s trailing 12-month return on equity was over 117%, and the hedges tracked by TipRanks increased their holdings in ERF by 37,700 shares last quarter.

In the eyes of Mike Murphy, 5-star analyst from BMO, Enerplus has plenty to offer investors. Murphy is particularly impressed by the company’s capital returns, as well as its potential to expand its position in the Bakken. Murphy writes, “We continue to view Enerplus as well positioned to deliver on its return of capital initiatives, with Bakken-focused M&A optionality in the near to medium term… We view Enerplus as an outperformer relative to the rest of the Canadian E&P names from an ESG perspective. The company ranks favorably from an emissions intensity perspective and in diversity metrics.”

Murphy complements his comments with an Outperform (Buy) rating, and a $19 price target that implies a potential gain of 29% on the one-year time horizon. (To watch Murphy’s track record, click here.)

There are 5 recent analyst reviews of Enerplus shares, including 4 to Buy and 1 to Hold – giving the stock a Strong Buy consensus rating. The shares are selling for $14.72, and their $19.54 average price target is somewhat more bullish than Murphy’s, suggesting a 33% one-year upside. (See Enerplus’s stock forecast.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.