At the end of June, the Biden Administration unveiled an ambitious goal to ensure reliable broadband internet access for the entire US, even the most remote rural areas. The project will involve a federal outlay of $42 billion, allocated to the states over the next two years. The President touts the initiative as a move to close the ‘digital gap’ that separates the haves and have-nots in the world of high-speed connectivity.

“It’s the biggest investment in high-speed internet ever, because for today’s economy to work for everyone, internet access is just as important as electricity, water, or other basic services,” Biden said.

For retail investors, the prospect of additional federal money flooding the broadband internet ecosystem will open up opportunities. Broadband internet providers will benefit long-term, as they’ll be the ones building out networks, adding capacity, and enrolling new customers.

So, let’s look at two stocks that are set to reap the rewards of the Administration’s largesse. These are well-known names in the world of broadband service, and according to TipRanks’ database, both hold Buy ratings from the Street’s analyst consensus.

Charter Communications (CHTR)

We’ll start with Charter Communications, a firm that bills itself as a ‘connectivity company.’ Charter provides advanced Wi-Fi, fast internet, and unlimited mobile services to more than 30 million residential and small-to-medium business customers. It also supports services for around 6.6 million mobile phone lines. Charter’s services are branded under Spectrum, and the company launched Spectrum One as its flagship bundled package product this past October.

Charter generated approximately $54 billion in annual revenue last year, based on its 32 million customer relationships. The company has nearly 500 million IP devices connected to its network, which spans across 41 states. In total, there are over 30 Spectrum networks delivering a wide range of content, including local news and sports.

All of this adds up to significant business, and for the last two years, Charter has consistently delivered over $13 billion in quarterly revenue. In the most recent reported quarter, 2Q23, the company’s top line reached $13.66 billion, a modest half-percent increase year-over-year – but it fell short of the forecast by over $180 million.

The revenue miss wasn’t the sole disappointment in the Q2 report; Charter’s EPS also fell short. The company reported earnings of $8.05 per share, a solid total, but 5 cents lower than expectations.

Benchmark analyst Matthew Harrigan is impressed by Charter’s overall position and its ability to deliver returns. He writes, “We continue to believe that Charter offers a compelling range of customer services, especially the Spectrum One Internet + Mobile proposition. We believe it can navigate the currently competitive broadband environment. The 2Q23 results were largely satisfactory, and management maintains its goal of surpassing 2023 broadband additions compared to last year, benefiting from its growing rural footprint in the intermediate term.”

“We view Charter’s 3-year network upgrade initiative as ROI accretive with attractive price value propositions for broadband + mobile, especially Spectrum One, and even video resonate with customers. A ~400K annual broadband unit add estimate after 2023 seems tenable. inclusive of RDOF build activity and BEAD (Broadband Equity, Access and Deployment) program benefits,” the analyst added.

To this end, Harrigan puts a Buy rating on Charter’s stock – and his $575 price target implies a potential one-year upside of 37%. (To watch Harrigan’s track record, click here)

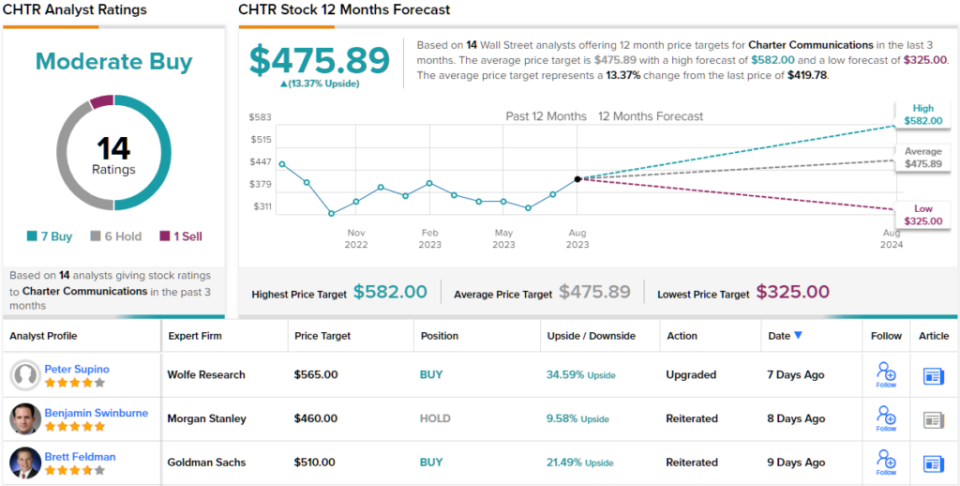

Zooming out to the macro view, Charter shows a Moderate Buy consensus rating based on 14 analyst reviews, including 7 Buys, 6 Holds, and 1 Sell. The shares are currently trading at $419.78 and their average price target of $475.89 suggests a 13% gain in the year ahead. (See CHTR stock forecast)

AT&T (T)

With a market capitalization of over $100 billion and 2022 revenues exceeding $120 billion, AT&T is one of the world’s largest telecom firms and the single largest provider of mobile phone services in the US market. The company can trace its roots back to the days of the first telegraph networks and was an early adopter of voice telephone technology (its name even stands for American Telephone and Telegraph).

Based in Texas, the company operates across the spectrum of modern telecommunications, providing local and long-distance landline telephone services, cellular mobile services, digital and wireless network communications, and is deeply involved in the rollout of the new 5G networks. AT&T has long been known for its expansive fiber optic cable network, offering customers a variety of internet packages.

In its recent 2Q23 earnings report, the company’s top-line revenues slightly missed the forecast by $30 million, coming in at $29.92 billion, reflecting a year-over-year gain of just under 1%. Drilling down, however, reveals that AT&T’s quarterly operating income of $6.4 billion was up 29% year-over-year, and the non-GAAP EPS of 63 cents per share exceeded estimates by 3 cents. The company’s standout performance was in its ability to generate cash flows. Cash from operating activities grew by 28% year over year, reaching $9.9 billion, while the free cash flow figure increased to $4.2 billion. AT&T is projecting a full-year 2023 free cash flow of at least $16 billion.

Thanks to its deep pockets, AT&T can comfortably cover its dividend, which is one of the most reliable in the market. The latest declaration, at 27.75 cents per common share, results in an annualized payment of $1.11 – offering a solid yield of 7.8%. The company has been consistently paying dividends, without missing a quarter, since 1984.

In mid-July, AT&T shares took a hit when the ‘lead-lined cable’ controversy rocked the industry. Legacy telephone cables, insulated with lead sheaths, were found to be much more widespread than previously thought, with lead posing a significant environmental concern. While AT&T had substantial exposure due to its network of phone lines, the company’s size and resources allow it to absorb such impacts – and more importantly, to replace the affected lines.

Among the bulls is Raymond James analyst Frank Louthan who holds an optimistic perspective on AT&T’s strong industry position – and its ability to generate an attractive cash flow.

“We continue to see AT&T as undervalued with upside potential as we see the wireless growth and FCF ramp as bringing investors back to the name. We remain confident in our assessment that the lead-sheathed lines in the network are largely a non-issue in the near-to-medium term and the remediation cost is low as well, and we see AT&T as our best large cap total return story over the next 12 months. Management upheld guidance and the simplified story is continuing to drive solid results, and we believe the Street should recognize this over the next few quarters, particularly as the additional $2B in cost savings begins to materialize,” Louthan opined.

Louthan backs up his stance with a Strong Buy rating, while his $25 price target shows his belief in a 76% upside for the stock in the next 12 months. Based on the current dividend yield and the expected price appreciation, the stock has ~84% potential total return profile. (To watch Louthan’s track record, click here)

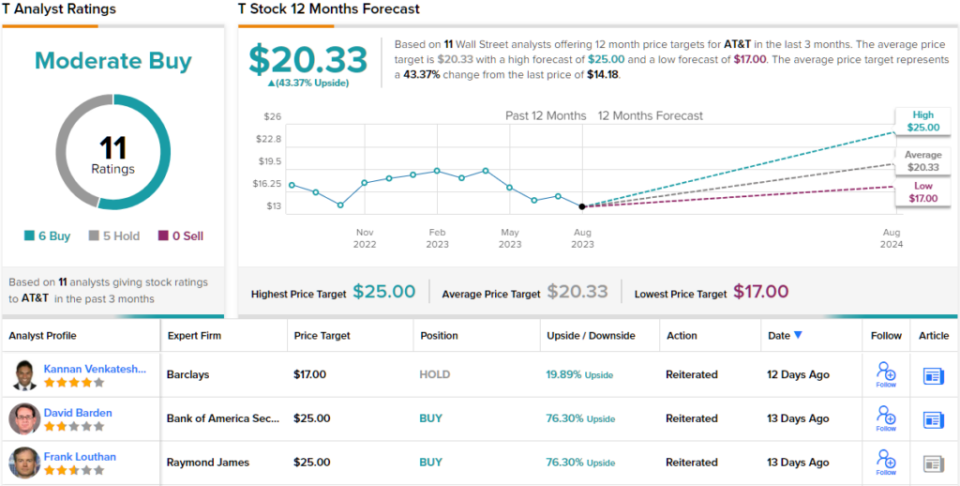

Turning now to the rest of the Street, opinions are split almost evenly. 6 Buys and 5 Holds add up to a Moderate Buy consensus rating. At $20.33, the average price target brings the upside potential to ~43%.(See AT&T’s stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.