(Bloomberg) — Key OPEC+ countries expressed confidence they would reach a production agreement on Sunday, despite a last-minute fight with African members that had threatened to derail the gathering. The start of the group’s meeting was pushed back to allow for further talks.

Most Read from Bloomberg

Ministers held side meetings and shuttled between Vienna hotels late into the night on Saturday, and discussions continued Sunday as they sought to smooth over the remaining differences. The United Arab Emirates was pushing for a change to the way its output cuts are measured, according to delegates. But the UAE’s gain would come at the expense of African countries asked to give up some of their unused quota — a politically unpalatable option for them.

Just two months after the group unveiled a surprise cut, an additional reduction is being discussed, though it’s not a done deal, delegates said. Weak economic data from China and recession fears are weighing on oil prices, which fell 11% in May.

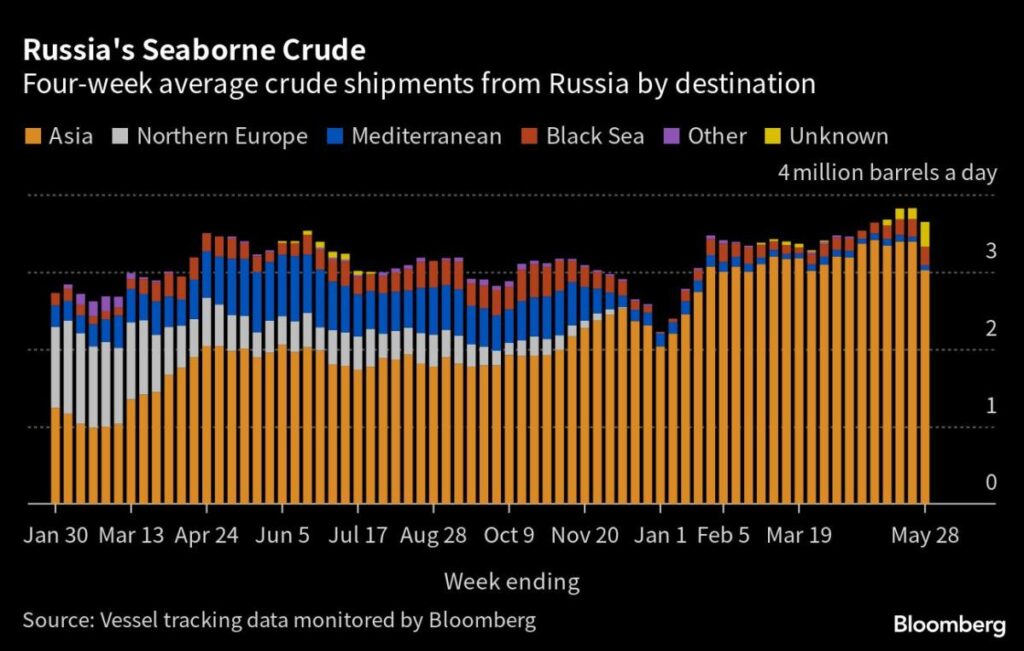

Festering in the background is the war in Ukraine and its impact on oil markets. Sanctions have redrawn the oil map and OPEC ally Russia is now sending more oil to Asia, competing with Saudi Arabia in its traditional market. What’s more, there’s little sign that Russia is delivering the production cuts it has promised.

Key Developments:

-

The UAE and Angola held bilateral talks on baseline revisions, said delegates.

-

Revised baselines for African countries was a “key unresolved issue,” according to RBC’s Helima Croft.

-

Bloomberg, Reuters and the Wall Street Journal have been barred from attending the headquarters for the meeting. Reporters continue to interview delegates on the sidelines.

(Time stamps are local time in Vienna)

Meeting Pushed Back Again (12:12 p.m.)

OPEC+ pushed back the start of the joint committee meeting, which was penciled in to start at 12 p.m., as informal talks between members to reach an agreement on production continue, delegates said.

Start of Meeting Delayed (11:17 a.m.)

The start of the meeting has been pushed back by an hour as talks between members continue, delegates said. The Joint Ministerial Monitoring Committee is now scheduled to begin at 12 p.m., followed by the full OPEC+ conference at 1 p.m., they said.

Congo Says Deal is Still Work in Progress (11:05 a.m.)

The Republic of Congo’s Minister of Hydrocarbons Bruno Jean-Richard Itoua, when asked about potential revisions to African countries’ production baselines, tells reporters that the group is still working on an agreement. The UAE and Angola are currently discussing the matter, said a delegate.

Ministers Arrive at OPEC Headquarters (10:57 a.m.)

National delegations including Venezuela, Kuwait and Iraq arrived at OPEC headquarters in Vienna before the scheduled start of talks at 11 a.m. The Joint Ministerial Monitoring Committee, which oversees the production cuts, will meet first, followed by a full conference of the group.

Formalizing Voluntary Cuts (10:33 a.m.)

One possible outcome for today’s meeting would be to formalize the voluntary cuts announced in April — equivalent to a reduction of about 5% — and apply them to the whole group. Extending that to the remaining members of OPEC+ would yield a reduction to the overall target of 2.1 million barrels a day. But it would entail a much smaller cut, of little more than 300,000 barrels a day, from estimated May production levels. It would also still leave both Angola and Nigeria pumping about 275,000 barrels a day below their new targets.

An additional cut of 1 million barrels a day from that new level would leave Saudi Arabia and Russia with formal targets of 9.7 million barrels a day. For the kingdom, that’s about 285,000 barrels a day below its current voluntary output target. For Moscow, it would be broadly in line with the level it says it’s pumping after its own 500,000 barrel-a-day cut, made in response to Western sanctions and price caps on its oil exports. But it would still leave production by the two big west African members well below their official quotas.

UAE Confident of an Agreement (10:25 a.m.)

UAE Energy Minister Suhail Al Mazrouei told reporters he is confident there will be an agreement today. Another delegate from a key OPEC+ country expressed a similar view, saying that the opposition from African members wouldn’t stop the proposed production-cuts deal.

Gearing Up for Press Conference (9:57 a.m.)

Late-Night Negotiations (9:48 a.m.)

Talks dragged into the early hours of Sunday in Vienna as delegates tried to find a way forward. Members’ delegations were on the move again this morning for last-minute negotiations. The first official meeting doesn’t start until 11 a.m. local time.

African Quota Row (7:45 a.m.)

The OPEC+ group’s African members are being pressed to give up unused portions of their output targets in order to redistribute them to the UAE, which has long pressed for a higher baseline for its own production. Rising production capacity in Abu Dhabi, the largest of the emirates, was not reflected in the original starting points for output cuts agreed in 2020. This has long been a issue for the Saudi ally, which has pushed repeatedly for a higher share of the group’s overall output target.

Four out of the five west African OPEC members are unable to meet their output targets, with their combined production in May more than 800,000 barrels a day below the volume they are permitted to pump. Angola and Nigeria, in particular, have struggled to meet their output targets almost since they were introduced three years ago.

But even if they can’t fully utilize their output quotas, the African nations may be unwilling to give them up. Several of them are seeking new investment to boost production in coming years and none will want to relinquish the right to use that new capacity when, or if, in comes online. The Saudis will need to find some way to encourage OPEC’s west African countries to play ball.

Oil Market Wobble (7 a.m.)

To cut, or not to cut, that’s the question facing the OPEC+ ministers gathering in Vienna today. A week ago a roll-over of existing output targets had seemed the most likely outcome. But things have shifted in the past seven days. Markets wobbled, with US crude dipping below $70 a barrel before recovering at the end of the week. Concerns over the strength of recovery in China’s oil demand are weighing on market sentiment, while production from several members of the producer group is higher than expected. That, combined with the Saudi oil minister’s warning that oil’s short sellers should “watch out,” has raised the prospects for an output cut.

Russian Production

In the background at this meeting is a question over Russian production.

There is no sign of Russia’s promised 500,000 barrel a day output cut in the country’s exports — and that’s what matters to the global market. Three months in, crude shipments in the four weeks to May 28 were more than 1.4 million barrels a day higher than they were at the end of last year and 270,000 barrels a day up on February, the baseline month for the pledged reduction.

Overseas shipments of refined products have fallen, but by less than they normally do at this time of year. And refinery runs, which typically drop for seasonal maintenance, have rebounded in late May.

Smiles All Around (Saturday)

OPEC’s top two Persian Gulf exporters, Saudi Arabia and the UAE, emerged from Saturday’s gathering with a shining display of unity – their respective ministers clasping hands and adorned with smiles as they stepped from the secretariat building into the Viennese sunshine. Still, each has their own priorities and for Abu Dhabi that involves getting their expanded production capacity formally recognized by the OPEC quota system with a higher output baseline. Whether they get that acceptance may determine the fate of today’s negotiations.

–With assistance from Julian Lee and Fiona MacDonald.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.