Do you wonder where the stock market is headed? Well, Wells Fargo’s senior global market strategist, Scott Wren, believes that the S&P 500 will remain range-bound, with a low end around 3,600 and a top end around 4,300, for the remainder of the year. Wren’s advice is not to chase the market when it nears that peak, but to make use of any pullbacks.

As for the best stocks to load up on in the current climate, Wren has an idea about those too. “We want to focus on U.S. over international, large- and mid- cap stocks over small, and favor sectors like Energy, Health Care, and Technology that we believe have the potential to weather the economic storm we may see later this year,” he explained.

The stock analysts at Wells Fargo are putting that stance into action. They are naming stocks from those recommended segments as ‘Top Picks’ and selecting the ones that have recently pulled back but are expected to rebound. We’ve used the TipRanks platform to look up the details on two of those picks. Here’s the lowdown.

Zscaler, Inc. (ZS)

The first Wells Fargo pick we’ll look at is a tech firm in the networking security niche, Zscaler. Zscaler’s unique selling point is the Zero Trust Exchange, or as the company puts it, ‘the world’s largest security cloud.’ This platform securely connects apps, devices, and users on any network, and provides the improvements to confidence, online navigation, and business apps necessary for improved productivity. The Zero Trust Exchange works at multiple levels, from machine-to-machine to app-to-user to app-to-app.

Since its founding in 2007, Zscaler has worked to leverage its network security expertise to turn the internet into the corporate world’s cloud. A look at some aggregate numbers makes it clear just how big Zscaler’s target market actually is. The company boasts that its platform processes more than 300 trillion daily signals, to generate a powerful artificial intelligence/machine learning effect. These include over 280 billion daily transactions, leading to some 9 billion incident and policy violations prevented per day.

One more number is important to understand Zscaler’s scale and success: $387.6 million. That was the company’s top line in the last reported quarter, Q2 of fiscal year 2023 (January quarter). The revenue figure was up more than 51% year-over-year, and beat the forecast by $22.8 million. The non-GAAP earnings figure came in at 37 cents, which was more than triple the year-ago figure and was a solid 8-cents above expectation.

Zscaler’s revenues have been increasing steadily for the past several years, and the earnings have registered four sequential quarterly increases in a row. The company has managed that, even as its stock value has been dropping; ZS shares are down 52% in the last 12 months. The share value drop comes as the company’s growth – still blisteringly fast – appears to be slowing down. Q2’s overall growth came in at 45% y/y, but the prior year saw 62% growth.

The slowdown in overall growth hasn’t dimmed Zscaler’s luster in the eyes of Wells Fargo’s 5-star analyst Andrew Nowinski, who writes, “We continue to believe Zscaler has an architectural advantage over the competition, which should drive long-term growth and market share gains. Despite a modest slowdown in Billings growth last quarter, we believe management has made improvements in their go-to-market strategy and has a strong pipeline. As such, we are reiterating ZS as our ‘Top Pick.’”

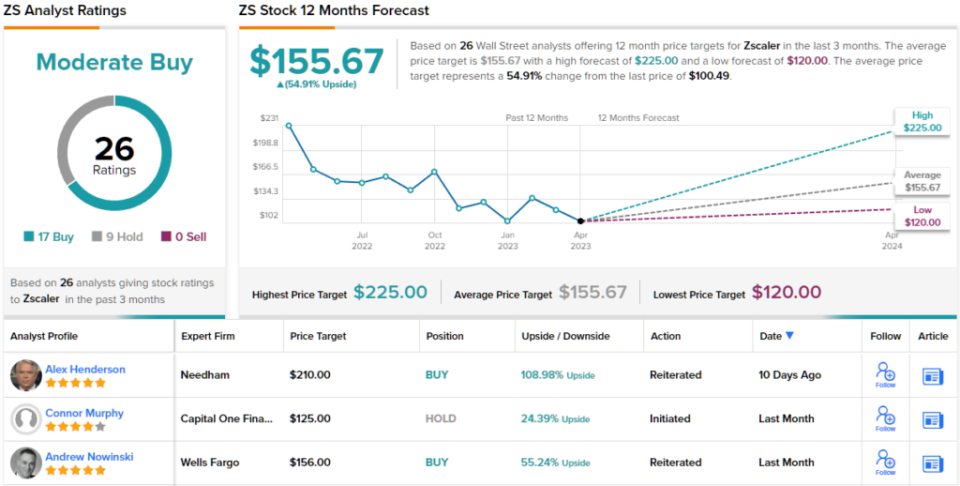

Looking ahead from that stance, Nowinski gives ZS an Overweight (i.e. Buy) rating – and a price target of $156 that implies one-year share growth of 55%. (To watch Nowinski’s track record, click here)

Backing up for a broader view, we find that ZS gets a Moderate Buy consensus rating from the Street, based on 26 reviews that include 17 Buys and 9 Holds. The stock is selling for $100.49, and its $155.67 average price target is almost identical to Nowinski’s objective. (See Zscaler stock forecast)

Intellia Therapeutics (NTLA)

Now we’ll switch gears, and look at Intellia, a biotech company whose work focuses on gene editing and the creation of new therapeutic agents for the treatment of genetic diseases. Intellia’s product line, based on gene editing, attacks genetic diseases directly at the causative genetic mutation. The gene medication agents are developed using CRISPR technology; Intellia typically follows a two-track approach in its development activities, using both in vivo and ex vivo techniques.

Intellia’s development pipeline includes pre-clinical tracks in the treatment of various diseases, including lymphomas, leukemia, and solid tumors, hemophilia, and liver and lung conditions. At the clinical stage, the company’s pipeline features two drug candidates, NTLA 2001, a treatment for transthyretin (ATTR) amyloidosis, and NTLA 2002, designed to treat hereditary angioedema (HAE). Each candidate has upcoming catalysts.

The first, NTLA 2001, is undergoing a Phase 1 clinical trial, and in November of last year released positive preliminary data. Coming up, there are three main catalysts on this track, all expected to take place by mid-year or year’s end. First, Intellia plans to submit and IND to include additional study sites for a pivotal trial of NTLA 2001 in patients with ATTR-CM. Second, the company will release an additional set of clinical data from the current trial. And finally, the company plans to initiate the pivotal trial before the end of the year.

On the second track, NTLA 2002, Intellia has initiated a Phase 2 trial, evaluating the drug candidate as a CRISPR-based, potential single-dose treatment for hereditary angioedema (HAE). The company last month received IND clearance from the FDA to allow enrollment of patients at US sites for this study, and is on-track to release data later this year for the first-in-human trial.

Intellia’s share price, however, has not gotten a meaningful boost from the upbeat pipeline news. The stock is down 50% from last August’s 52-week peak. However, Wells Fargo analyst Yanan Zhu still considers Intellia as a ‘Top-Pick’ and has an explanation for the stock’s lackluster performance.

The analyst writes, “We view the IND clearance as a key step forward for the field and for NTLA value inflection. We would note that while NTLA demonstrated best-case scenario clinical data last year, the stock has been depressed due to a concern of whether FDA would allow in vivo editing to go forward (which we thought should not be an issue due to clear regulatory precedents). With the first IND now cleared, we see significant room for value creation as additional data are reported from the TTR and HAE studies.”

These comments back up Zhu’s Overweight (i.e. Buy) rating, while the analyst’s $100 price target indicates the stock may have room to grow a robust 180% over the next year. (To watch Zhu’s track record, click here)

Most on the Street back Zhu’s take. NTLA shares have a Strong Buy consensus rating, based on 17 recent recommendations that include 14 Buys against 3 Holds. The stock’s $35.76 trading price and $85.33 average target price combine to give ~139% upside on the one-year time frame. (See NTLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.