If a new model of cutting drug costs that includes Amazon Pharmacy, Mark Cuban’s Cost Plus Drugs and … [+]

If a new model of cutting drug costs that includes Amazon Pharmacy, Mark Cuban’s Cost Plus Drugs and Abarca is to grow, it may need to lure more Blue Cross and Blue Shield health plans.

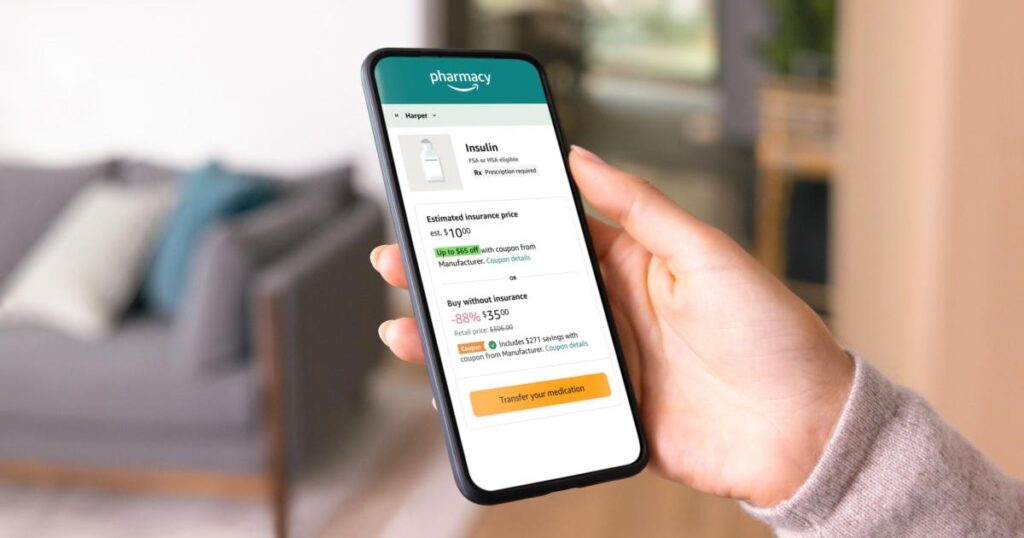

Blue Shield of California last week grabbed a big headline with a Wall Street Journal “exclusive” that said the health insurer “aims to save millions on drug costs and plans to drop CVS Caremark as pharmacy-benefit manager.” Instead, Blue Shield said it will beginning next year using five companies, led by Amazon Pharmacy, Mark Cuban’s Cost Plus Drugs and Abarca to manage prescription costs of its nearly 5 million health plan members.

Pharmacy benefit managers (PBMs) are considered middlemen between drug companies and consumers when it comes to purchasing prescription medicines. But the PBM’s role has been under fire in recent years as the public, taxpayers and Congress question whether they are passing along as much savings as they should to health plan enrollees.

Still, given the market clout and scale of the three biggest PBMs and the relationship they have with some of the biggest health insurance companies, analysts questioned how the new model Blue Shield unveiled would grow and gain scale to compete.

The market is already dominated by three PBMs that are under the same ownership as a large health insurance companies, making it difficult for smaller rivals to gain leverage.

And all three of these larger PBMs are now touting their ability to manage all aspects of their clients’ prescription costs, including specialized prescriptions for complex conditions. Neither Amazon nor Cuban’s venture own or operate specialty pharmacies.

The top three ranked PBMs by “total equivalent prescription claims managed” last year in the U.S. market share were: CVS Health’s Caremark PBM (33%); Cigna and Evernorth’s Express Scripts PBM (24%) and UnitedHealth Group’s OptumRx (22%), according to Drug Channels.

“As the three large PBMs still control the vast majority of claims volume (and therefore have the benefit of scale), we believe it is still difficult for smaller disruptor competitors to come in and materially shift competitive dynamics (barring any major regulatory changes),” Barclays analyst Steve Valiquette wrote in a note after the Blue Shield announcement.

That leaves some 20% of the pharmacy market that is divvied up among several PBMs including Prime Therapeutics, which is owned by 19 Blue Cross and Blue Shield Plans and manages the pharmacy benefits of nearly 38 million health plan members across the U.S.

Though Prime is one of the five companies tapped by Blue Shield of California to manage its prescription costs, Blue Shield is not one of Prime’s owners.

Some have wondered why Prime Therapeutics was involved in the Blue Shield venture given the PBM is already owned by Blue Cross and Blue Shield plans and recently gained scale with its $1.35 billion acquisition of MagellanRx Management, which was formerly part of Magellan Health, and divested in December by Centene. The acquisition was designed to unite Prime’s PBM capabilities with MagellanRx’s specialty drug management expertise, executives have said.

For its part, Prime Therapeutics says it is “responsible for manufacturer rebate contracting only” in its role as one of the five companies working with Blue Shield of California starting next year.

Prime Therapeutics executives wouldn’t agree to an interview.

“It was Blue Shield of California’s decision to design their PBM model with multiple companies working together,” a Prime Therapeutics spokeswoman said. “Prime has no further comment.”

Meanwhile, Elevance Health, the nation’s second largest health insurer, launched its own PBM four years ago and has been committed to growing the business on its own. Elevance operates Blue Cross and Blue Shield health plans in 14 states and has been growing its CarelonRx PBM, formerly known as IngenioRx, after ending a longtime relationship with Cigna’s Express Scripts PBM in 2019.

Elevance Health been aggressively adding ways to compete with the three largest PBMs, acquiring the specialty pharmacy BioPlus earlier this year.

“BioPlus provides a complete range of specialty pharmacy services for patients living with complex and chronic conditions, such as cancer, multiple sclerosis, hepatitis C, autoimmune diseases, and rheumatology,” Elevance Health said earlier this year. “The company covers more than 100 limited distribution medications and has a footprint that touches all 50 states. This acquisition will help Elevance Health meet the specialty drug needs of its clients and customers with a whole-health approach, supported by programs across Elevance Health and Carelon, Elevance Health’s healthcare services brand.”