It hasn’t gone unnoticed that the market’s strong performance this year has been led by the mega-caps, with the tech giants largely responsible for the surge in the S&P 500 and NASDAQ. This has led many commentators to issue warnings about the lack of market breadth driving the gains, with many believing it indicates that the market is a lot more fragile than it looks.

However, that is not the case at all, according to billionaire Ken Fisher, who thinks that “bad breadth” is a bullish indicator.

“This widespread doom and gloom – whether it’s the Fed, the Ukraine invasion, or the latest banking crisis – is actually bullish for stocks,” says the Fisher Investments founder whose net worth is valued at ~$6.7 billion. “This is what we call fear of a false factor. False fear is always hurting prices in a given moment, setting the stage for spring-loaded gains. Bad breadth is the latest such false fear – and it screams that this mega-cap-led surge has legs — maybe not this week or this month, but fully through 2023.”

So, the rally, according to Fisher, is set to push ahead. With this in mind, we thought we’d get the lowdown on three stocks residing in his portfolio that he clearly expects to capitalize on the upward trend.

According to the TipRanks database, Wall Street analysts are on board too, giving all of these picks a ‘Strong Buy’ consensus rating. Let’s see why Fisher and the Street’s experts think these are good investment choices right now.

Danaher Corporation (DHR)

The first stock Fisher is betting on is Danaher, a multinational corporation working in the global life sciences and diagnostics industry. The company’s extensive offerings range from scientific instruments and water treatment systems to dental tools, and industrial technologies. Danaher operates as a conglomerate, with over 20 distinct companies operating under its wing. This is a huge business boasting a market-cap of almost $172 billion with the company’s R&D, manufacturing, sales, distribution and administrative premises located in over 60 countries.

For a feel for this global firm’s size, we can look at the latest quarterly numbers. In 1Q23, Danaher raked in revenues of $7.2 billion. However, that represented a 6.4% year-over-year decline on account of lower Covid-19-related sales. Likewise at the other end of the scale, adj. EPS dropped from $2.76 a year ago to $2.36. Furthermore, the operating cash flow reached $1.9 billion, while the non-GAAP free cash flow amounted to $1.7 billion by the end of the quarter.

While the top-and bottom-line figures still trumped Street expectations, investors appeared less convinced with the results or the firm’s outlook of high-single-digit % growth of base business core revenue, subsequently sending shares lower. All told, the shares have yet to enjoy any of 2023’s market spoils, down by 12% year-to-date.

Nevertheless, Ken Fisher’s confidence in Danaher’s trajectory remains steadfast, as evidenced by his fund’s significant ownership of 4,035,913 shares, which are currently valued at over $940 million.

The company also gets the support of SVB Securities analyst Puneet Souda who points out to investors the opportunity at play here.

“We see DHR as the most meaningful mega-cap long for 2023-24 among the life science tools universe with its guide now fully reset on the most attractive, spec’d-in and recurring revs market of bioprocess tools,” Souda explained. “Despite the near-term growth contraction that is already baked in, we believe DHR’s scale, diversification, its DBS (Danaher business system) process, leading profitability profile (60%+ GM; 30%+ OM) and $25B dry powder for M&A, combined with the best-in-class or near-best-in-class businesses (Aldevron, Cepheid, Cytiva…), set the stage for outperformance for years to come.”

These comments underpin Souda’s Outperform (i.e., Buy) rating, while his $300 price target makes room for 12-month returns of ~29%. (To watch Souda’s track record, click here)

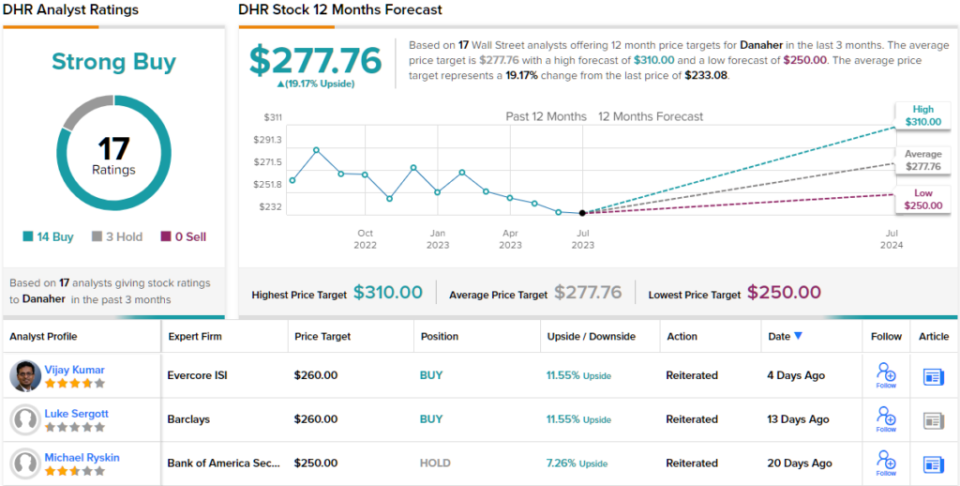

Most agree with that thesis. DHR claims a ‘Strong Buy’ consensus rating, based on 14 Buys vs. 3 Holds. At $277.76, the average target implies shares will appreciate by 19% in the year ahead. (See DHR stock forecast)

Schlumberger Limited (SLB)

Let’s now switch gears and take a turn into the energy sector for our next Fisher-backed stock. Schlumberger, the largest offshore drilling company in the world, is a dominant player in the oilfield services industry. With a presence in over 120 countries, the company delivers a wide range of oilfield equipment and services to the international oil and gas industry. Its extensive service portfolio encompasses crucial operations such as oil well testing, site evaluation, data analysis, drilling, and lifting activities.

Boasting a market cap of $76 billion, this is a big operation, one that generated over $28 billion in revenues last year. Going by the sales delivered in Q1, the Houston, Texas-based company appears on track to exceed that this year.

In the quarter, the company generated revenue of $7.7 billion, amounting to a 30% increase on the same period last year and beating the consensus estimate by $240 million. Adj. EPS of $0.63 also outpaced analyst expectations by $0.02.

While those were good results, the company delivered softer-than-anticipated cash flow and indicated that North American onshore market activity – specifically U.S. shale gas, which boosted growth last year – could plateau during 2023.

Meanwhile, Fisher remains heavily invested in Schlumberger, as his fund currently owns 19,604,360 SLB shares, valued at over $1.04 billion.

Mirroring that confident stance, RBC analyst Keith Mackay likes the look of what’s on offer, so much so that SLB is on RBC’s Global Energy Best Ideas List.

“We believe SLB is well-positioned to benefit from a continuing up-cycle in the international and offshore space which should drive further revenue growth and margin expansion,” the 5-star analyst said. “Longer-term, the company has also identified five key areas for Energy Transition-related growth.”

Quantifying this stance, Mackay rates SLB shares an Outperform (i.e., Buy), along with a $67 price target. If the figure is met, investors could potentially earn returns of 25.5% a year from now. (To watch Mackay’s track record, click here)

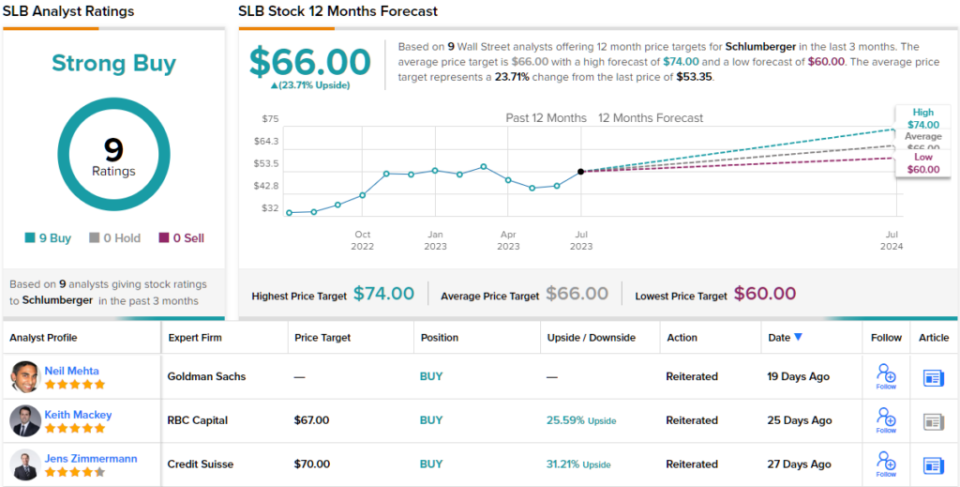

Looking at the consensus breakdown, other analysts have also been impressed. Based on 9 Buys and no Holds or Sells, the word on the Street is that SLB is a Strong Buy. At $66, the average target suggests shares will climb ~24% higher over the one-year timeframe. As an added bonus, Schlumberger also pays a quarterly dividend. The current payout stands at $0.25 per share and yields 1.87%. (See SLB stock forecast)

ConocoPhillips (COP)

We’ll stay in the energy sector for our last Fisher-endorsed name and check out another industry giant. When it comes to production and proved reserves, ConocoPhillips stands as one of the world’s largest independent E&P (exploration and production) firms. In other words, it is a company actively involved in searching for and extracting oil and gas resources. With a history dating back to the late 19th century, ConocoPhillips operates in various regions worldwide, including the Americas, Europe, Asia, and Australia. The company maintains a diverse portfolio of assets that encompasses both conventional and unconventional resources.

With a market cap of $125 billion, the company sits at number 49 on the Fortune 500 list, climbing 28 spots higher this year after revenue increased by almost 70%, and its profits rose 131% in 2022, boosted by an uptick in crude oil prices on account of Russia’s invasion of Ukraine.

In the most recently reported quarter, profits didn’t quite reach the levels attained in the same period last year but still exceeded Street expectations. Q1 earnings reached $2.9 billion, or $2.38 per share vs. $5.8 billion ($4.39 per share) in 1Q22, although the analysts were only looking for EPS of $2.07. Additionally, Q1 production climbed by 45,000 boe/day to a quarterly record of 1.792 million boe/day, while the firm also increased its full-year production outlook at the midpoint by 10 MBOED.

ConocoPhillips offers both a fixed dividend and a variable dividend that changes depending on the company’s performance. The latest payout included a regular dividend of $0.51 per share (offering a 1.98% yield) and a variable dividend of $0.60 per share (2.32% yield).

Ken Fisher is evidently keen on this oil and gas exploration company. He holds a big COP position, owning 7,022,759 shares. These are currently worth almost $725 million.

It’s no wonder that Truist analyst Neal Dingmann comprehends Fisher’s investment rationale, as the appeal of Conoco is easy to explain. The 5-star analyst writes, “The fruits of prior labor is paying dividends (literally) as Conoco’s legacy acreage along with the highly successful 2021 Concho and Shell Permian additions are resulting in the highest production in company history. COP also continues to position itself smartly with strategic non-Lower 48 assets such as Willow, Port Author LNG, APLNG, and various conventional assets among others. We forecast the company to easily generate the highest FCF yield among the majors using the proceeds to reward investors, eliminate debt, and potentially take down further strategic external assets.”

Accordingly, Dingman rates COP shares a Buy, while his $165 price target represents potential upside of 60% from current levels. (To watch Dingman’s track record, click here)

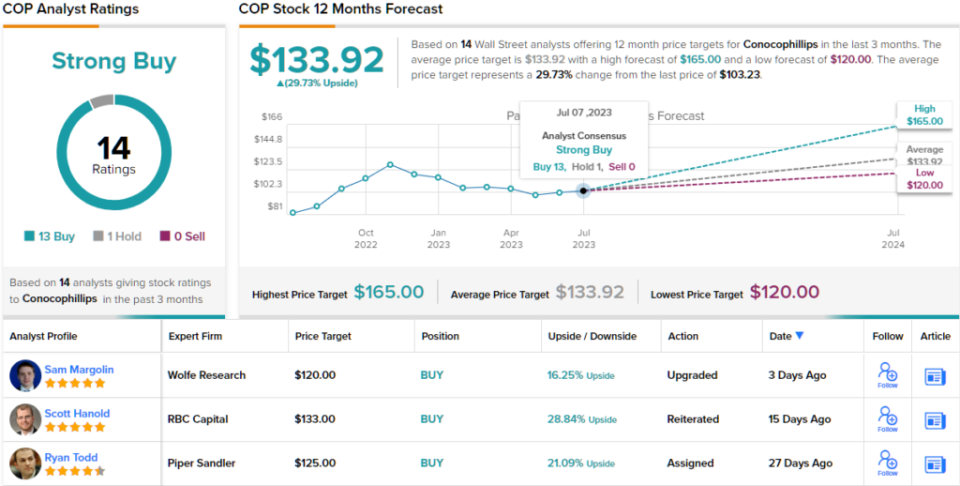

On the Street, barring one fencesitter, all 13 other analyst reviews are positive, making the consensus view here a Strong Buy. The forecast calls for 12-month returns of ~30%, considering the average target stands at $133.92. (See COP stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.