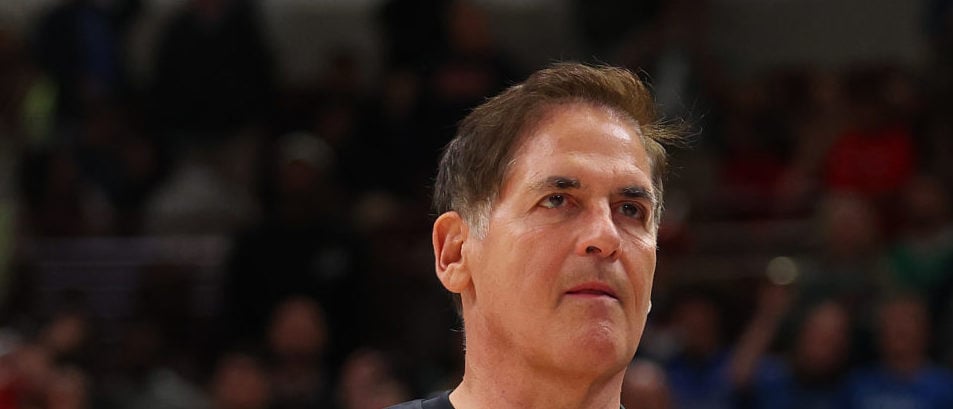

Billionaire Mark Cuban on Tuesday gave Democratic California Rep. Ted Lieu an investing lesson after he expressed doubt about former President Donald Trump’s billionaire status.

Trump’s lawyers said the former president is unable to post a $454 million bond in his appeal of a New York civil fraud judgment against him. Cuban said that although he is anti-Trump, Lieu is wrong that the former president’s inability to post the bond means he is not a billionaire, explaining that one does not need a billion dollars in cash in order to have this status in a Tuesday post. (RELATED: Trump Posts $91 Million Bond As He Appeals E. Jean Carroll Verdict)

Ted, you know I’m no supporter of Trump. That’s for damn sure.

How anyone can vote for someone who has so many of his executive employees turn on him, and, say he is incompetent is beyond me.

But you are wrong on this topic Ted.

Net worth is completely different than… https://t.co/WG6cY1t5qq

— Mark Cuban (@mcuban) March 19, 2024

“Trump claims he is a billionaire. But he can’t pay a $464 million judgement. That means he is lying.” Lieu posted. “How do I know? Math. #TrumpIsBroke.”

“Ted, you know I’m no supporter of Trump. That’s for damn sure,” Cuban responded on X. “How anyone can vote for someone who has so many of his executive employees turn on him, and, say he is incompetent is beyond me. But you are wrong on this topic Ted. Net worth is completely different than cash in the bank. We were in a zero interest rate environment for a long, long time. So keeping cash in the bank or even money markets was dumb. In fact searching for yield is what killed small banks last year.”

Trump allegedly falsified his company’s assets in order to obtain loans for business ventures.

“You can also argue Trump sucked at growing his net worth which led to him putting himself in this position by lying to banks about his assets,” Cuban wrote. “There is only one reason to lie on a loan application – you have to.”

Forbes estimates Trump’s net worth to be $2.6 billion and it is comprised mostly of “hard” assets, the most significant among them being commercial property. Cuban also explained why the current real estate market, where Trump has most of his assets, is not helping the former president get a loan.

“On a more macro basis Ted. Even if rates were along a long term trend line for the past ten years, few people are keeping more than 45 percent of their assets in liquid assets,” Cuban asserted. “And as far as the bond companies Trump’s assets are mostly interests in commercial real estate and foreign assets. No bond company is loaning against them in this commercial real estate market, if ever.”

Lieu did not immediately respond to the Daily Caller News Foundation’s request for comment.

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.