Wilt Chamberlain holds the NBA record for career rebounds, with 23,924 in total, or 22.9 per game, for a truly great sustained performance. But rebounds don’t only come in basketball, and a savvy investor, while not likely to pick up 23,924 rebounding stock transactions, can still find plenty of stocks that are primed for rebounds in the current market environment.

That environment, with headwinds still in play making every shot more difficult, has left plenty of fundamentally sound stocks undervalued, down from their peaks, sometimes by 50% or more. According to Wall Street’s analysts, these are the opportunities that investors should be looking for

We’ve made a start on it, using the TipRanks platform to locate three stocks with beaten-down prices but solid prospects for the future. According to the data, each of these has fallen more than 50% in recent months, but each also has a ‘Strong Buy’ consensus rating from the analysts and boasts plenty of upside potential. In fact, certain Street analysts see all three posting triple-digit gains over the coming year. Here are the details.

Sunrun, Inc. (RUN)

Let’s start with Sunrun, a company in the residential solar power niche that offers customers a range of options for home-based solar power installations. These are package deals, custom made for each customer’s home, and include everything needed to make a perfect fit to the customer’s particular location and power needs. Sunrun can handle everything involved in the installation, from setting up the rooftop photovoltaic panels to installing power storage batteries and smart control systems, to connecting the solar installation to the local power grid.

In addition to offering a full-service solar installation, Sunrun also offers several financing options. Customers can choose from paying the full cost up front, to own the system completely, or can amortize it as a lease, on a long-term or a monthly basis. The company can also provide loans to make the installations affordable. The company’s combination of complete residential installations and flexible financing have attracted some 700,000 customers, spread across 22 states, plus DC and Puerto Rico.

In the recently reported 1Q23 print, Sunrun showed several important growth metrics. The company reported 240 total installed megawatts for the quarter, beating the high end of its previously published guidance, and an overall 30% increase year-over-year in sales activities. In California alone, the company reported 80% y/y growth.

Getting to the firm’s financial results, we find that Sunrun had a mixed quarter. The top line was up, with the $589.85 million in reported revenue growing 19% y/y and beating the forecast by over $72 million. At the bottom line, however, the company’s EPS of -$1.12 missed expectations by $0.97. Sunrun reported $1.1 billion annual recurring revenue, and an average contract life of 17.6 years, both metrics that bode well going forward.

Overall, it’s important to note that Sunrun stock has experienced a significant decline of 57% from its peak in September.

Nevertheless, following the Q1 print, Evercore ISI analyst James West sees the stock as primed to claim back those losses and lays out the bull-case. He writes, “RUN continues to experience strong momentum across all of its sales channels and is expanding its customer value proposition. The company grew solar energy capacity installed by 12% YoY and reiterated its guidance for at least another 10-15% growth in 2023. This would equate to adding over 1 GW of capacity this year, the equivalent of an average nuclear power plant which takes decades to build.

“In addition,” West went on to say, “there is likely upside to this forecast driven by when the Treasury provides further guidance on the ITC (investment tax credit) adders which are only available with the subscription model, increasing battery attach rates and its new Shift offering, working through its elevated pipeline from strong CA customer growth in the first quarter ahead of the net metering changes, and potential market share gains as the mix continues to shift to its subscription model.”

To this end, West gives RUN shares an Outperform (i.e. Buy) rating, with a $60 price target to suggest a powerful one-year upside of ~261%. (To watch West’s tack record, click here)

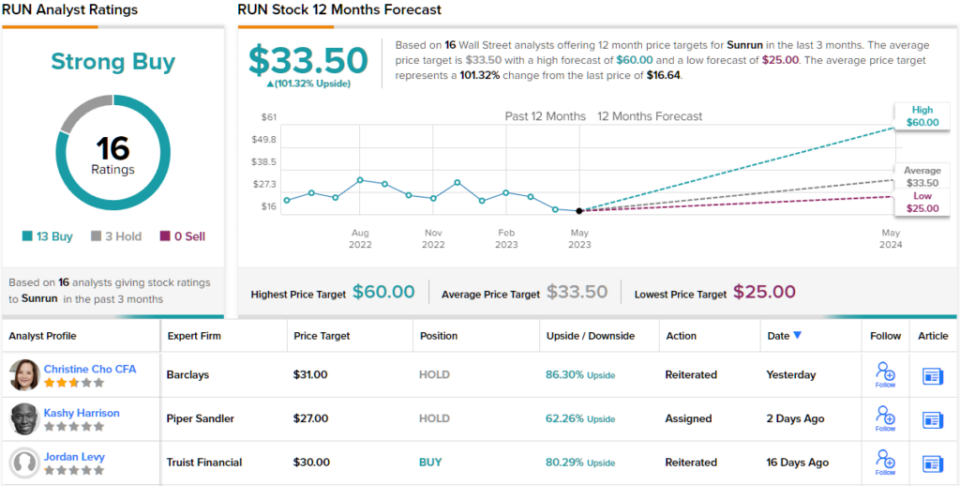

Overall, the Street’s outlook on Sunrun is a Strong Buy, supported by 15 recent analyst reviews that include 12 Buys and 3 Holds. The shares are currently trading for $16.64 and have an average price target of $33.50, indicating room for ~101% growth in the next 12 months. (See Sunrun stock forecast)

OptimizeRx Corporation (OPRX)

Next up is OptimizeRx, a company that brings digital tech to the field of healthcare. The firm provides a platform to connect the main points of the healthcare industry – providers, patients, and facilities – to create a seamless network of mutually accessible information and ready answers. The end result is a healthcare process that delivers more precise and more efficient care, directly to the patient.

OptimizeRx’s platform offers different features for patients and providers, based on what’s needed. For patients, the solutions center on communications with physicians and other providers, supporting patient engagement with treatment, and maintaining compliance with privacy regulations. For providers, the platform includes patient communications, but focuses on streamlining patient record keeping, maintaining contact with test labs, hospitals, and specialists, tracking and monitoring prescriptions, and coordinating discharge services.

Overall, this company has made good penetration into the US healthcare field. Its network is connected to more than 300 electronic health record systems, and the company can reach more than 60% of ambulatory prescribers. OptimizeRx has reported some real successes, including an 86% physician engagement with the system’s messaging, and a 12% increase in therapy days for patients dealing with chronic conditions.

The firm’s Q4 financials are typically the year’s best, so a dropoff in Q1 was expected – but still, the recently released Q1 results were decidedly mixed. In 1Q23, the top line revenue of $13 million was down 5.3% y/y but beat the forecast by almost $648,000. At the bottom line, the adj. EPS loss of 9 cents was deeper than the 8 cents expected, and compared poorly to the year-ago period’s 1-cent EPS loss.

Shares dropped following the quarterly readout, and in total, they are down 51% in the last 12 months.

Despite the mixed financials and the lower share price, this stock remains fundamentally attractive in the eyes of Roth MKM analyst Richard Baldry. He writes: “1Q22 results were fair, with a modest yr/yr revenue decline as seen in 2H22, but with reiterated guidance implying a near-term (we model 2Q23) return to positive growth and 10%+ revenue growth overall for 2023. Importantly, 1Q23 revenues narrowly beat our forecast and hit the high-end of guidance to signal greater management visibility into underlying demand. With shares already far below their 2021 highs, we believe the risk/reward outlook has turned meaningfully positive.”

Baldry uses this stance to back up his Buy rating, and his $31 price target implies a robust 156% upside on the one-year horizon. (To watch Baldry’s track record, click here)

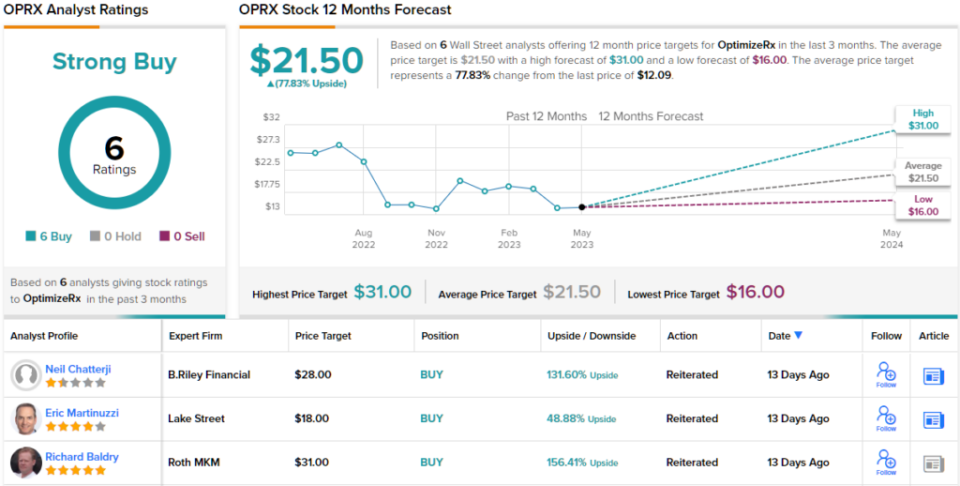

The Street is clearly in the bulls’ corner on this one, as the Strong Buy consensus rating, based on 6 positive analyst reviews, is unanimous. Shares are trading for $12.09, and the $21.50 average price target suggests a 78% increase from that level in the year ahead. (See OPRX stock forecast)

Largo Resources (LGO)

Last on our beaten-down list is Largo Resources, a leader in the move towards lowering carbon emissions and energy use in the sector. Specifically, Largo is a world leader in the production of vanadium batteries and sources its vanadium metal from the Maracas Menchen mine, which it owns. Located in Brazil, the mine contains high-grade vanadium deposits necessary for the production of vanadium batteries. These batteries offer a lifespan of 25+ years and provide a safe and efficient recycling process at the end of their life. Largo’s batteries are finding applications for long-term energy storage in the US energy industry.

Vanadium is considered a rare earth metal, and Largo’s mine is one of the world’s major sources. The company produces two main vanadium products from the mine. The first is VPURE+ Flakes, high-grade vanadium flakes with a purity level of 99% or higher, used in master alloy production. These flakes increase the strength-to-weight ratios of titanium alloys used in the aerospace industry. The second chief product from the mine is VPURE+ vanadium pentoxide powder. This product, also with a purity level of 99%, is used in catalyst and battery applications. Largo is working on improving its mine operations through infill drilling at its Campbell Pit project.

In addition to its vanadium operations, Largo is in the process of commissioning a major ilmenite concentration plant, planned for opening this year. Ilmenite is a titanium-iron oxide mineral with various uses, including the production of paints, inks, fabrics, plastics, paper, and even sunscreen and cosmetics. The company plans to complement its vanadium business with ilmenite production.

Regarding financial results, Largo reported revenues of $57.4 million in Q1 of this year, representing a 35% year-on-year increase and surpassing analyst forecasts by $3.27 million. The increase in revenue was attributed to higher vanadium prices in the global market. However, the bottom line showed a net loss, with an EPS figure of -$0.02. While this was an improvement compared to the loss of 3 cents in the year-ago quarter, it fell 4 cents below expectations. The company reported solid vanadium production during Q1, extracting a total of 341,967 metric tons of ore from the ground, which marked a significant increase from the 303,652 metric tons produced in the same period last year.

In those last 12 months, however, Largo’s shares are down 56%.

That hasn’t bothered H.C. Wainwright analyst Heiko Ihle, who says of Largo: “We remain optimistic about Largo’s vanadium operations as market fundamentals continue to outline considerable long-term demand growth even though spot pricing has been quite lackluster as of late.”

Putting some numbers where his mouth is, Ihle gives LGO shares a $12 price target, suggesting ~208% upside in the next 12 months, and supporting his Buy rating. (To watch Ihle’s track record, click here)

Overall, this stock has picked up 4 analyst reviews recently, and they favor Buys over Holds by a 3 to 1 margin – for a Strong Buy consensus rating. The stock is selling for $3.90, and its $8.80 average price target suggests it has room to grow ~126% in the year ahead. (See LGO stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.