The U.S. electric grid is undergoing a huge transformation and renewables have steadily become more widely adopted over the past decade.

Adoption is set to continue at a brisk pace, says Goldman Sachs analyst Carly Davenport. Looking ahead, Davenport reckons that by 2032, over 45% of the U.S.’s power generation capacity will come from renewable sources and 6% from coal. That compares to a mix of 30%/16% today and 17%/27% in 2012, making the ongoing change very clear.

With this as backdrop, boosted by the Inflation Reduction Act, and as the power generation mix shifts and the Energy transition advances, Davenport believes utilities are “uniquely positioned to facilitate this shift and address associated challenges in a way that creates a cleaner power grid while maintaining reliability and customer affordability.”

“This shift will require a significant amount of capital investment,” the analyst went on to add, “which we believe will contribute to attractive earnings and rate base growth in the coming years.”

And investors can obviously take advantage of this development, too. With themes such as clean technology, nuclear power, LNG (liquefied natural gas) project additions, and “transmission build out” coming to the fore, investors stand to make use of an “attractive investment opportunity set.”

Davenport has compiled a list of stocks, what she and her team call “Decarbonization Enablers,” that are well positioned to take advantage of this trend – and she sees three names posting double-digit growth over the coming months. We ran these picks through the TipRanks database to get a fuller view of their prospects. Let’s check the results.

NextEra Energy, Inc. (NEE)

We’ll start with NextEra Energy, a Florida-based electric utility firm, which, with its $150 billion market cap, is one of the largest utility holding firms in the US utility landscape. NextEra’s chief subsidiary is Florida Power & Light (FPL), which boasts more than 5.8 million customer accounts and provides power to more than 12 million people across Florida. The company generates power at seven utility-grade nuclear generation plants in Florida, making it a major provider of zero-emission power.

NextEra isn’t just depending on nuclear power for clean energy. The company is also moving into the hydrogen segment of the energy industry. In April of this year, the company announced an understanding between its renewable energy subsidiary NextEra Energy Resources and CF Industries, a major ammonia producer, for development of a hydrogen project at a CF Industries facility in Oklahoma.

At the end of Q1, NextEra owned and operated approximately 4,600 megawatts of solar power generation capacity, a total that includes the 970 megawatts of solar capacity brought online during the quarter. This total makes NextEra the largest utility provider of solar power in the US. The company has more than 2,000 megawatts of renewable power and storage projects in its work backlog.

This company has a history of beating the earnings expectations and has done so consistently for the past several years, as the case again in the last reported quarter – for 1Q23. Adj. EPS rose from $0.74 in the same period a year ago to $0.84, in turn beating the forecast by $0.11. Likewise on the top-line, revenue climbed by a big 132.5% y/y to $6.72 billion, coming in ahead of expectations by $1.5 billion.

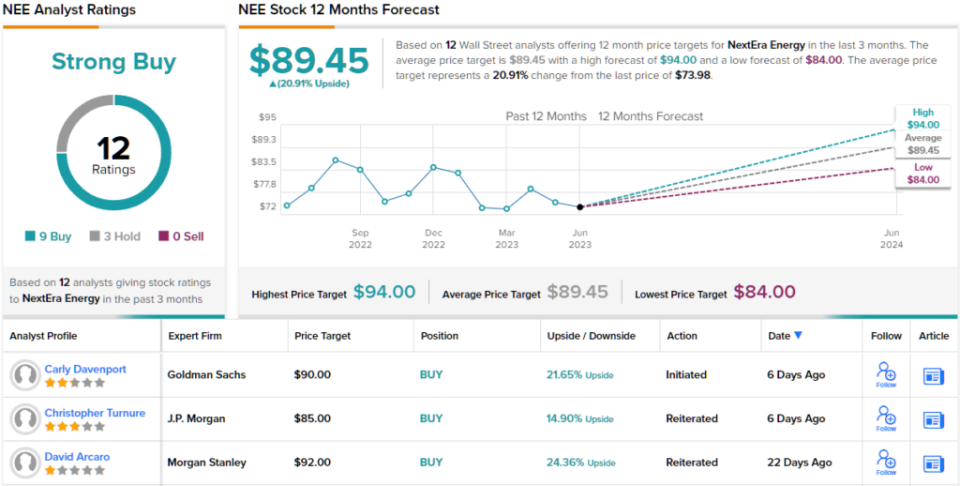

Turning to Goldman Sachs’ Carly Davenport, we find her putting a Buy rating on NEE shares, along with a $90 price target that implies a one-year gain of ~22%. (To watch Davenport’s track record, click here)

In Davenport’s view, the company’s ability to grow earnings while expanding renewable generation capacity are key points. She writes: “Three key factors underpin our Buy rating: leverage to renewables growth, positive regulatory environment and a long track record of execution at FPL, and above average EPS growth with discounted valuation relative to history. We view NEE’s regulated utility Florida Power & Light (FPL) as a premium regulated utility with a long runway for growth in a positive regulatory backdrop… NEE shares have underperformed the XLU by ~5% YTD, which we believe provides an attractive entry point for investors.”

Overall, NEE gets a Strong Buy from the Street’s analyst consensus, based on 12 recent reviews that include 9 Buys and 3 Holds. The shares are trading for $73.98 and have an average price target of $89.45, suggesting ~21% gain on the one-year time frame. (See NEE stock forecast)

Sempra Energy (SRE)

Next up is Sempra Energy, a San Diego-based energy firm working to deliver power – electricity and natural gas – to some 40 million customers in California, Texas, and Mexico. Sempra is deeply involved in the shift toward cleaner energy technologies, including renewables, and is a major supplier and exporter of liquified natural gas (LNG), which generates significantly fewer carbon emissions than other fossil fuels.

Sempra’s LNG operations are extensive. The company currently holds a large ownership stake in the 12 million ton per annum (Mtpa) export facility, Cameron LNG, located in Hackberry, Louisiana on the Gulf Coast. Befitting the firm’s home base in San Diego, Sempra is also working to develop LNG export terminals on the Pacific, at Energia Costa Azul in the northwest of Mexico’s Baja California peninsula. This facility offers potential to cut LNG export transit times to Asia from 21 days to 11 days.

Natural gas is big business, and Sempra brought in $6.56 billion in total revenues during Q1 of this year. This was up 71.7% from the prior year, and beat the analysts’ forecast by over $2.5 billion. The company’s bottom line showed a solid profit; adjusted net earnings in 1Q23 came to $2.92 per share – 15 cents better than had been expected.

Sempra is using its strong financial base to expand its infrastructure business. As noted, Sempra is building an LNG export facility in northwest Mexico – the company is working on additional LNG export terminals in Texas, to meet expanding global demand for LNG.

Expansion of the infrastructure and further buildout of LNG export capabilities are prime points for investors to consider, in Carly Davenport’s opinion. The Goldman analyst writes of Sempra: “SRE has a significant project pipeline for LNG at its Sempra Infrastructure Business (SIP), with the potential for 62 mtpas of total capacity online if all proposed projects come to fruition, with SRE owning a portion of the capacity. While the projects will likely not come online until the late 2020s at the earliest, we expect progress towards reaching FID and beginning construction will serve as positive catalysts for SRE along the way… We view SRE’s business mix favorably and see SIP as a unique opportunity to gain exposure to LNG in the utility sector.”

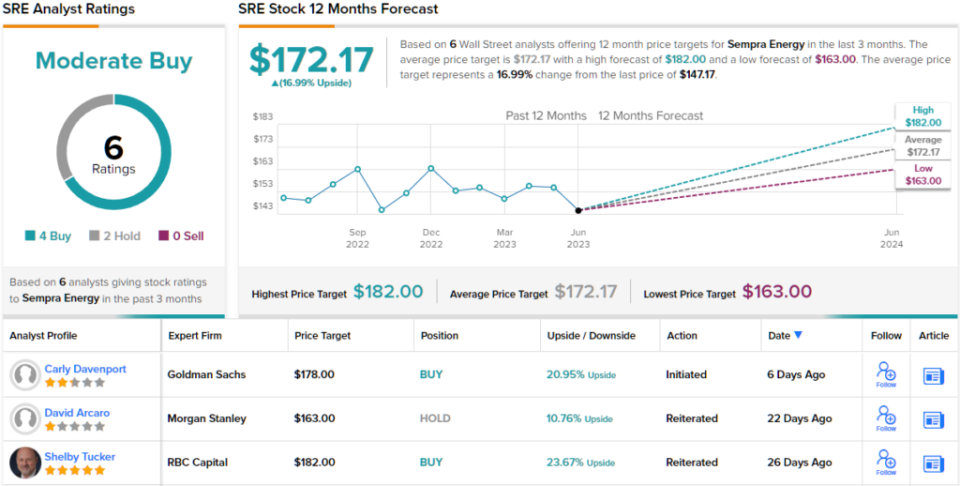

Davenport goes on to rate Sempra shares a Buy, with a $178 price target that shows her confidence in a 21% upside over the coming year.

Overall, with 6 recent analyst reviews on file, including 4 Buys and 2 Holds, Sempra gets a Moderate Buy consensus rating from the Street. The shares are selling for $147.17, and their $172.17 average price target implies a 17% gain in the next 12 months. (See Sempra stock forecast)

Xcel Energy (XEL)

Last on our Goldman-backed energy list is Xcel Energy. This company is known for its commitment to clean, renewable power generation, and boasts a power generation portfolio that features wind, solar, and hydroelectric power, supplemented by natural gas, nuclear, and biomass generation.

Power generation is useless without transmission, and Xcel boasts an extensive network of electricity transmission assets. This includes more than 1,200 substations and over 20,000 miles of transmission lines, capable of serving 22,000 megawatts of customer load. Xcel is working to expand this network, which is currently active across 10 states in two major regions of the country. Xcel has transmission networks in Texas-New Mexico-Colorado-Kansas-Oklahoma, as well as in the northern Plains and Great Lakes states of North and South Dakota, Minnesota, Wisconsin, and Michigan.

In addition to its power generation and transmission activity, Xcel has been promoting clean energy use and zero-emission vehicles. The company is involved in developing electric vehicle (EV) technology, and offers customers subscription services for renewable energy resources, including solar panel installations.

On the financial side, Xcel’s 1Q23 results showed $4.08 billion in total revenues, a solid result that was up 8.8% year-over-year and beat the analyst estimates by $320 million. The bottom-line adj. EPS figure, of 76 cents per share, was up 8.5% y/y, and beat the forecast by 2 cents per share.

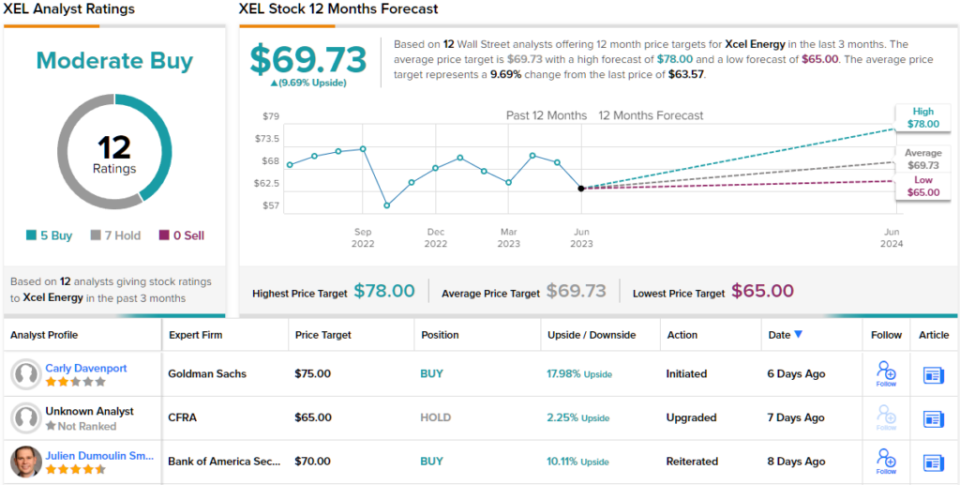

For Goldman’s Carly Davenport, there are several reasons to back Xcel. She writes: “The primary drivers of our positive view are the accelerated coal replacement with regulated renewables, rate case activity that could drive improved earned vs. authorized ROEs, and leverage to the transmission build out opportunity. We view XEL’s wind and solar resource rich service territory as a key competitive advantage which should enable it to execute on its goals.”

Putting some numbers where her mouth is, Davenport gives XEL shares a $75 price target, suggesting an 18% upside in the next 12 months, and supporting her Outperform (i.e. Buy) rating. (To watch Davenport’s track record, click here)

Overall, XEL stock gets a Moderate Buy from the analyst consensus, based on 12 reviews with a breakdown of 5 Buys and 7 Holds. The shares have an average price target of $69.73 and a trading price of $63.57, implying upside potential of ~10% for the year ahead. (See XEL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.