Tech has been the undeniable powerhouse of the rally. But if a stock doesn’t perform, sometimes it’s best to part ways. Especially with swing trading. Here’s why we got out of ANET stock before it fell further.

X

ANET Stock Shows Promise During Base

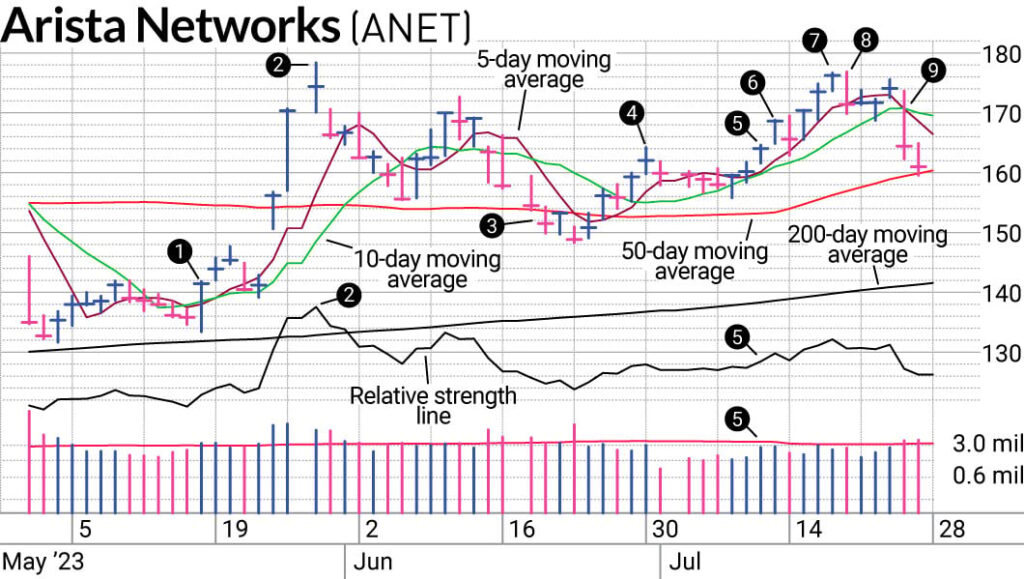

After finding support at its 200-day line (1), we saw Arista Networks (ANET) rally over 30% in just over a week’s time (2). It was enough to shoot its relative strength line near its March high.

While the Nasdaq composite pulled back to its 21-day exponential moving average, ANET stock fell below its 50-day line (3) leading to the relative strength line falling into a downtrend.

A late June rally saw one final pause in ANET stock where the relative strength line held up better. We used the June 30 high (4) as a potential entry. When ANET stock crossed that high (5), we put it on SwingTrader.

Interested in the story behind the stock? The New America series dives into ANET stock and artificial intelligence

Volume wasn’t above average, but it was well above the recent trading history of the prior two weeks. And though the relative strength line wasn’t at a 52-week high, it was higher than June 30.

Holding For Longer

We’ve continued to sell our first third of the position into strength and ANET stock was no exception. As it hit 2.5% profit from our entry (6), we took some profit.

Just because we’re trying to hold longer, doesn’t mean we want to give up much in profits. Once we hit 5% profit, we raise our stop to the entry price. We targeted a 10% gain for another potential third to come off but ANET stock came up short with a top at 8% from our entry (7).

But how much profit are we willing to give up. The 5- and 10-day lines can be useful to lock in gains. With less cushion we often opt for the 5-day moving average line. That was breached by ANET stock on July 19 by a small fraction (8). Not what we could call a decisive close below the line.

Even the next couple days didn’t see further selling but rather holding the level of the July 19 close.

Exit Before Things Get Worse

But when ANET stock plunged below both its 5-day and 10-day line, we acted by removing the remaining position while we still had a 2.5% gain (9).

At that point the risk of losing ground was greater than what we saw as our potential reward. Especially in the short-term since breaks like that usually require time to heal. The goal of swing trading is to have the money in more constant motion rather than sitting in positions that need time.

Many times, the quick decision prevents further heartache. It looks like the case with ANET stock as it’s now 10 points below our entry with earnings coming next week. It might be a beneficiary of artificial intelligence but we won’t take the chance unless the price confirms the conclusion.

More details on past trades are accessible to subscribers and trialists to SwingTrader. Free trials are available. Follow Nielsen on Twitter at @IBD_JNielsen.

YOU MAY ALSO LIKE:

Swing Trading Strategy Basics

Simon Erickson Shares His 3 Steps For Finding Hidden Gems

MarketSmith: Research, Charts, Data And Coaching All In One Place

This Tool Tells You Who Is Winning Between The Buyers And Sellers