Investors are constantly looking for ways to generate solid returns, after all, that is the whole point of investing. Achieving that goal is easier said than done, however. As with anything, if it were really simple, investors would only have success stories to tell.

That said, there are ways to gain an edge in the market, and one common route is to keep track of insiders’ actions. Insiders are the high-level company officers, Board members, CFOs and COOs, up to CEOs, whose positions give them a close-up knowledge of their firms’ inner workings – and they do trade on that knowledge.

Now, their trades can involve both buying and selling, and what investors need to remember is that insiders only have one reason to buy their own stock – they think it will gain value. It’s as clear a signal as any investor could want.

And when the insiders start spending millions on their stocks, that signal gets even clearer.

That’s what we’re seeing now, using the Insiders’ Hot Stocks tool. Insiders have been pouring millions into two dividend stocks, signaling a strong confidence in their long-term potential.

In fact, these insiders are not the only ones thinking the time is right for loading up. Several Wall Street analysts are also bullish on these equities, further bolstering the case for investment. Let’s take a closer look.

ExxonMobil (XOM)

The first stock we’ll look at is ExxonMobil, a leader among the world’s top ten largest oil companies. With a market cap of $433 billion, Exxon reported revenues in the neighborhood of $390 billion last year.

The company is a major operator in the discovery, production, and delivery of hydrocarbon energy resources, with a diversified portfolio that includes various other essential activities. ExxonMobil is a key supplier of industrial chemicals, and its fuel products are extensively used in the construction and manufacturing sectors. Additionally, it’s contributing to the development of new, lightweight plastics used in a multitude of products, from smartphones to airliners.

ExxonMobil operates in both the US and international markets. Earlier this year, it announced a significant expansion in its oil production off the coast of Guyana. The company has received government approval for the Uaru, the fifth project in the Stabroek block, an enhancement expected to generate an additional quarter-million dollars in revenue per day, with a planned startup in 2026.

In July, Exxon announced its acquisition of Denbury, an innovative company in the carbon capture and oil recovery segment. The Denbury acquisition will enhance ExxonMobil’s capacity for low carbon solutions, reflecting the oil company’s commitment to a cleaner future.

Turning to the financial side, we find that Exxon posted $82.9 billion in total revenue for 2Q23, reported at the end of July. This total was down by 28% from the year-ago quarter, and missed the forecast by $7.4 billion. The bottom line earnings also came in below expectations. The EPS figure of $1.94 per share was 8 cents lower than had been anticipated. The misses were influenced by headwinds in the hydrocarbon industry, including falling prices in the first half of this year.

Even though revenues and earnings were down, ExxonMobil retained its ability to generate strong cash flows. The company had $9.4 billion in cash flow from operations in Q2, and a free cash flow of $5 billion.

Sound cash flows help to maintain the dividend, which Exxon will next pay out to common shareholders on September 11. The payment is set at 91 cents per common share, and the annualized rate of $3.64 gives an above-average yield of 3.4%.

Looking at insider activity, we discover a notable buy made by Jeffrey Ubben, a member of the Board of Directors, earlier this week. Ubben dropped an impressive $48.97 million to buy 458,000 shares of XOM. Ubben stake in the company totals over $175 million.

On the analyst front, Piper Sandler’s 5-star analyst Ryan Todd notes the disappointing headlines from the earnings report – but also notes that the company has strengths, including its ability to generate cash and the likelihood of higher energy prices in 2H23.

“While both the headline earnings and upstream performance are disappointing, this was offset slightly by cash flow dynamics that were stronger than expected. Similar to peers, global gas headwinds were significant, however we expect many 2Q headwinds to reverse in 2H23, including gas pricing, refining margins (already +15%-30% vs. 2Q), and chemicals. And with structural cost savings ($8.3B to date) driving nearly 2x the profitability, we expect XOM to continue to drive relative outperformance,” Todd opined.

These comments back up Todd’s Overweight (i.e. Buy) rating on XOM, and his $127 price target indicates his belief in an 18.5% upside potential for the shares. Based on the current dividend yield and the expected price appreciation, the stock has ~22% potential total return profile. (To watch Todd’s track record, click here)

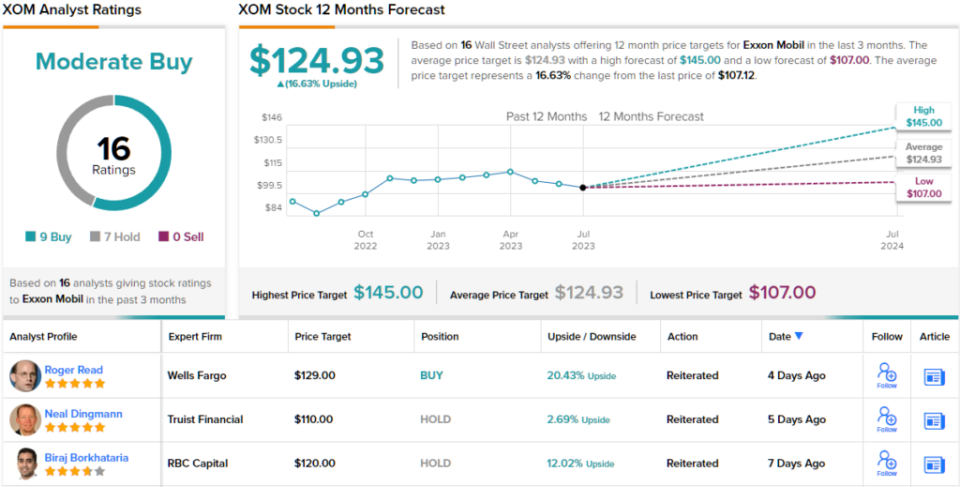

Overall, this oil major gets a Moderate Buy rating from the Street’s consensus, based on 16 recent analyst reviews that include 9 Buys and 7 Holds. The shares are priced at $107.12, with an average price target of $124.93 to suggest ~17% one-year upside potential. (See XOM stock forecast)

Agree Realty Corporation (ADC)

From oil majors, we’ll shift focus to the real estate investment trust (REIT) segment, where Agree Realty, based in the Metro Detroit area, operates through the acquisition, ownership, and management of a wide range of real properties.

Agree’s portfolio is both valuable and highly diversified. As of the end of 2Q23, Agree had 2,004 properties in its portfolio, located in 49 states, and totaling 41.7 million square feet of leasable area. The company’s portfolio was 99.7% leased at the end of Q2, with the investment-grade retail tenants generating 67.9% of the annualized base rents.

In addition to traditional real properties, Agree also invests in ground leases, and in Q2, the company acquired three more of these properties for a total purchase price of $25.8 million. These brought the company’s ground lease portfolio up to 210 leases, with a total of 5.7 million square feet of gross leasable area. The ground lease portfolio was fully occupied at the end of Q2 and had a weighted average remaining lease term of nearly 11 years.

This all translates to a portfolio capable of generating solid revenue – Agree posted a top line of $129 million for Q2, up 24% year-over-year and modestly $58K better than the estimates. The company’s net income per share, at 42 cents, was down over 7% y/y, and was a penny lower than expected.

One of Agree Realty’s standout features is its reputation for providing a reliable monthly dividend payout. The latest declared dividend stands at $0.243 per common share, resulting in an annualized payment of $2.916 and an attractive yield of 4.5%.

Recent insider activity further reinforces a positive outlook on the company. Three insiders, including the CEO and executive chairman of the board, made ‘informative buy’ transactions earlier this week, investing a total of over $3.25 million in the company’s stock. Specifically, Board member John Rakolta spent $1.89 million on 30,000 shares of ADC stock, CEO Joey Agree spent $627,900 to buy 10,000 shares, and finally, executive chairman – and company founder – Richard Agree picked up 11,751 shares for $739,725.

Truist analyst Ki Bin Kim also shares a favorable view of Agree Realty. Kim is impressed by the company’s share value, and its balance sheet – and by management’s proven competence. He says of this stock, “We remain BUY rated due to: 1) attractive valuation, 16.5x 2023 P/AFFO; 2) stock has already significantly underperformed triple net peers this year -8.9% vs. -2.4%; 3) downside protection via 68% IG tenancy; 4) strong balance sheet and mgmt. track record.”

Looking ahead, Kim rates ADC a Buy, and his $77 price target suggests that he sees a 20% upside on the one-year horizon. (To watch Kim’s track record, click here)

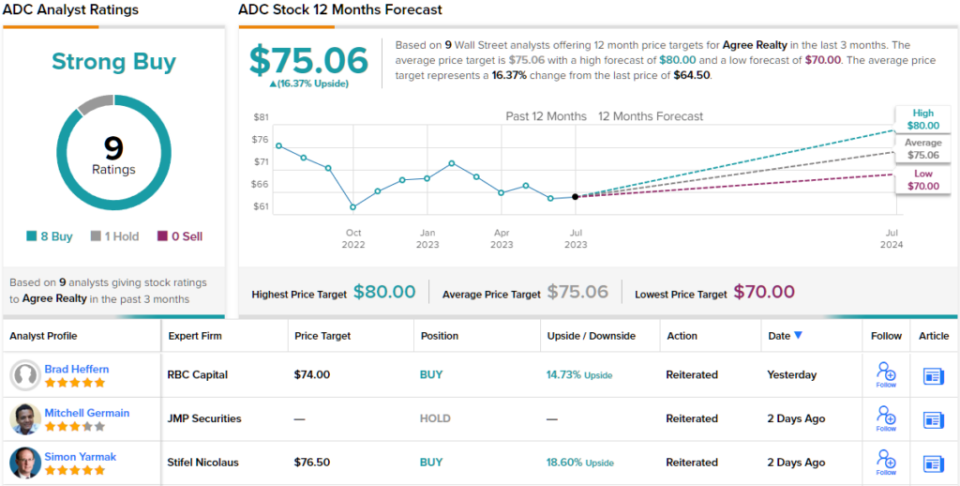

Overall, the 9 recent analyst reviews here break down 8 to 1 in favor of Buys over Holds, giving ADC its Strong Buy consensus rating. The shares are currently trading for $64.50 and their $75.06 average price target implies a 16% upside for the next 12 months. (See ADC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.