NEW YORK/LONDON, Sept 22 (Reuters) – Treasury prices rebounded but a gauge of global equities fell on Friday, adding to sharp sell-offs earlier this week, after three Federal Reserve officials warned further rate hikes may be needed to ensure inflation is brought under control.

The officials, in remarks at separate events, said they were uncertain the inflation battle is finished and indicated the U.S. central bank’s monetary policy will likely remain tight longer than previously expected.

The Fed on Wednesday raised its forecast next year for the U.S. central bank’s overnight lending rate to 5.1%, but lifted its outlook for economic growth. The forecasts seem at odds as higher rates raise credit costs that can slow the economy.

The two projections do not line up because if higher rates are in restrictive territory, as the Fed indicates, that should lead to a slowdown, said Marvin Loh, senior global macro strategist at State Street in Boston.

“Certainly they wanted to send the message that higher is going to be around for longer and they went all-in on the soft landing,” Loh said about the Fed’s projections released on Wednesday. “There’s some inconsistencies associated with that.”

MSCI’s gauge of global equity performance and stocks on Wall Street fell after early gains. U.S. Treasury yields, which move inversely to price, fell. The benchmark 10-year note slid to 4.30% from 16-year highs of more than 4.5% late Thursday.

The two-year Treasury yield, which reflects interest rate expectations, fell 4 basis points to 5.108%.

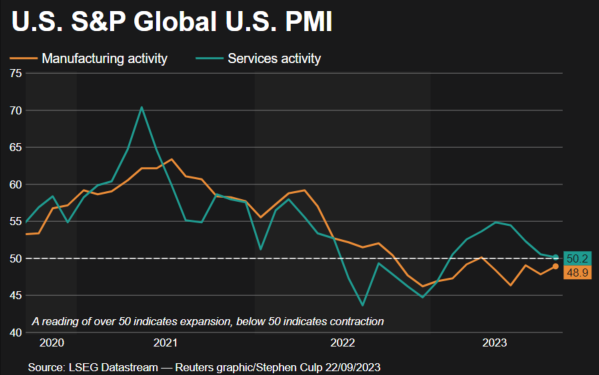

In a sign of slowing growth, a flash reading of S&P Global’s U.S. Composite PMI index showed U.S. business activity basically at a stand still in September, with the vast services sector essentially idling at the slowest pace since February.

Yields on two- and 10-year notes remained inverted at -67.6 basis points as the shorter-dated note yields more than the longer one. The inversion is seen as a reliable recession harbinger.

“I don’t think the Fed’s forecasts are consistent with the most likely outcome of how the economy evolves and how things get back to normal,” said Joe LaVorgna, chief economist SMBC Nikko Securities America in New York.

“I don’t see a soft landing,” he said, citing the yield curve’s inversion. “The only way out of this is going to be a recession where the Fed has to cut rates.”

MSCI’s all-world country index for stocks (.MIWD00000PUS) closed down 0.10%, and the pan-European STOXX 600 index (.STOXX) fell 0.31%.

On Wall Street, the Dow Jones Industrial Average (.DJI) fell 0.31%, the S&P 500 (.SPX) lost 0.23% and the Nasdaq Composite (.IXIC) dropped 0.09%.

The Nasdaq, S&P 500 and MSCI’s global stock gauge posted their biggest weekly percentage declines since early March.

In currency markets, the dollar advanced against a basket of currencies as PMI data on business activity from around the world highlighted the superior U.S. position relative to other major economies.

The dollar index , a measure of the U.S. currency against six major counterparts, was 0.2% higher at 105.59.

The yen traded lower at 148.38 to the dollar after falling sharply earlier following the Bank of Japan’s decision to hold interest rates in negative territory, suggesting it was in no rush to phase out its massive stimulus program.

Oil prices rose as renewed global supply concerns from Russia’s fuel export ban countered demand fears driven by macroeconomic headwinds and higher interest rates.

U.S. crude futures CLc1> settled up 40 cents at $90.03 a barrel and Brent fell 3 cents to settle at $93.27.

MSCI’s index of Asia-Pacific shares ex-Japan (.MIAPJ0000PUS) touched a 10-month low before bouncing to trade up 0.9% on vows in China to support private business. It is down 2.8% this week.

Japan’s Nikkei (.N225) pared losses of as deep as 1% to trade 0.5% lower.

Investors were still assessing a slew of policy decisions from major central banks during the week.

Central banks in Sweden and Norway announced 25 bp hikes with the prospect of more to come.

Yet the Bank of England, in a split decision, left rates on hold for the first time in nearly two years, sending sterling to a six-month low, while the Swiss franc fell sharply after a surprise hold on rates from the Swiss National Bank.

In emerging markets, Indian bonds and the rupee rallied after JPMorgan said it would add Indian debt to its widely tracked emerging markets index, setting the stage for billions of dollars in foreign inflows.

Gold prices edged higher, helped by a slight pullback in the dollar and bond yields.

U.S. gold futures settled 0.3% higher at $1,945.60 an ounce.

Reporting by Huw Jones, additional reporting by Tom Westbrook; Editing by Marguerita Choy, Rashmi Aich, Aurora Ellis and David Gregorio

: .