The largest financial institutions deemed systemically important are expanding even more during the 2023 banking crisis, leading to greater systemic risks, according to economists who spoke to the Daily Caller News Foundation.

When the FDIC bailed out Silicon Valley Bank (SVB) and Signature Bank in March due to a systemic risk exception, depositors moved their money to the biggest banks in the country. “Larger banks mean larger bailouts,” Dr. Thomas Hogan, senior research faculty at the American Institute for Economic Research and former chief economist for the Senate Committee on Banking, Housing and Urban Affairs, told the DCNF.

“For example, JPMorgan Chase, the nation’s largest bank, just got a sweetheart deal from the FDIC to acquire failing First Republic Bank,” he said.

These developments and future ones will cause more consolidation in the sector. “Increasing the concentration in the banking industry simply increases the systemic risk,” E.J. Antoni, research fellow for Regional Economics at the Heritage Foundation’s Center for Data Analysis, told the DCNF.

“There were already concerns about concentrations of deposits in the banking industry, both because a few firms already held such a large portion of the deposits and because the number of banks in the country has been declining for years,” he said. “These concentrations spawned the ‘too-big-too-fail’ mentality.”

The largest 25 banks in the U.S. gained $120 billion in deposits while smaller banks lost $108 billion immediately following the SVB and Signature rescues, according to The Wall Street Journal. (RELATED: The Biden Admin Just Made America’s Biggest Bank Even Bigger)

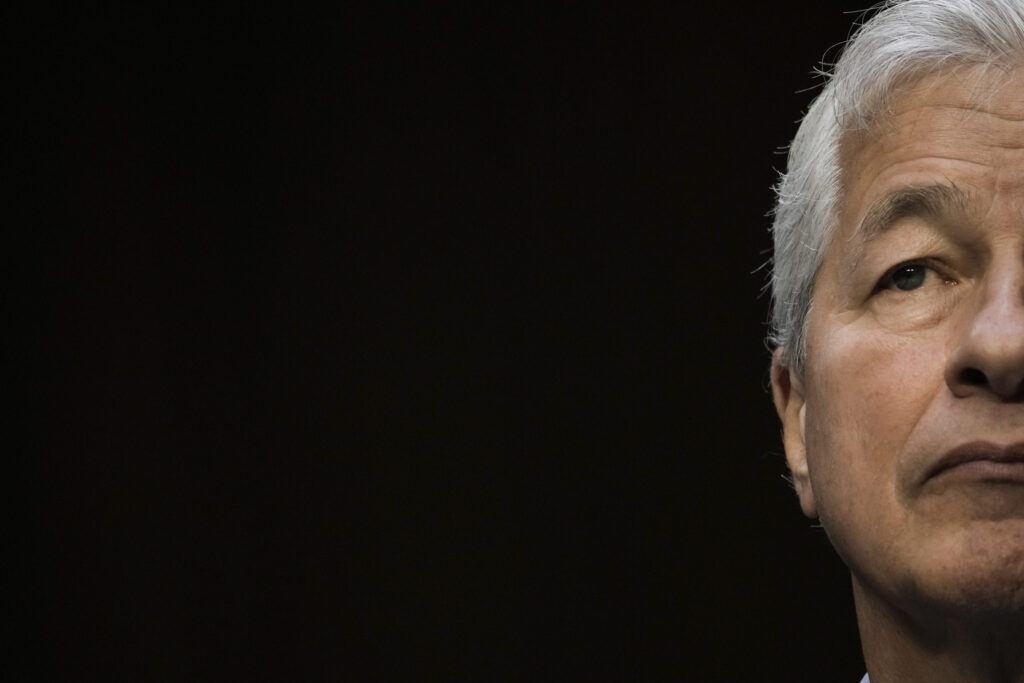

WASHINGTON, DC – SEPTEMBER 22: JPMorgan Chase & Co CEO Jamie Dimon testifies during a Senate Banking, Housing, and Urban Affairs Committee hearing on Capitol Hill September 22, 2022 in Washington, DC. The committee held the hearing for annual oversight of the nation’s largest banks. (Photo by Drew Angerer/Getty Images)

Regional bank stocks have rapidly fallen since then. PacWest Bancorp, Western Alliance Bancorporation, Zions Bancorporation, Comerica Incorporated, and KeyCorp have all plummeted since March when the crisis began.

The biggest banks also expanded after the 2008 financial crisis because they were deemed too valuable for the economy to collapse, according to the WSJ. Their immense profitability enabled them to survive and prosper during the current regional bank turmoil.

Antoni added that the government will likely enact additional regulations following this crisis, thwarting competition.

“Regulation imposes costs on businesses, including banks, and those costs have to be paid for by the banks’ customers. Large banks are able to spread those costs out among more customers and so the per-customer cost of compliance is low relative to small and mid-sized banks,” he said. “Large banks are also more influential in the crafting of regulation, and are better positioned to steer any regulation in a direction that helps them while hurting their competitors.”

More regulations are not the solution and were one reason banks failed recently, Hogan told the DCNF.

“The banks that failed were mostly holding assets that the regulators deemed very safe,” he added. “The problem is that they were highly subject to interest rate risk, which the regulators ignored. … Bank regulators were asleep at the wheel, and their regulations have made bank failures worse, not better.”

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact licensing@dailycallernewsfoundation.org.