The Federal Reserve’s preferred metric to gauge inflation increased by 0.3% in January compared to 0.1% in the previous month, in line with expectations following other hot inflation reports for the month, according to the Bureau of Economic Analysis (BEA).

The personal consumption expenditure (PCE) price index increased 2.4% year-over-year, down from 2.6% in December, according to the BEA. The increase in month-to-month PCE follows a higher-than-expected consumer price index (CPI) report, which increased 3.1% year-over-year in January compared to expectations of 2.9% and led to the biggest single-day drop in the Dow Jones Industrial Average in nearly a year. (RELATED: High Rent Prices Are Crushing Americans — And They Could Be Here To Stay, Experts Say)

The PCE price index experienced downward pressure from deflation in the cost of energy, falling 1.4% for the month, according to the BLS. Core PCE, which excludes the volatile categories of energy and food, increased 0.4% month-over-month and 2.8% for the year.

The producer price index, another measure that tracks inflation before it reaches consumers, increased 0.3% in January, which was higher than expectations of 0.1%.

If you think the Inflation story is over, think again.

PCE numbers cam in hot this morning, and the monthly pace of price increases shoots higher.#Bidenomics continues to inflict pain upon Americans, especially those of modest means… pic.twitter.com/DA4ePU0205

— Steve Cortes (@CortesSteve) February 29, 2024

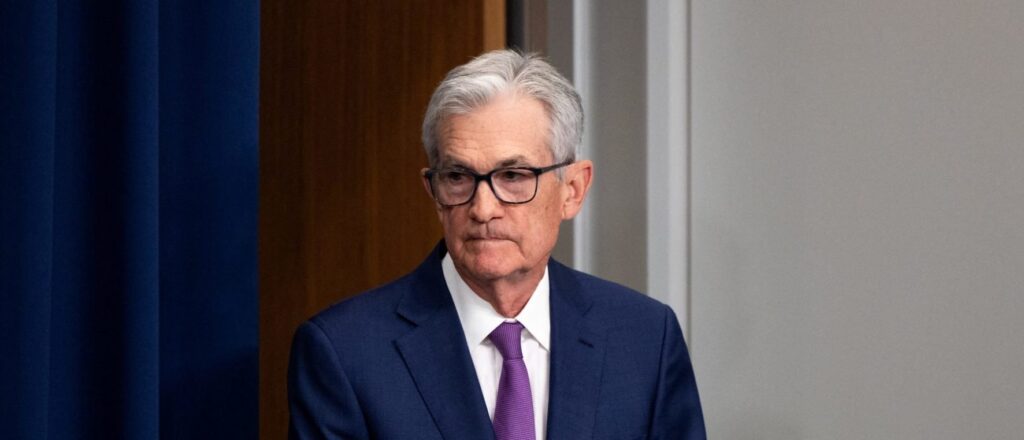

The sustained hot inflation throws uncertainty on investor hopes of a cut to the Fed’s federal funds rate, which is currently set to a range of 5.25% and 5.50%, the highest rate in 23 years. A majority of investors now do not predict that the Fed will cut rates until at least the Federal Open Market Committee’s June meeting, according to the CME Group as of Thursday.

Following disappointing CPI data, investors have increasingly started projecting a “no landing” scenario where inflation does not retreat to the Fed’s target of 2% but economic growth remains above trend. Inflation, as measured by the CPI, has risen a total of 18% since President Joe Biden first took office in January 2021.

The White House did not immediately respond to a request to comment to the Daily Caller News Foundation.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.