A version of this story first appeared on TKer.co

Stocks closed lower last week with the S&P 500 falling 1.4%. The index is now up 13.3% year to date, up 21.6% from its October 12 closing low of 3,577.03, and down 9.3% from its January 3, 2022 record closing high of 4,796.56.

In recent weeks, strategists across Wall Street have revised up their year-end targets for the S&P 500. These updated calls incorporate the improving outlook for earnings, expectations for the Fed to soon dial back hawkish monetary policy, and the fact that stock prices have mostly gone up since the beginning of the year.

Some prominent bears are still calling for a big pullback in prices before the year’s over. They include Morgan Stanley’s Michael Wilson, who has been reiterating his call for the S&P 500 to fall to 3,900 by the end of the year, and Capital Economics’ Thomas Mathews, who recently revised his target up to just 4,000 from an initial target of 3,800.

Both of these strategists, however, have bullish things to say about the longer term.

Wilson, who expects S&P 500 earnings per share (EPS) to fall to $185 in 2023, predicts a “sharp rebound” in growth with EPS surging 23% to a record $228 in 2024 and jumping another 10% to $250 in 2025.

Wilson hasn’t yet issued S&P price targets for the ends of those years, but Capital Economics Mathews’ has. And they’re bullish.

Mathews predicts the S&P will explode to 5,500 by the end of 2024 and 6,500 by the end of 2025. This would imply a 37.5% surge assuming the index falls to 4,000 this year, followed by an 18.1% gain in 2025.

From Mathews’ June 20 research note:

…By next year, we think worries about growth will be fading and, what’s more, the Fed will probably be in easing mode. That could create a backdrop for enthusiasm about equities – and AI specifically – to recover.The median rebound in the S&P 500 from a recession-induced slump since 1960 is ~38%. The fairly mild recession – and associated fall in the S&P 500– we forecast would probably argue for a smaller recovery than that median. But if we’re right that it will come alongside a rekindling of AI enthusiasm as well, the index could perform quite well.

Now, there’s no guarantee we’ll see a recession in the coming months. In fact, economists have been dialing back their recession warnings in recent weeks.

That said, it would certainly not be unprecedented to see massive returns in the stock market following a recession.

Zooming out 🔭

Strategists’ short-term returns expectations for the S&P will often range from very positive to very negative.

But longer term, they tend to skew positively. (After all, the stock market usually goes up!)

It’s something for investors to remember as they read news articles and other publications that cite the research of Wall Street strategists. Sometimes, these experts’ short-term predictions look very different from their long-term views.

Reviewing the macro crosscurrents 🔀

There were a few notable data points and macroeconomic developments from last week to consider:

🦅 Powell reiterates inflation fight isn’t over. From Federal Reserve Chair Jerome Powell’s appearance before the House Financial Services Committee: “Inflation has moderated somewhat since the middle of last year. Nonetheless, inflation pressures continue to run high, and the process of getting inflation back down to 2 percent has a long way to go.”

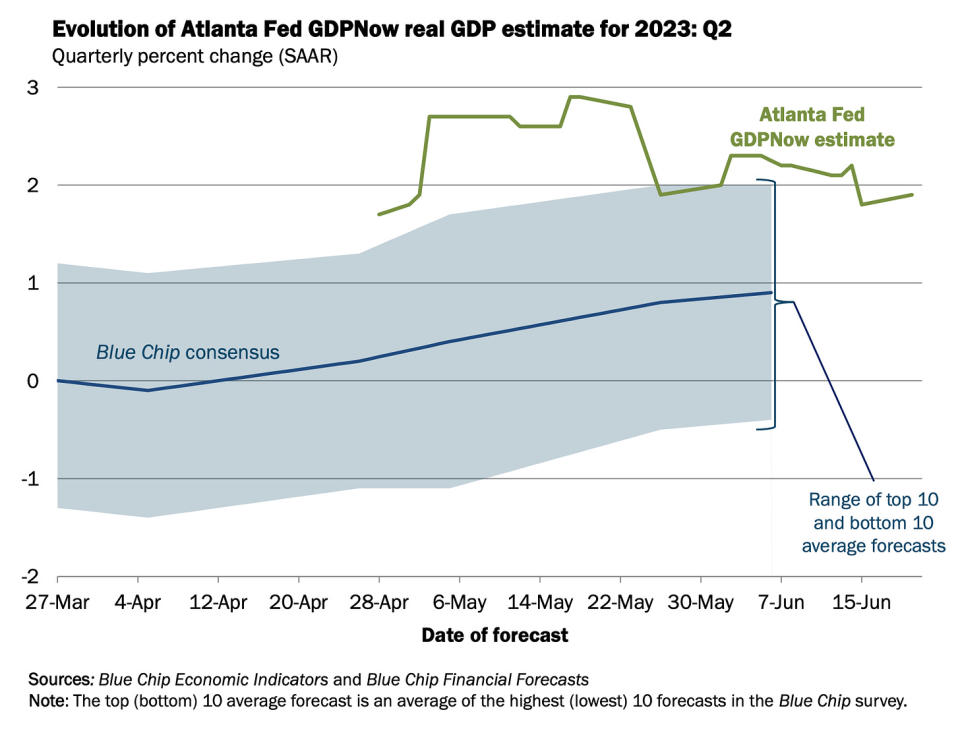

👍 The U.S. economy is growing. From S&P Global’s June Flash U.S. PMI report (via Notes): “The overall rate of expansion of business activity in the US remained robust in June, consistent with GDP rising at a rate of 1.7% to put second quarter growth in the region of 2%.”

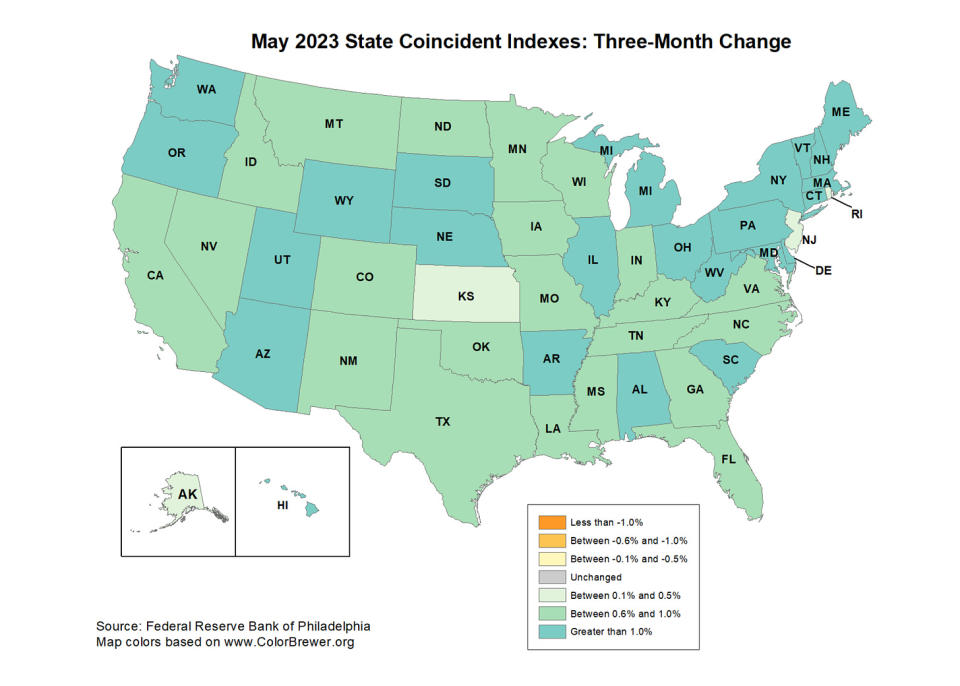

🇺🇸 All 50 states are growing. From the Philly Fed’s State Coincident Indexes

report: “Over the past three months, the indexes increased in all 50 states, for a three-month diffusion index of 100. Additionally, in the past month, the indexes increased in 47 states, decreased in one state, and remained stable in two, for a one-month diffusion index of 92.”

📈 Near-term GDP growth estimates remain positive. The Atlanta Fed’s GDPNow model sees real GDP growth climbing at a 1.9% rate in Q2. While the model’s estimate is off its high, it’s nevertheless very positive and up from its initial estimate of 1.7% growth as of April 28.

🏚 Home sales tick up. Sales of previously owned homes climbed 0.2% in May to an annualized rate of 4.30 million units. From NAR chief economist Lawrence Yun: “Mortgage rates heavily influence the direction of home sales… Relatively steady rates have led to several consecutive months of consistent home sales.”

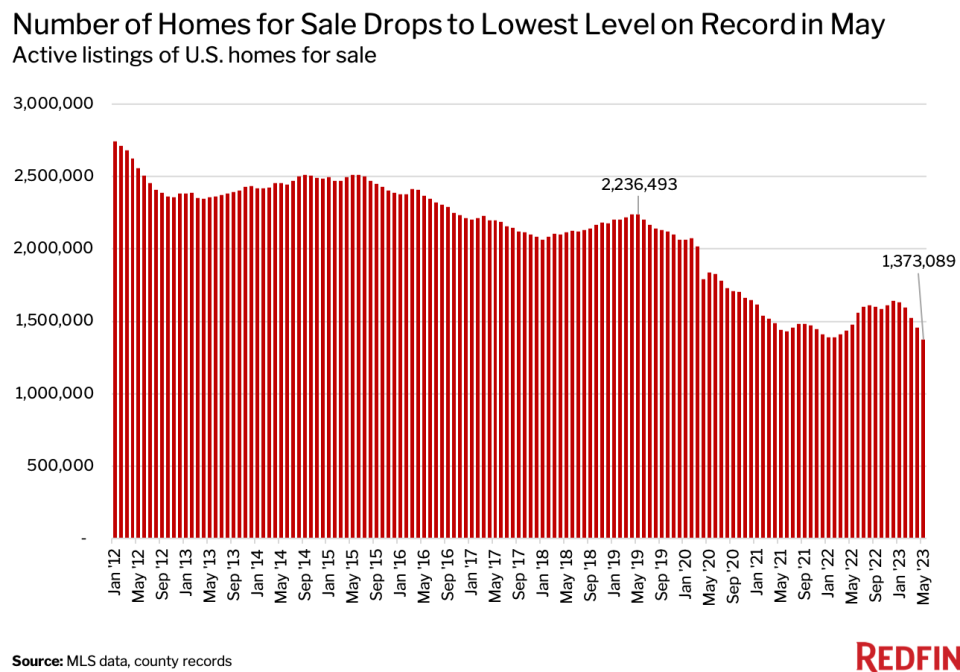

“Available inventory strongly impacts home sales, too,” Yun added. “Newly constructed homes are selling at a pace reminiscent of pre-pandemic times because of abundant inventory in that sector. However, existing-home sales activity is down sizably due to the current supply being roughly half the level of 2019.”

Indeed, according to Redfin: “The number of homes for sale in the U.S. fell 7.1% year over year to 1.4 million on a seasonally adjusted basis in May. That’s the lowest level in Redfin’s records, which date back to 2012, and the first annual decline since April 2022… “

More from Redfin: “America’s housing stock is dwindling because there are very few people selling homes. New listings of homes for sale declined 25.2% year over year in May to the third lowest level on record on a seasonally adjusted basis, as homeowners were handcuffed by high mortgage rates. Nearly every homeowner with a mortgage has an interest rate below 6%, meaning many are opting to stay put because selling and buying a new home would mean taking on a higher monthly mortgage payment.”

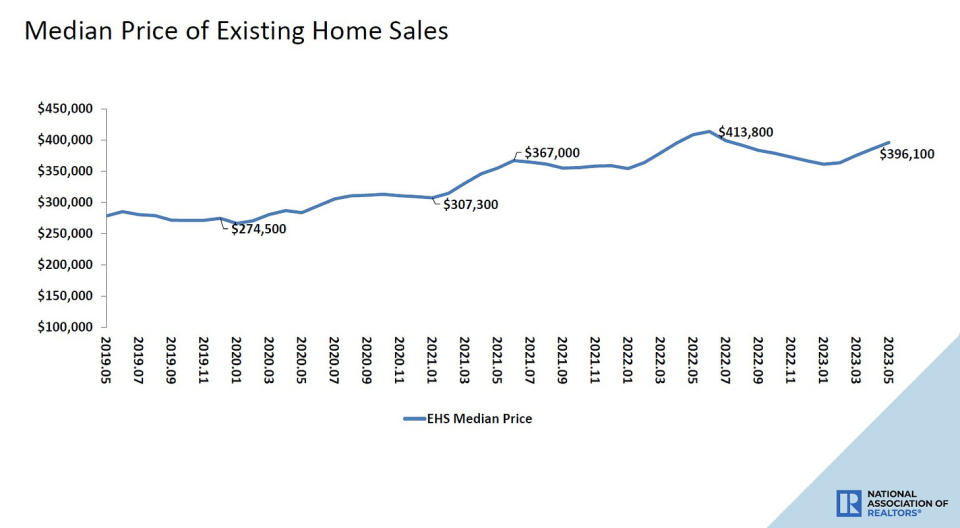

💸 Home prices rise. Prices for previously owned homes rose month over month, but were down from year ago levels. From the NAR: “The median existing-home price for all housing types in May was $396,100, a decline of 3.1% from May 2022 ($408,600). Prices grew in the Northeast and Midwest but fell in the South and West.”

🏠 Home builder sentiment turns positive. From the NAHB (via Notes): “Solid demand, a lack of existing inventory and improving supply chain efficiency helped shift builder confidence into positive territory for the first time in 11 months.”

From NAHB Chief Economist Robert Dietz: “A bottom is forming for single-family home building as builder sentiment continues to gradually rise from the beginning of the year… The Federal Reserve nearing the end of its tightening cycle is also good news for future market conditions in terms of mortgage rates and the cost of financing for builder and developer loans.”

🔨 New home construction surges. Housing starts jumped 21.7% in May to an annualized rate of 1.63 million units, according to the Census Bureau (via Notes). Building permits rose 5.2%% to an annualized rate of 1.49 million units.

From JPMorgan: “After weakening substantially last year as the Fed embarked on its aggressive hiking cycle, most US housing data not only have stabilized this year but also are now showing signs of rebounding from recent lows. Yesterday’s NAHB home builders’ sentiment measure jumped 5pts to an 11-month high of 55, with the largest move in the survey seen in expected single-family sales over the next six months. The combination of tight supply and recent stability in mortgage rates — along with still-supportive consumer fundamentals from excess savings and robust employment growth — appear to be supporting the housing market despite signals from the Fed that it is not yet done tightening policy.”

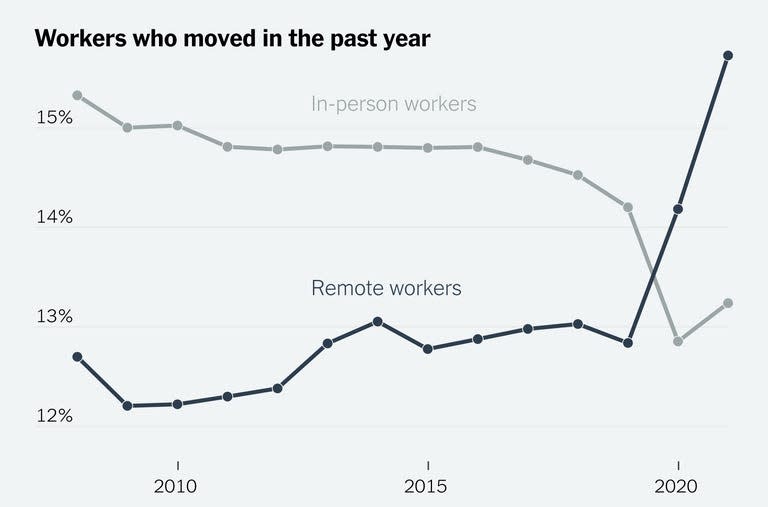

🚛 Remote workers are more likely to move. From the New York Times: “During the pandemic, people who worked from home became significantly more likely to move — and more likely to do so than all other workers… This rising mobility was driven by remote workers who sought new housing in their same metro areas, but also by a wave of remote workers decamping to other parts of the country. In the first two years of the pandemic, one in four workers who moved long-distance was working remotely in a new home — a previously unheard-of scale of remote migration.”

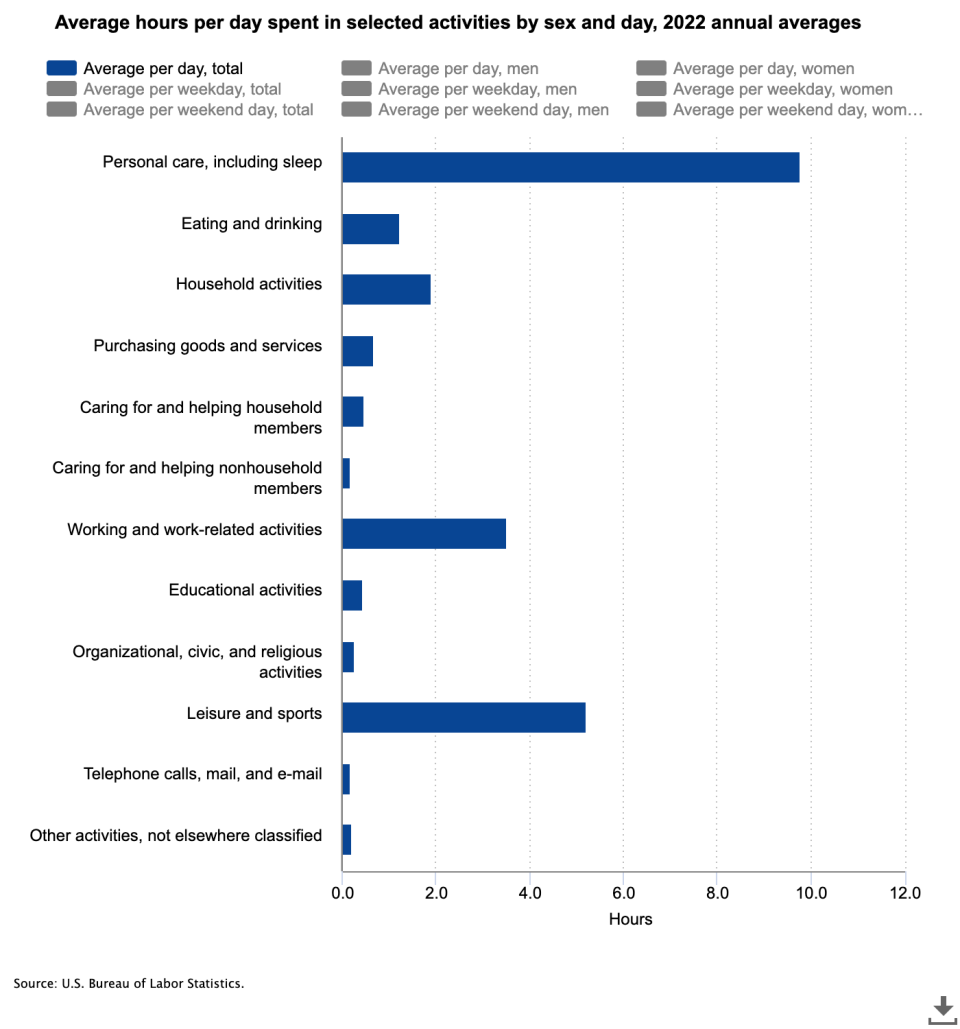

🕰️ How we pass the time. From the BLS:

💼 Unemployment claims tick up. Initial claims for unemployment benefits stood at 264,000 during the week ending June 17, unchanged from the week prior. While this is up from the September low of 182,000, it continues to trend at levels associated with economic growth.

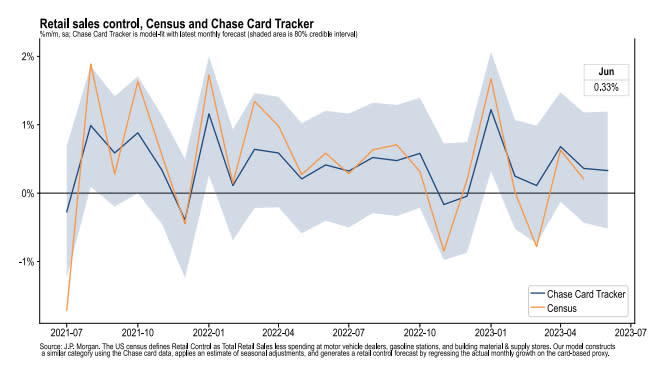

💳 Card spending soft but stable. From JPMorgan Chase: “As of 18 Jun 2023, our Chase Consumer Card spending data (unadjusted) was 1.1% above the same day last year. Based on the Chase Consumer Card data through 18 Jun 2023, our estimate of the US Census June control measure of retail sales m/m is 0.33%.”

Putting it all together 🤔

We continue to get evidence that we could see a bullish “Goldilocks” soft landing scenario where inflation cools to manageable levels without the economy having to sink into recession.

The Federal Reserve recently adopted a less hawkish tone, acknowledging on February 1 that “for the first time that the disinflationary process has started.” On May 3, the Fed signaled that the end of interest rate hikes may be here. And at its June 14 policy meeting, it kept rates unchanged, ending a streak of 10 consecutive rate hikes.

In any case, inflation still has to come down more before the Fed is comfortable with price levels. So we should expect the central bank to keep monetary policy tight, which means we should be prepared for tight financial conditions (e.g. higher interest rates, tighter lending standards, and lower stock valuations) to linger.

All of this means monetary policy will be unfriendly to markets for the time being, and the risk the economy sinks into a recession will be relatively elevated.

But, we also know that stocks are discounting mechanisms, meaning that prices will have bottomed before the Fed signals a major pivot in monetary policy.

Also, it’s important to remember that while recession risks are elevated, consumers are coming from a very strong financial position. Unemployed people are getting jobs. Those with jobs are getting raises. And many still have excess savings to tap into. Indeed, strong spending data confirms this financial resilience. So it’s too early to sound the alarm from a consumption perspective.

At this point, any downturn is unlikely to turn into economic calamity given that the financial health of consumers and businesses remains very strong.

And as always, long-term investors should remember that recessions and bear markets are just part of the deal when you enter the stock market with the aim of generating long-term returns. While markets have had a pretty rough couple of years, the long-run outlook for stocks remains positive.