(Bloomberg) — In July this year, Nuremberg’s mayor celebrated the final beam being placed atop the redeveloped Quelle building, a monumental 1950s symbol of postwar Germany’s economic revival. Revamped with offices, shops and homes, a big part of the giant complex was slated to open in 2024.

Most Read from Bloomberg

In recent weeks, however, the site’s developer Gerch Group, which has €4 billion ($4.2 billion) of projects under construction, has filed for insolvency proceedings, along with one of its project companies linked to the development. The opening date’s now in doubt.

It’s yet another blow to a property market that’s reeling from the end of the cheap-money era, but it also shows who’s most vulnerable to the shakeout. While investor fears during the current real estate crisis have centered on landlords, the travails of Gerch and its ilk show that developers — the firms that own the building projects — are the ones in imminent danger.

“Project developers are struggling with the increased construction costs, increased interest rates and the drop in prices,” says Marlies Raschke, cohead of restructuring and insolvency at law firm Noerr. “We’ve seen several of them filing for insolvency in the last weeks and we expect more.”

Alongside Gerch, Munich’s Euroboden, which touts star architects such as David Chipperfield among its collaborators, is in preliminary insolvency proceedings. Project Immobilien Group also filed for insolvency in August along with many of its project companies, with some of the work being tendered for new contractors, according to a spokesperson for the preliminary administrator. The three firms didn’t respond to requests for comment.

Developers around the world face similar woes. In Australia, Porter Davis is among homebuilders that have gone into liquidation this year after surging costs and falling demand. In Sweden, a rise in bankruptcies has been driven by a construction slump, while in Finland housing starts could plunge to levels not seen since the 1940s, according to the country’s construction lobby.

It’s a rapid change in fortunes after the years of rock-bottom interest rates, when money poured into property as investors hunted for yield. Developers like Gerch could comfortably load up projects with cheap debt and sell into a market where prices just kept rising.

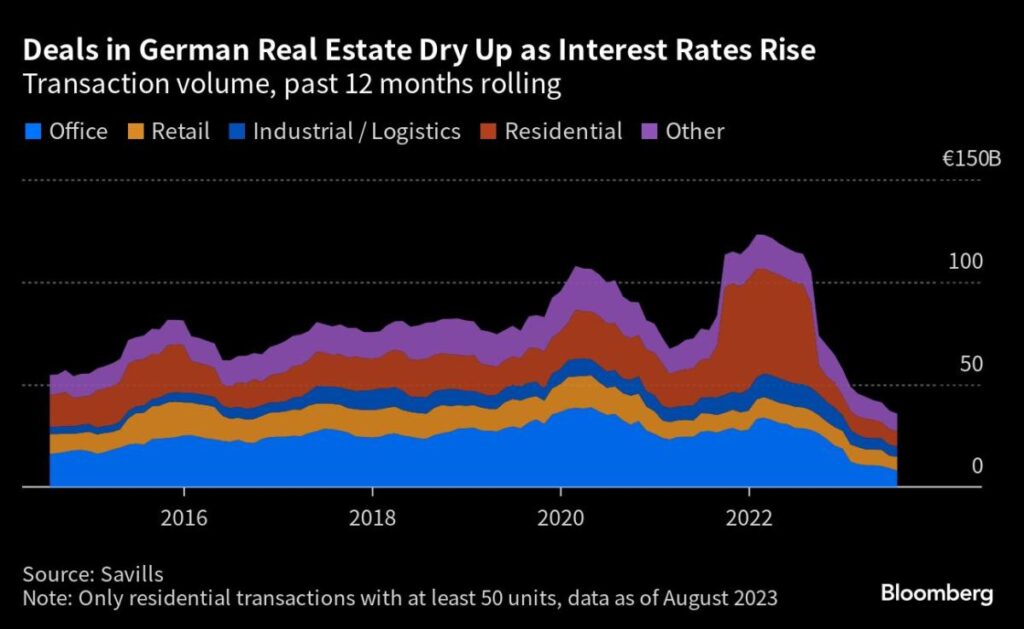

The mood’s very different now. German real estate transactions for offices are at their lowest point on a 12-month rolling basis since at least 2014, according to property firm Savills. Vonovia SE, a big landlord, warned in its financial results that new construction developments are “barely viable.”

“The speed of correction is significant,” says Henning Koch, boss of Commerz Real, one of Germany’s biggest property investors. “The recession in the German real estate market started one and a half years ago and now in the last 2-3 months we’ve seen more and more developers go bust.”

Read More: European Real Estate Faces Pressure as Funds Wobble

Developers are particularly vulnerable because of a collapse in land values, which makes projects riskier. As interest rates have soared, investors have demanded higher rental yields to compensate, which in turn pushes down the price they’ll pay for a finished site. Construction costs are also spiraling and developers are having to put more money aside for unexpected expenses.

Taken together, all these factors depress the underlying value of developer land. It upends the economics of property development, too, with the price drop meaning some companies may lose money just by finishing a building.

In one example Aggregate Holdings SA, the diminished real estate empire run by Cevdet Caner, had to hand over the keys of Berlin’s QH Track project to creditor Oaktree Capital Management. Hit by cost overruns, it tried to negotiate with lenders to fund the project through to completion but the talks failed.

Unfinished State

Germany’s development boom was fueled in part by mezzanine lenders including Corestate Capital who were willing to make chunky loans to developers with little equity. That worked when part-built or yet-to-start projects could be forward sold to pension funds happy to pay ahead for a completed site. The market correction has left developers without agreed forward sales in limbo, saddled with pricey debt and runaway costs.

“Normally we’re looking for fresh money from the existing financing parties – from shareholders, investors — to try to complete the project,” says Christoph Morgen at Brinkmann & Partner, who’s acted as an insolvency administrator for some smaller developers. “It usually causes a loss of time, it interrupts the building process. And all the time, it’s getting more expensive.”

Creditors are taking note. One senior German banker says their bank is trying to establish ties to some of the country’s stronger developers, so it can tap them to take over if a building runs into trouble.

Grandiose developments in an unfinished state can also become civic eyesores, and a political problem if left dormant too long. In Nuremburg the mayor’s office says it’s “confident” the Q project will continue, after receiving positive noises from the various owners of the different parts of the vast complex.

“The owners want to realize their projects without consideration of Gerch Group’s insolvency,” the mayor’s office says in a statement. “On the city’s side, we support by continuing all planning and administrative processes.”

Pensioner Pain

The exposure of retail investors and smaller pension funds, who piled into real estate during the boom times, adds another awkward political dimension. Their involvement can make negotiations complicated, especially if new money’s needed. Noerr’s Raschke says German pension funds — such as those for doctors, lawyers or dentists — may be limited in providing more liquidity for regulatory reasons.

Some retail investors are exposed to developers via high-yield bonds. Euroboden noteholders, for instance, are readying themselves for an upcoming creditor meeting. This class of debtholder is often in a weaker position than other creditors. While bank finance is usually tied to projects or buildings, many junk bonds are issued at a holding company level with little security — worsening the chance of getting money back.

“From the perspective of bondholders, the interest received on those bonds in recent years was much too low,” says Daniel Bauer, chairman of the board of SdK, a German investor group. “They were taking on an equity-like risk.”

Developer defaults will hurt the broader property industry, too. Residential builders are already missing out on work, with more than one in five construction companies surveyed by the Ifo Institute reporting canceled projects. That’s the worst since the survey started in 1991.

“It’s a warning signal for the building-materials and construction sector,” says Ralf Moldenhauer, a senior partner at Boston Consulting Group in Frankfurt. “We expect to see more stress in that sector as well.”

–With assistance from Stephan Kahl and Neil Callanan.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.