July 31 (Reuters) – U.S. banks reported tighter credit standards and weaker loan demand from both businesses and consumers during the second quarter, Federal Reserve survey data released on Monday showed, evidence that the central bank’s interest-rate hike campaign is slowing the nation’s financial gears as intended.

The Fed’s quarterly Senior Loan Officer Opinion Survey, or SLOOS, also showed that banks expect to further tighten standards over the rest of 2023.

“The most cited reasons for expecting to tighten lending standards were a less favorable or more uncertain economic outlook, an expected deterioration in collateral values, and an expected deterioration in credit quality of CRE (commercial real estate) and other loans,” the Fed said.

The Fed has raised interest rates by 5.25 percentage points since March 2022, and its surveys and hard data have shown banks have been slowing their lending in response.

Monday’s SLOOS report – which Fed policymakers had in hand last week when they decided to deliver an 11th interest-rate hike after skipping one at their June meeting – suggests credit tightening is ongoing.

“You’ve got lending conditions tight and getting a little tighter, you’ve got weak demand, and … it gives a picture of a pretty tight credit conditions in the economy,” Fed Chair Jerome Powell said last week when asked about the survey results.

But it does not point to a rush to tighten of the kind that some Fed policymakers had worried would occur after the banking turmoil in March and that might have made them skittish about further policy tightening ahead.

Still, it could threaten the Fed’s “soft-landing” scenario.

“The degree of tightening in recent quarters looks pretty significant by broad historic standards,” wrote JPMorgan economist Daniel Silver, noting that in the past such tightening has generally been associated with recessions. The data “are not a guarantee of a recession to come, but the tightening evident as of late suggests that the economy should slow.”

TIGHTER TERMS

The survey showed a net 50.8% of banks tightened terms of credit last quarter for commercial and industrial (C&I) loans to medium and large businesses, up from 46% in the prior survey. For small firms, a net 49.2% of banks said credit terms were stiffer, versus 46.7% in the last survey.

Both measures fell short of the 70%-plus levels reached at the height of the pandemic in 2020; excluding that period, they were the largest increases since the Fed’s first-quarter report in 2009, during the Great Financial Crisis.

Demand for C&I loans remained weak, though not to the degree reported in the previous survey covering the first three months of the year when banks said business demand for credit was the softest since 2009. In the latest survey, conducted in the last two weeks of June, the net share of banks reporting stronger demand from large and medium firms was -51.6%, compared with -55.6% in the prior period and from small firms was -47.5%, up from -53.3%.

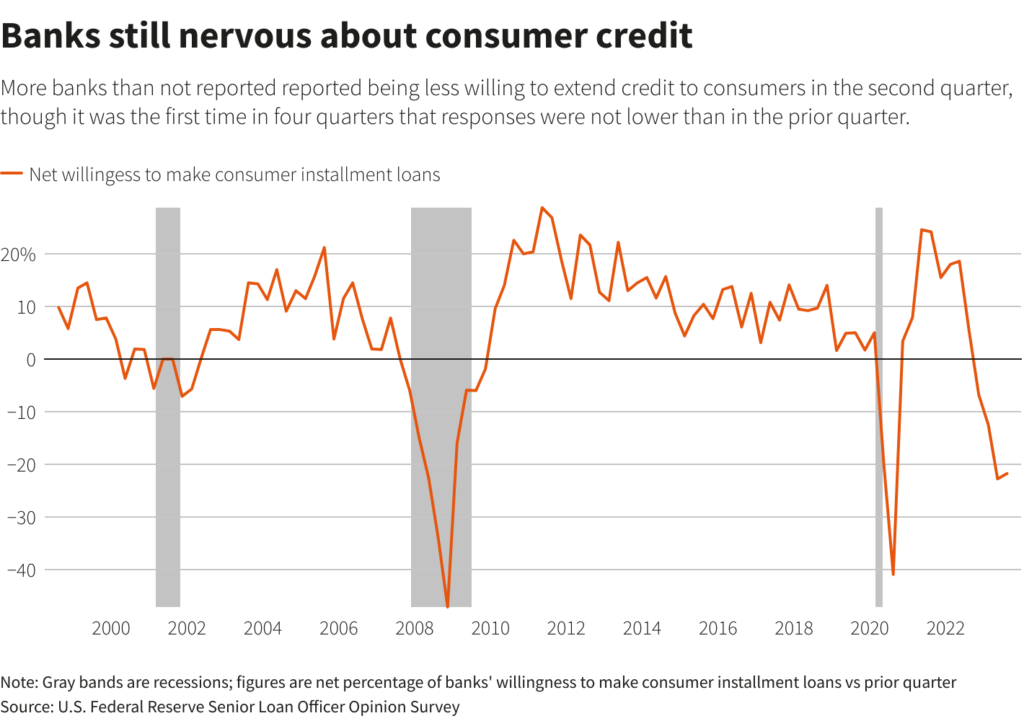

On the consumer slate, credit terms continued tightening and demand slackening, though in some categories conditions were somewhat improved from the first quarter.

For instance, the net percentage of banks reporting greater willingness to make consumer installment loans was -21.8% versus the first quarter’s -22.8%, which had been the lowest outside of the pandemic since 2008. Smaller net shares of banks reported tightening standards for auto loans, though terms for credit cards did tighten somewhat.

While still weak, demand for auto loans was the least soft in four quarters, while demand for credit card loans was essentially flat after two straight negative quarters.

Reporting by Ann Saphir, Editing by Nick Zieminski , Dan Burns and Cynthia Osterman

: .