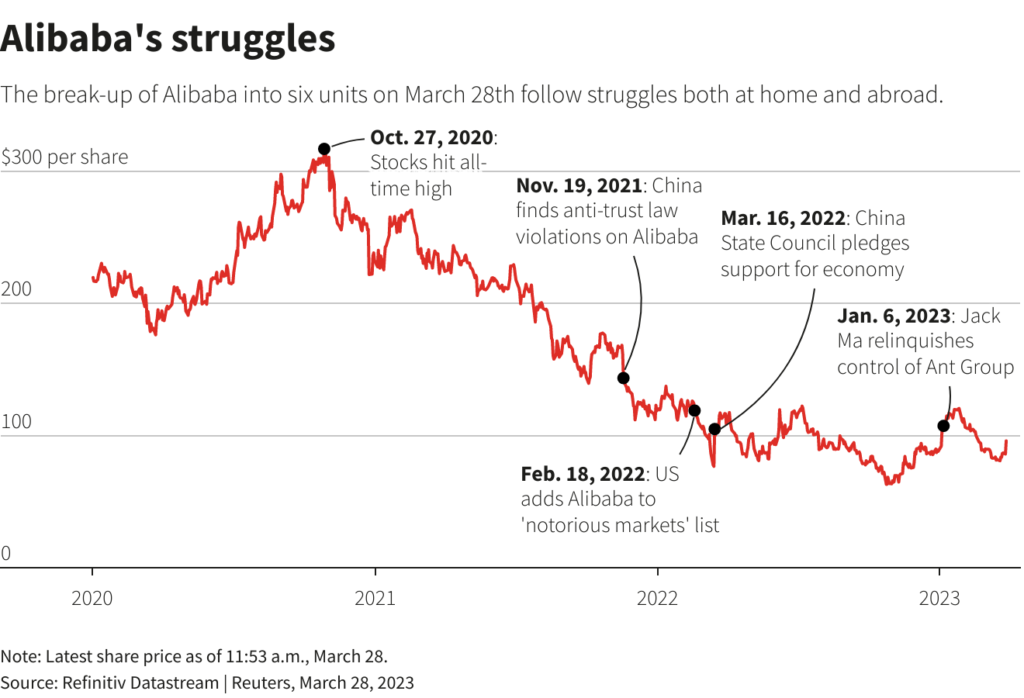

March 29 (Reuters) – Alibaba Group’s (9988.HK) plans for a major revamp have been taken as a signal that Beijing’s regulatory crackdown on corporates is ending, propelling its shares higher and boosting investor confidence in prospects for Chinese tech firms.

The Jack Ma-founded conglomerate said on Tuesday it was planning to split into six units and explore fundraisings or listings for most of them, marking the biggest restructuring in its 24-year history.

Its Hong Kong-listed shares closed up 12%, tracking a rally in its U.S.-listed shares overnight , and giving the group a market value of about $255 billion. Those gains led the Hang Seng Index (.HSI) and other markets in the region higher.

Many investors have seen a wave of regulatory blitzes over the last couple of years that have hit its internet, private education and property sectors hard as a major cloud hanging over China’s private sector.

“We think this is likely a sign that we are moving closer to the end of the regulatory scrutiny…and we would expect that the company moves back into the good graces of the regulators and policy makers after this,” said Jon Withaar, head of Asia special situations at Pictet Asset Management.

Alibaba will discuss the plan at a conference call on Thursday.

Alibaba said it would split into six units – Cloud Intelligence Group, Taobao Tmall Commerce Group, Local Services Group, Cainiao Smart Logistics Group, Global Digital Commerce Group and Digital Media and Entertainment Group.

The group has been planning to spin off individual business units for a long time, according to two sources familiar with the company’s thinking.

“There was a consensus within and outside Alibaba that the stock was trading at a major discount to the inherent value of the businesses,” said one of the people, adding that the company had become “too bloated”.

The person said there would be five initial public offerings from the units, while Taobao and Tmall, Alibaba’s core revenue drivers, would remain with the current listed entity.

Hong Kong is the most likely venue for these IPOs, said the person, and a separate source familiar with Chinese tech companies’ capital markets transactions.

The sources declined to be identified as the information was not public. Alibaba did not respond to a request for comment.

Alibaba would re-organise into a holding company structure. Daniel Zhang will retain his position as group CEO and will also lead the cloud-focused unit. The other divisions will have their own CEOs and boards.

It would not be the first time Alibaba has spun off its business units. In 2011, the company hived off its fast-growing payments arm Alipay, which later evolved into the fintech major Ant Group.

PAIN ENDING?

Bank of America analysts described Alibaba’s restructuring as “an important experiment”, which would test whether or not China’s biggest companies could meet Beijing’s demand to “contribute to society”.

Morgan Stanley said the announcement would step up support for private sectors and platform companies.

“We believe such efforts will help stimulate efficiency and creativity by restoring/improving the business environment,” analyst Laura Wang said in a research note.

She added that a recent statement from China’s cyberspace regulator about protecting entrepreneurs from defamation also signalled a possible end to regulatory pressure on the sector.

Morgan Stanley values the entire group at as much as $530 billion or $200 a share, based on their valuation model of each business unit.

During the regulatory crackdown, Alibaba faced scrutiny for engaging in monopolistic behaviour in e-commerce, as well as for data security practices in its cloud business and labour practices at its delivery units.

In what many observers viewed as symbolic of the regulatory chill, Ma left China in late 2021 and was seen travelling to a number of different countries.

He was spotted on Monday in Hangzhou, home to Alibaba, just one day before the company announced the restructuring.

Brian Tycangco, who tracks China’s tech sector at Stansberry Research, said that in addition to enabling higher valuations, the restructuring better protects individual divisions from future government regulation.

“Any new regulations will likely not affect the whole company now – just the particular division that that regulation covers,” he said.

The split may pave the way for other Chinese tech giants to undergo similar restructuring, CMC Markets analyst Tina Teng said.

In addition to its core gaming and social media businesses, Tencent Holdings (0700.HK) also has cloud and fintech arms. JD.com (9618.HK), Alibaba’s longtime e-commerce rival, has in recent years made a number of spin-offs, including its JD Logistics (2618.HK) and its cloud and AI-focused arm JD Digits.

Shares in Tencent and JD.com initially surged but later pared gains to end just under 2% higher. In Japan, SoftBank Group Corp (9984.T), which has a 13.7% stake in Alibaba, shot up 6.2%.

Reporting by Josh Horwitz in Shanghai, Kane Wu, Selena Li, Donny Kwok and Julie Zhu in Hong Kong; Anirban Sen in New York, Ken Li and Ankur Banerjee in Singapore; Editing by Muralikumar Anantharaman, Sam Holmes and Edwina Gibbs

: .