(Bloomberg) — The latest marker of underlying US price pressures will offer little hope of settling the debate among Federal Reserve officials about whether they’ve made enough progress on inflation to step off the monetary-policy brakes.

Most Read from Bloomberg

The Fed’s preferred price metrics on Friday are projected to show inflation remained elevated in April, running more than double the central bank’s goal. Minutes of its early-May meeting on Wednesday may help shed some light on officials’ appetite for standing pat next month.

Various Fed officials this week have indicated they’re keeping an open mind as they assess economic data as well as stress in the banking sector. Lorie Logan, head of the Dallas Fed, said she’s not yet convinced that officials should skip a rate hike next month, while Governor Philip Jefferson said patience is in order.

Read More: Powell Steers Policy Debate With Clear Signal on June Rate Pause

The core personal consumption expenditures price index, which excludes often volatile food and energy components, is seen climbing 4.6% from a year ago, matching the prior month’s annual advance. On a monthly basis, the core measure is projected to rise 0.3% for a second month.

The personal income and spending report is also forecast to show inflation-adjusted consumer outlays remained tepid at the start of the second quarter. That helps explain why economists expect the US economy to cool further after expanding at a 1.1% pace in the first quarter.

What Bloomberg Economics Says:

“The Fed’s preferred inflation measure will show little to no progress on inflation over the past month, and the final May reading of the University of Michigan’s long-term inflation expectations will confirm whether the elevated preliminary reading was a fluke or not.”

—Anna Wong, Stuart Paul, Eliza Winger and Jonathan Church. For full analysis, click here

Other US data this coming week include new-home sales and durable goods orders for April, as well as revised first-quarter gross domestic product data.

St. Louis Fed President James Bullard and San Francisco’s Mary Daly are slated to speak Monday, while Atlanta’s Raphael Bostic and Richmond’s Thomas Barkin will discuss disruptive technology at a conference.

Meanwhile, the US debt limit standoff is nearing a critical deadline, with June 1 being the expected last day the US can fully pay its bills.

Further north, Canadian payrolls data will reveal a detailed portrait of earnings, employment and hours worked in March, as some fear rising wages stand in the way of efforts to slow inflation.

And elsewhere, German data will reveal if the country succumbed to a recession in the first quarter after all, while UK inflation probably slowed markedly. Among multiple rate decisions, New Zealand may hike again.

Click here for what happened last week and below is our wrap of what is coming up in the global economy.

Asia

The Group of Seven summit in Hiroshima wraps up Sunday with economic security including the diversification of supply chains among the key issues on the agenda.

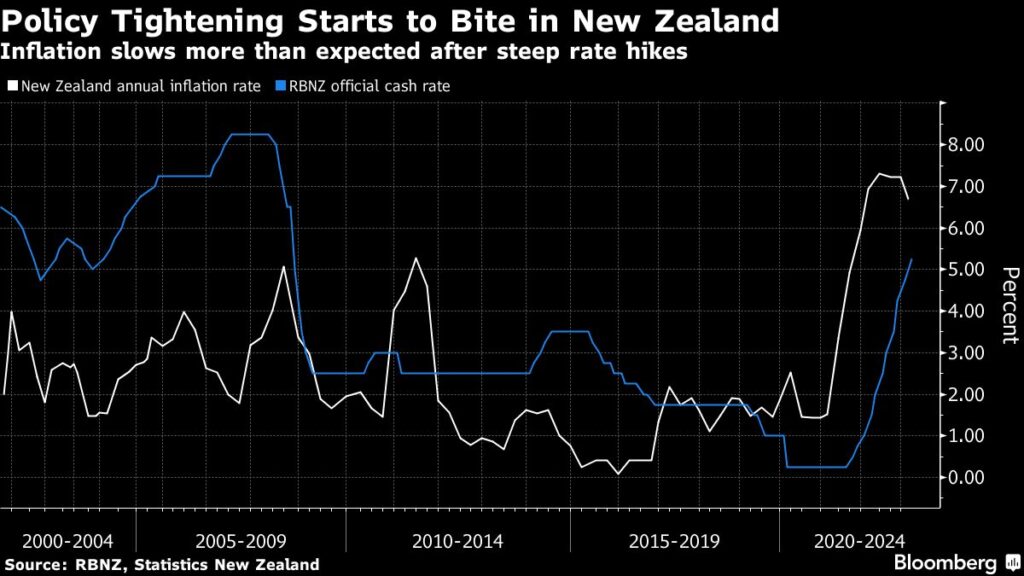

Central bankers in New Zealand, South Korea and Indonesia will make their latest decisions on rates during the week as an intense global wave of inflation-tackling policy tightening draws nearer to its end.

The Reserve Bank of New Zealand is expected to make at least one more 25 basis point increase after five percentage points of hikes since late 2021.

Both the Bank of Korea and Bank Indonesia have already been on hold since early in the year and are expected to stand pat again.

Chinese banks will likely keep their benchmark lending rates unchanged on Monday, but pressure is mounting on the central bank to ease policy as the rebound weakens.

Policymakers in Singapore and Malaysia will also be keeping an eye on the latest price data to check on the pace of cooling of inflation in their economies.

CPI figures from Tokyo on Friday will point to the national trend in Japan. Deputy premiers of Singapore, Vietnam and Thailand along with the leaders of Sri Lanka and Laos will speak at a media event hosted in Tokyo at the end of the week.

Europe, Middle East, Africa

The health of Germany’s economy will take center stage this week with multiple reports that may illustrate persisting malaise.

Among them, purchasing-manager indexes for the euro zone and its biggest members will be released on Tuesday. The Ifo survey of German business confidence will be published on Wednesday, with declines in all headline measures anticipated by economists.

And on Thursday, a new estimate for German gross domestic product will be released. Given weakness in recent data, economists will be watching for a potential downward revision that could mean a contraction in the first quarter. Such an outcome would imply that a recession many thought the country had escaped has transpired after all.

Multiple European Central Bank officials will speak this week including President Christine Lagarde as they celebrate the 25th anniversary of the institution’s creation in 1999.

Meanwhile in the UK, a major drop in the inflation rate is forecast by economists, though with the median prediction at 8.2%, the outcome is only likely to underscore the challenge still faced by the Bank of England.

Elsewhere, several central-bank decisions are due across the whole region in the coming week:

-

On Monday, The Bank of Israel is expected to deliver an unprecedented 10th consecutive rate hike Monday to try to damp stubbornly high inflation.

-

Also on Monday, officials in Ghana will likely leave the benchmark unchanged as inflation is forecast to continue to slow.

-

A day later, Hungary’s central bank may start cutting the European Union’s highest key rate.

-

On Wednesday, the Central Bank of Nigeria is predicted to extend its longest phase of monetary tightening in more than a decade.

-

Also that day, an Icelandic decision could potentially deliver another hike.

-

Turkey will most likely hold rates at 8.5% on Thursday, pausing its hiking cycle ahead of a second round of presidential elections this month where President Recep Tayyip Erdogan is seeking to extend his two-decades in power.

-

The same day, policymakers in South Africa are widely expected to raise the key rate by 50 basis points, against a backdrop of significant rand weakness and sticky inflation in an economy flirting with recession.

-

And on Friday, Eswatini, whose currency is pegged to South Africa’s rand, will probably also hike.

Latin America

In a very light week in the region, market expectations surveys from Brazil and Mexico are on tap for Monday along with Brazil’s weekly trade data.

In Peru, the first-quarter output report can be expected to show the economy shank from previous three months as well as from the same period a year earlier as high inflation, tight financial conditions and political turmoil take a toll.

The mid-month reading of Brazil’s benchmark inflation index could see the year-on-year print come in right around 4%, within the central bank’s target range and tantalizingly close to the 3.25% target.

Paraguay’s central bank will likely keep its key rate at 8.5% even though inflation is just 5.3% now and appears to be on its way back to the 4% target.

Mexico reports March GDP-proxy data and the final reading on first-quarter output, which should highlight the resilience of Latin America’s second-biggest economy. Mid-month inflation readings will likely show further slowing to put the year-on-year print not far off 6% even as the core reading runs more than a percentage point higher.

–With assistance from Jeremy Diamond, Andrea Dudik, Robert Jameson and Sylvia Westall.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.