(Bloomberg) — As the odds of a recession collapse on Wall Street, markets are back to being vulnerable to any sign that the US economy is running too hot.

Most Read from Bloomberg

From high-yield credit to equities, the odds of an economic downturn priced into financial assets have fallen to the lowest since April 2022, according to JPMorgan Chase & Co. It’s a big reversal from the doom and gloom of the past year, when a recession was effectively seen as a done deal.

That means markets are increasingly at the mercy of economic news that signals another bout of rampant inflation, spelling trouble for interest rate-sensitive strategies. For many investors, positive economic data — and its potential to spur more policy tightening — is the headwind they’re fighting.

“I worry that current good economic data are likely to keep inflationary pressures bubbling under the surface,” said Marija Veitmane, a senior multi-asset strategist at State Street Global Markets. “That would keep the Fed and other central banks from cutting rates, which would eventually break the economy.”

Solid jobless claims figures on Thursday and service-sector activity topping all forecasts on Wednesday, for example, reinforced the case for the Federal Reserve to keep rates elevated, fueling a drop in equities.

Even investors in government bonds — one of the few markets where recession bets have run wild — are less glum these days, thanks to a string of stronger-than-expected data.

The dreaded inversion of the Treasury yield curve, a traditional economic warning sign, is easing at long last. And traders over the past two months have been paring their bets on how much the Fed will be forced to cut interest rates next year to fight a recession.

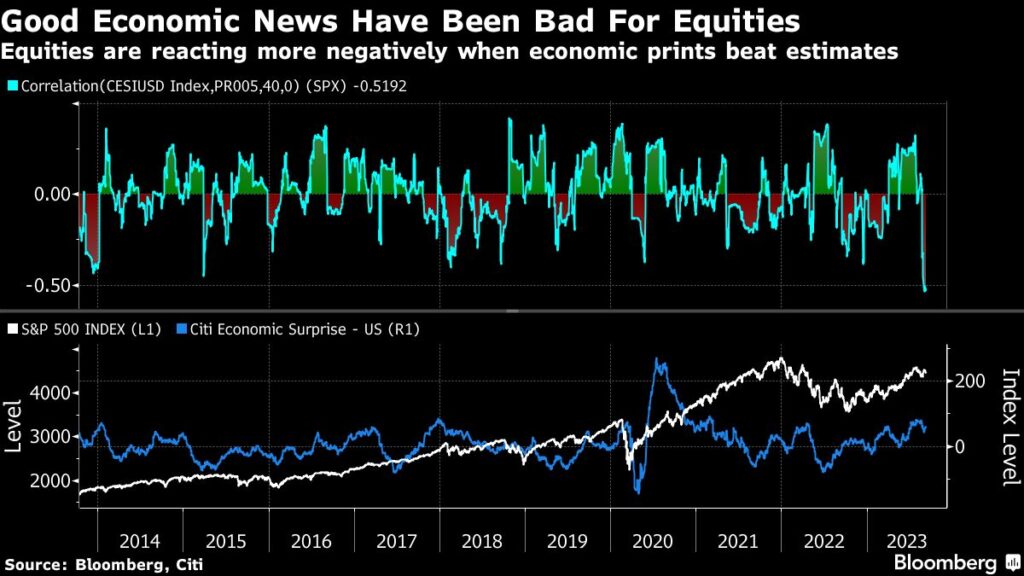

One way of thinking about just how sensitive the market is to fresh economic data: the link between the S&P 500 and Citigroup Inc.’s widely followed surprise index for the US economy.

That 40-day correlation has tumbled to the most negative on record, meaning that when big-picture readings from employment to manufacturing come hotter than economists expect, stocks fall. Conversely a downside surprise triggers a rally.

The relationship between Treasuries and data has also turned more negative, with economic strength suggesting weaker bond prices.

“We’re in the ‘bad news is good news’ part of the cycle and the reason is because the market is quite concerned about the Fed raising interest rates again,” Yung-Yu Ma, chief investment strategist at BMO Wealth, wrote in a note.

A sudden flurry of bad economic news clearly has the potential to cause global volatility. But for now, good news may be the bigger risk, bringing with it inflation and higher policy rates that would hurt corporate earnings, crimp business investment and threaten consumers with high debt loads.

What Bloomberg’s Strategists Say…

“And so we are left in a sort of economic and market purgatory, with the curve saying everything is going to hell but risky assets holding out hope of a nirvana-like soft-landing.”

— Cameron Crise, macro strategist

Click here for full report

For their part, Fed policymakers are doing their best to quash bets on a pivot to easier policy — and keep markets alive to the potential for rate hikes.

Traders have already pared the degree of Fed easing they see next year to about 100 basis points, down from well over 150 basis points early in 2023. The Fed is widely expected to hold rates at the range of 5.25% to 5.5% at its next meeting on Sept. 20.

With the US economy humming along at a clip of 2%, even Fed staff have written out a recession from their forecasts for this year. One widely-followed, unofficial tracker from Atlanta Fed has the US economy expanding 5.6% on an annualized basis in the third quarter.

“I think markets are going to be skeptical of recessions until they see the whites of its eyes,” said James Rossiter, head of global macro strategy at TD Securities. He now expects a US economic contraction early next year, after being caught out this year. “Too many times this last year or so, people like me have cried wolf on recession forecasts, only to see the world turn out better than feared.”

Like him, investors across assets are rethinking bets on a downturn. Equity, credit and rate markets together are assigning 16% probability to a US recession over the next six to 12 months, down from more than 50% in October, a JPMorgan trading model reveals.

The S&P 500 is assigning just 22% odds to recession, down from 98% in October while the market for junk bonds sees a 9% chance. The bank calculates the metrics by comparing the pre-recession peaks of various classes and their troughs during the economic contraction.

Some worry that the reversal has gone too far, with a hot economy driving consumer price pressures too high for Fed comfort. A soft landing, where rate hikes slow inflation and the economy without crashing it, has eluded policy makers for most of the past half century.

“Goldilocks is more likely a way station on the way to a better or a worse growth backdrop,” said Dan Suzuki, deputy chief investment officer at Richard Bernstein Advisors. “In a stronger growth environment, greater inflationary pressure should be a given, and the market will have to contend with more rate hikes.”

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.